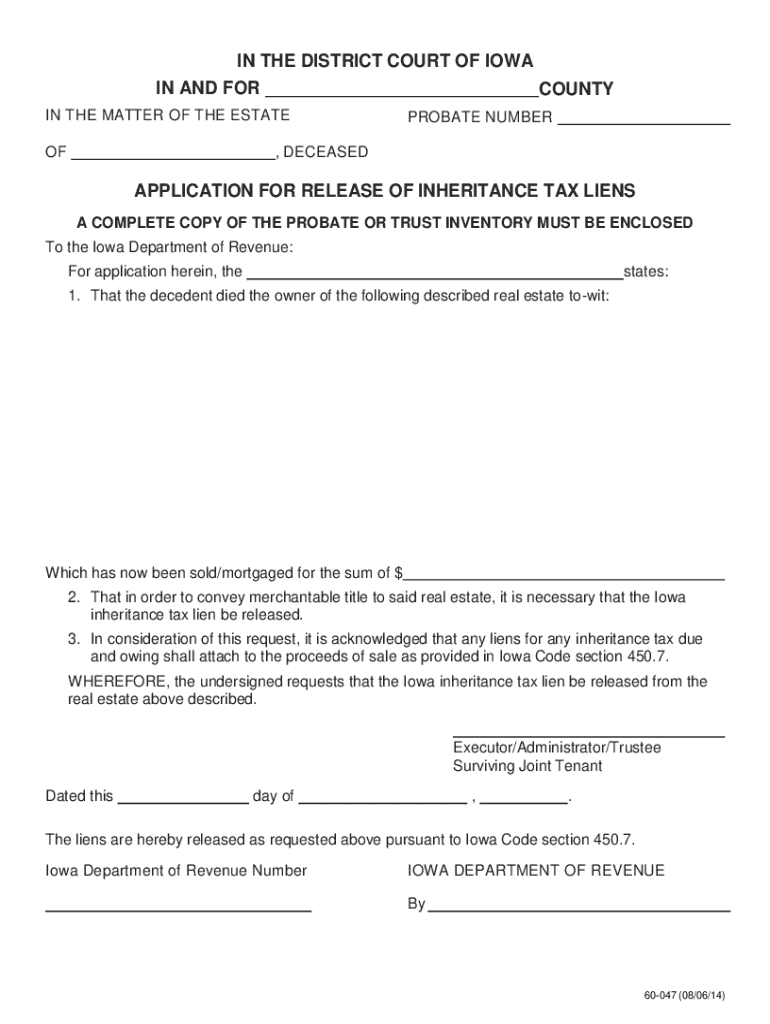

IA Inheritance Tax APPLICATION for RELEASE of INHERITANCE TAX LIENS, 60 047 2014-2026

Understanding the Inheritance Release Form

The inheritance release form is a crucial legal document used when an heir or beneficiary wishes to waive their right to inherit a portion of an estate. This form is often utilized in situations where the beneficiary may want to relinquish their claim for various reasons, such as financial planning or family dynamics. By completing this form, individuals can ensure that their decision is legally recognized, preventing any future claims on the estate. It is essential for all parties involved to understand the implications of signing this document, as it can significantly affect the distribution of assets.

Steps to Complete the Inheritance Release Form

Filling out an inheritance release form involves several key steps to ensure accuracy and compliance with legal standards. Here is a straightforward process to follow:

- Gather Necessary Information: Collect all relevant details, including the decedent's information, the beneficiary's details, and specifics about the inheritance being waived.

- Complete the Form: Fill out the form accurately, ensuring that all sections are completed. This typically includes the names of the parties involved, the relationship to the decedent, and a clear statement of the waiver.

- Review the Document: Carefully review the completed form for any errors or omissions. It may be beneficial to consult with a legal professional to ensure that the form meets all necessary requirements.

- Sign and Date: All involved parties must sign and date the form. Depending on state laws, notarization may also be required.

Legal Considerations for the Inheritance Release Form

When utilizing an inheritance release form, it is vital to understand the legal implications. This document serves as a formal acknowledgment of the beneficiary's decision to forgo their inheritance rights. It is important to note that once signed, this waiver is generally irrevocable, meaning the beneficiary cannot later claim the waived portion of the estate. Additionally, state-specific laws may dictate the validity and enforceability of the form, so it is advisable to familiarize oneself with local regulations. Consulting with an attorney can provide clarity on how the form fits within the broader context of estate law.

Required Documents for the Inheritance Release Form

To successfully complete an inheritance release form, certain documents may be required. These typically include:

- Death Certificate: A certified copy of the decedent's death certificate may be needed to validate the claim.

- Will or Trust Documents: If applicable, copies of the will or trust documents should be included to clarify the terms of the inheritance.

- Identification: Valid identification for all parties involved may be necessary to verify identities during the signing process.

Submission Methods for the Inheritance Release Form

Once the inheritance release form is completed, it needs to be submitted according to the specific requirements of the estate or jurisdiction. Common submission methods include:

- Online Submission: Some jurisdictions may allow electronic submission of the form through a designated portal.

- Mail: The completed form can typically be mailed to the executor of the estate or the appropriate court.

- In-Person Submission: In certain cases, delivering the form in person to the relevant office may be required.

Potential Consequences of Not Using an Inheritance Release Form

Failing to utilize an inheritance release form can lead to various complications. Without this document, beneficiaries may retain their rights to the inheritance, which could result in disputes among heirs. Additionally, not formally waiving an inheritance can lead to unintended tax implications or affect the distribution of assets as outlined in the decedent's will. It is crucial for beneficiaries to understand the importance of this form in ensuring a smooth and conflict-free estate settlement process.

Quick guide on how to complete ia inheritance tax application for release of inheritance tax liens 60 047

Prepare IA Inheritance Tax APPLICATION FOR RELEASE OF INHERITANCE TAX LIENS, 60 047 effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to easily locate the necessary form and securely store it online. airSlate SignNow provides all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Manage IA Inheritance Tax APPLICATION FOR RELEASE OF INHERITANCE TAX LIENS, 60 047 on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

How to edit and electronically sign IA Inheritance Tax APPLICATION FOR RELEASE OF INHERITANCE TAX LIENS, 60 047 with ease

- Locate IA Inheritance Tax APPLICATION FOR RELEASE OF INHERITANCE TAX LIENS, 60 047 and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or errors requiring the printing of new document copies. airSlate SignNow fulfills your document management requirements within a few clicks from any device you prefer. Edit and electronically sign IA Inheritance Tax APPLICATION FOR RELEASE OF INHERITANCE TAX LIENS, 60 047 and ensure exceptional communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ia inheritance tax application for release of inheritance tax liens 60 047

Create this form in 5 minutes!

How to create an eSignature for the ia inheritance tax application for release of inheritance tax liens 60 047

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an inheritance release form?

An inheritance release form is a legal document that allows heirs to relinquish their rights to an inheritance. This form is essential for ensuring that the distribution of assets is clear and legally binding. Using airSlate SignNow, you can easily create and eSign your inheritance release form online.

-

How can airSlate SignNow help with my inheritance release form?

airSlate SignNow provides a user-friendly platform to create, send, and eSign your inheritance release form. With its intuitive interface, you can customize the form to meet your specific needs and ensure that all parties can sign it securely. This streamlines the process and saves you time.

-

Is there a cost associated with using airSlate SignNow for an inheritance release form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. You can choose a plan that fits your budget while gaining access to features that simplify the creation and management of your inheritance release form. Check our pricing page for more details.

-

What features does airSlate SignNow offer for managing inheritance release forms?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking for your inheritance release form. These tools enhance the efficiency of document management and ensure that you can monitor the signing process in real-time.

-

Can I integrate airSlate SignNow with other applications for my inheritance release form?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow when handling an inheritance release form. Whether you use CRM systems or cloud storage solutions, our platform can connect seamlessly to enhance your document management.

-

What are the benefits of using airSlate SignNow for an inheritance release form?

Using airSlate SignNow for your inheritance release form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform ensures that your documents are signed quickly and stored safely, making the entire process hassle-free.

-

How secure is my inheritance release form with airSlate SignNow?

Security is a top priority at airSlate SignNow. Your inheritance release form is protected with advanced encryption and secure access controls, ensuring that only authorized individuals can view or sign the document. This gives you peace of mind when handling sensitive information.

Get more for IA Inheritance Tax APPLICATION FOR RELEASE OF INHERITANCE TAX LIENS, 60 047

- Adlai e stevenson high school grade point waiver request d125 form

- Dilations translations worksheet form

- Gurs visiting professor program application form

- Petition for permission test or retest form

- 1 petition for permission to test or retest please print form

- Aadhar card change name surname correction online form

- Competition release and waiver form participant

- Canine export submission form kansas state veterinary

Find out other IA Inheritance Tax APPLICATION FOR RELEASE OF INHERITANCE TAX LIENS, 60 047

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample

- How To Sign West Virginia Lease agreement contract

- How Do I Sign Colorado Lease agreement template

- Sign Iowa Lease agreement template Free

- Sign Missouri Lease agreement template Later

- Sign West Virginia Lease agreement template Computer

- Sign Nevada Lease template Myself

- Sign North Carolina Loan agreement Simple

- Sign Maryland Month to month lease agreement Fast

- Help Me With Sign Colorado Mutual non-disclosure agreement