Instructions for New York State Tax Forms CT 4 and CT 3 2024-2026

Understanding the CT-3S Instructions for New York State Tax Forms

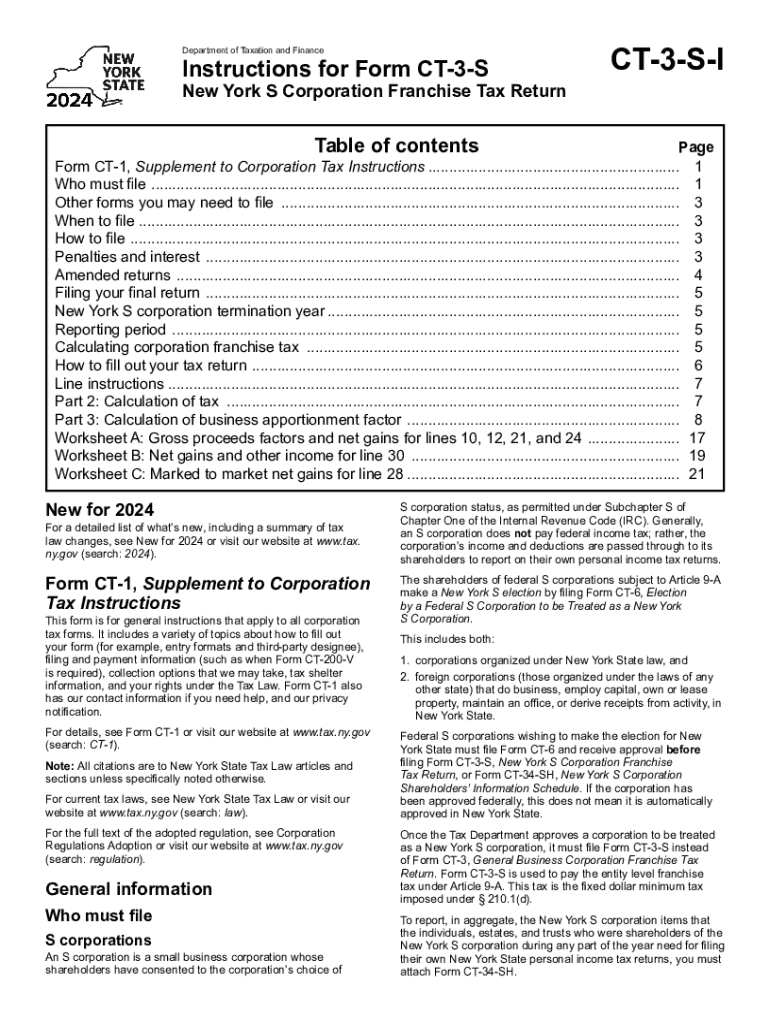

The CT-3S instructions provide essential guidance for businesses filing their New York State tax returns. This form is specifically designed for S corporations, allowing them to report income, deductions, and credits effectively. Understanding these instructions is crucial for ensuring compliance with state tax laws and avoiding potential penalties.

The CT-3S form is part of the larger suite of tax forms used in New York, including the CT-4. It is important for businesses to familiarize themselves with the specific requirements and nuances of the CT-3S to ensure accurate reporting.

Key Elements of the CT-3S Instructions

The CT-3S instructions include several key elements that businesses must pay attention to when completing the form. These elements encompass:

- Filing Requirements: Details on who must file the CT-3S and under what circumstances.

- Income Reporting: Guidelines on how to report various types of income, including capital gains and dividends.

- Deductions: Information on allowable deductions that can reduce taxable income.

- Credits: An overview of available tax credits that can benefit S corporations.

Each section of the instructions is designed to guide taxpayers through the complexities of state tax obligations, ensuring that all necessary information is reported accurately.

Steps to Complete the CT-3S Instructions

Completing the CT-3S instructions involves several systematic steps that help ensure accuracy and compliance:

- Gather Required Documents: Collect all necessary financial records, including income statements and expense reports.

- Review Eligibility Criteria: Confirm that your business qualifies as an S corporation and meets all filing requirements.

- Fill Out the Form: Carefully enter all required information, following the guidelines provided in the instructions.

- Double-Check Entries: Review the completed form for accuracy, ensuring all calculations are correct.

- Submit the Form: Choose your preferred submission method, whether online, by mail, or in person.

Following these steps can help streamline the filing process and minimize errors that could lead to compliance issues.

Filing Deadlines and Important Dates for the CT-3S

Timely filing of the CT-3S is critical to avoid penalties and interest charges. The primary filing deadline for S corporations is typically the fifteenth day of the third month following the end of the tax year. For most businesses, this means:

- For calendar year filers, the deadline is March 15.

- For fiscal year filers, the deadline is the fifteenth day of the third month after the end of the fiscal year.

It is advisable to mark these dates on your calendar and prepare your documentation in advance to ensure timely submission.

Legal Use of the CT-3S Instructions

The CT-3S instructions are legally binding documents that outline the requirements for S corporations in New York. Adhering to these instructions is essential for compliance with state tax laws. Failure to follow the guidelines can result in penalties, including fines and interest on unpaid taxes.

Understanding the legal implications of the CT-3S instructions helps businesses maintain compliance and avoid potential legal issues. It is recommended to consult with a tax professional if there are uncertainties regarding the instructions or filing process.

Obtaining the CT-3S Instructions

Businesses can obtain the CT-3S instructions through several methods. The most straightforward way is to visit the official New York State Department of Taxation and Finance website, where the instructions are available for download in PDF format. Additionally, printed copies may be requested directly from the department.

Having access to the most current version of the CT-3S instructions is important, as tax laws and requirements may change annually. Always ensure you are using the latest version when preparing your tax return.

Create this form in 5 minutes or less

Find and fill out the correct instructions for new york state tax forms ct 4 and ct 3

Create this form in 5 minutes!

How to create an eSignature for the instructions for new york state tax forms ct 4 and ct 3

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the ct 3 s instructions for using airSlate SignNow?

The ct 3 s instructions for airSlate SignNow guide users through the process of sending and signing documents electronically. These instructions ensure that you can efficiently navigate the platform, from uploading documents to obtaining signatures. Following these steps will help streamline your document management process.

-

How much does airSlate SignNow cost?

Pricing for airSlate SignNow varies based on the plan you choose, but it remains a cost-effective solution for businesses. The ct 3 s instructions provide details on how to select the right plan for your needs, ensuring you get the best value. You can also take advantage of free trials to explore the features before committing.

-

What features are included in the ct 3 s instructions?

The ct 3 s instructions cover a range of features available in airSlate SignNow, including document templates, real-time tracking, and secure eSigning. These features are designed to enhance your workflow and improve efficiency. By following the instructions, you can maximize the benefits of these tools.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow offers integrations with various applications, enhancing its functionality. The ct 3 s instructions detail how to connect with popular tools like Google Drive, Salesforce, and more. This allows for a seamless workflow across different platforms.

-

What are the benefits of using airSlate SignNow?

Using airSlate SignNow provides numerous benefits, including increased efficiency, reduced paper usage, and enhanced security for your documents. The ct 3 s instructions highlight how these advantages can transform your document management process. Businesses can save time and resources while ensuring compliance.

-

Is airSlate SignNow suitable for small businesses?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small enterprises. The ct 3 s instructions emphasize how small businesses can leverage the platform to streamline their operations without breaking the bank. It's an ideal solution for those looking to enhance productivity.

-

How secure is airSlate SignNow for document signing?

Security is a top priority for airSlate SignNow, which employs advanced encryption and authentication measures. The ct 3 s instructions explain the security features in place to protect your sensitive information. You can confidently send and sign documents knowing they are secure.

Get more for Instructions For New York State Tax Forms CT 4 And CT 3

Find out other Instructions For New York State Tax Forms CT 4 And CT 3

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple