Closing Disclosure This Form is a Statement of Final Loan

What is the Closing Disclosure?

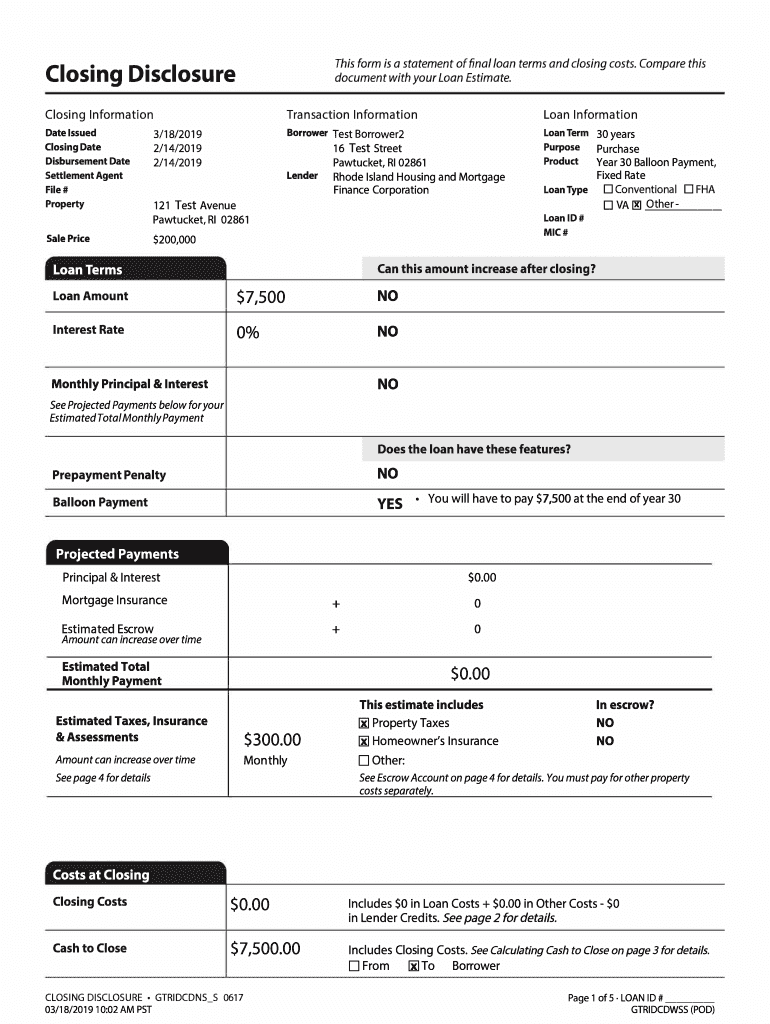

The Closing Disclosure is a critical document in the home buying process, serving as a statement of the final loan terms and conditions. This form outlines essential details about the mortgage, including the loan amount, interest rate, monthly payments, and closing costs. It is designed to provide borrowers with a clear understanding of their financial obligations before finalizing the purchase of a home. The Closing Disclosure must be provided to the borrower at least three days before the closing date, allowing time to review and compare it with the Loan Estimate received earlier in the process.

Key Elements of the Closing Disclosure

Understanding the key elements of the Closing Disclosure is essential for borrowers. The document typically includes:

- Loan Information: Details about the loan amount, interest rate, and loan type.

- Projected Payments: A breakdown of monthly payments, including principal, interest, taxes, and insurance.

- Closing Costs: An itemized list of all closing costs, including lender fees, title insurance, and escrow charges.

- Cash to Close: The total amount the borrower needs to bring to the closing table.

Each of these elements plays a vital role in helping borrowers understand their financial commitments and prepare for the closing process.

How to Use the Closing Disclosure

Using the Closing Disclosure effectively involves a thorough review of the document. Borrowers should compare the figures on the Closing Disclosure with those on the Loan Estimate to ensure consistency. Key steps include:

- Reviewing the loan terms and conditions to confirm they match expectations.

- Checking the closing costs to identify any discrepancies or unexpected fees.

- Understanding the projected payments to ensure affordability.

By carefully analyzing this document, borrowers can make informed decisions and address any concerns with their lender before closing.

Steps to Complete the Closing Disclosure

Completing the Closing Disclosure involves several important steps. The lender is responsible for preparing the form, but borrowers should be proactive in ensuring its accuracy. The steps include:

- Receiving the Closing Disclosure at least three days before closing.

- Reviewing all sections for accuracy and completeness.

- Contacting the lender with any questions or discrepancies.

- Signing the document at closing, confirming agreement to the terms.

Following these steps helps ensure a smooth closing process and minimizes the risk of surprises on closing day.

Legal Use of the Closing Disclosure

The Closing Disclosure is a legally mandated document under the Truth in Lending Act and the Real Estate Settlement Procedures Act. Lenders must adhere to strict regulations regarding its preparation and delivery. Key legal aspects include:

- Providing the form to borrowers at least three business days before closing.

- Ensuring the information is accurate and reflects the final loan terms.

- Allowing borrowers the opportunity to ask questions and clarify any concerns.

Compliance with these legal requirements protects borrowers and promotes transparency in the lending process.

How to Obtain the Closing Disclosure

Borrowers typically receive the Closing Disclosure from their lender or mortgage broker. To obtain this document, borrowers should:

- Communicate with their lender to confirm when the Closing Disclosure will be provided.

- Ensure they have provided all necessary information to the lender to prepare the document.

- Request a copy if it is not received within the required timeframe.

Being proactive in obtaining the Closing Disclosure ensures that borrowers have ample time to review the document before closing.

Quick guide on how to complete closing disclosure this form is a statement of final loan

Complete Closing Disclosure This Form Is A Statement Of Final Loan effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly and without hindrance. Manage Closing Disclosure This Form Is A Statement Of Final Loan on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to edit and eSign Closing Disclosure This Form Is A Statement Of Final Loan seamlessly

- Locate Closing Disclosure This Form Is A Statement Of Final Loan and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose your preferred method of delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to missing or lost files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your choosing. Edit and eSign Closing Disclosure This Form Is A Statement Of Final Loan to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the closing disclosure this form is a statement of final loan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Closing Disclosure and why is it important?

The Closing Disclosure is a critical document that outlines the final terms of a loan, including the loan amount, interest rate, and closing costs. This form is a statement of final loan details that borrowers must review before closing on a mortgage. Understanding this document helps ensure that there are no surprises at closing.

-

How does airSlate SignNow facilitate the signing of the Closing Disclosure?

airSlate SignNow provides a seamless platform for electronically signing the Closing Disclosure. This form is a statement of final loan details that can be signed quickly and securely, allowing for a more efficient closing process. Our user-friendly interface makes it easy for all parties involved to complete the signing process.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. Our cost-effective solution ensures that you can manage documents like the Closing Disclosure, which is a statement of final loan details, without breaking the bank. You can choose from monthly or annual subscriptions based on your usage.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow integrates seamlessly with a variety of software applications. This allows you to manage documents, including the Closing Disclosure, which is a statement of final loan details, alongside your existing tools. Our integrations enhance workflow efficiency and streamline the signing process.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure cloud storage. These features make it easy to manage important documents like the Closing Disclosure, which is a statement of final loan details. Our platform ensures that you have everything you need for efficient document handling.

-

Is airSlate SignNow secure for handling sensitive documents?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that all documents, including the Closing Disclosure, which is a statement of final loan details, are protected. We use advanced encryption and security protocols to safeguard your information throughout the signing process.

-

How can airSlate SignNow improve the closing process for real estate transactions?

By using airSlate SignNow, you can streamline the closing process for real estate transactions signNowly. The platform allows for quick and secure signing of essential documents like the Closing Disclosure, which is a statement of final loan details. This efficiency can lead to faster closings and improved customer satisfaction.

Get more for Closing Disclosure This Form Is A Statement Of Final Loan

Find out other Closing Disclosure This Form Is A Statement Of Final Loan

- Electronic signature Ohio Unlimited Power of Attorney Easy

- How Can I Electronic signature Oklahoma Unlimited Power of Attorney

- How Do I Electronic signature South Carolina Unlimited Power of Attorney

- How Can I Electronic signature Alaska Limited Power of Attorney

- How To Electronic signature Massachusetts Retainer Agreement Template

- Electronic signature California Limited Power of Attorney Now

- Electronic signature Colorado Limited Power of Attorney Now

- Electronic signature Georgia Limited Power of Attorney Simple

- Electronic signature Nevada Retainer Agreement Template Myself

- Electronic signature Alabama Limited Partnership Agreement Online

- Can I Electronic signature Wisconsin Retainer Agreement Template

- Can I Electronic signature Michigan Trademark License Agreement

- Electronic signature Indiana Letter Bankruptcy Inquiry Now

- eSignature Oklahoma Payroll Deduction Authorization Easy

- How To eSignature Texas Payroll Deduction Authorization

- Can I Electronic signature Connecticut Retainer for Attorney

- How Do I Electronic signature Idaho Assignment of License

- Electronic signature New Jersey Lease Renewal Free

- Electronic signature Texas Lease Renewal Fast

- How Can I Electronic signature Colorado Notice of Intent to Vacate