Give Your Tax Deductible Donation to TEAMCharity Forms Form TemplatesJotFormCharity Forms Form TemplatesJotFormCharity Forms for 2019

Understanding the Give Your Tax Deductible Donation To TEAMCharity Form

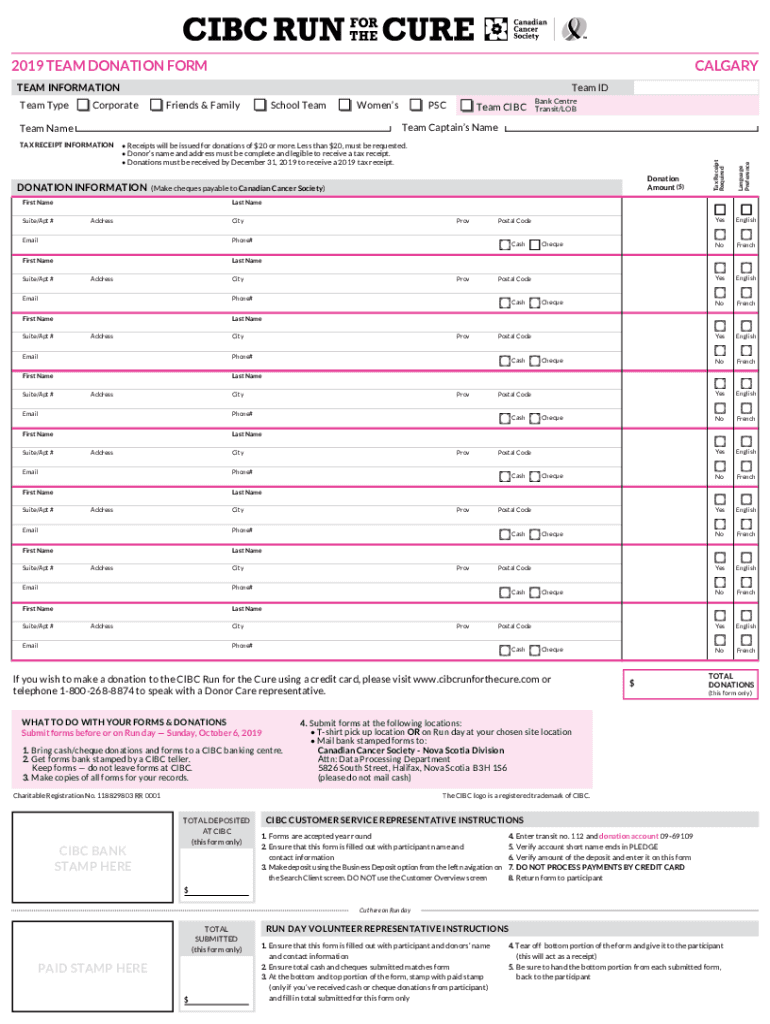

The Give Your Tax Deductible Donation To TEAMCharity form is designed for individuals and organizations wishing to make charitable contributions that qualify for tax deductions. This form serves as a formal record of the donation, which is essential for both the donor and the charity. It outlines the details of the donation, including the amount, date, and purpose, ensuring compliance with IRS regulations.

Steps to Complete the Give Your Tax Deductible Donation To TEAMCharity Form

Completing the Give Your Tax Deductible Donation To TEAMCharity form involves several straightforward steps:

- Gather Necessary Information: Collect details such as your name, address, and the charity's information.

- Fill Out the Form: Enter the donation amount, date of the contribution, and any specific purpose for the donation.

- Review for Accuracy: Double-check all entries to ensure that the information is correct.

- Sign and Date: Provide your signature and the date to validate the form.

- Submit the Form: Follow the submission guidelines to send the form to the appropriate charity or keep it for your records.

Legal Use of the Give Your Tax Deductible Donation To TEAMCharity Form

The legal use of the Give Your Tax Deductible Donation To TEAMCharity form is crucial for ensuring that donations are recognized as tax-deductible. The form must be filled out accurately to meet IRS guidelines. It serves as proof of the donation, which is necessary for claiming deductions on your tax return. Keeping a copy of this form is advisable in case of an audit or for your personal records.

Key Elements of the Give Your Tax Deductible Donation To TEAMCharity Form

Several key elements are essential for the Give Your Tax Deductible Donation To TEAMCharity form to be valid:

- Donor Information: Full name and contact details of the donor.

- Charity Information: Name and address of the charity receiving the donation.

- Donation Amount: The total amount donated.

- Date of Donation: The date when the donation was made.

- Purpose of Donation: Any specific purpose for which the donation is intended.

IRS Guidelines for Tax Deductible Donations

According to IRS guidelines, to qualify for a tax deduction, donations must be made to qualified charitable organizations. The donor should ensure that the charity is registered as a tax-exempt organization under section 501(c)(3) of the Internal Revenue Code. Additionally, the donor must keep adequate records, including the completed Give Your Tax Deductible Donation To TEAMCharity form, to substantiate the deduction claimed on their tax return.

Examples of Using the Give Your Tax Deductible Donation To TEAMCharity Form

Utilizing the Give Your Tax Deductible Donation To TEAMCharity form can take various forms, such as:

- Making a one-time cash donation to a local charity.

- Contributing goods or services, documented through the form.

- Setting up recurring donations, with each contribution recorded using the form.

These examples highlight the versatility of the form in accommodating different types of charitable contributions while ensuring compliance with tax regulations.

Quick guide on how to complete give your tax deductible donation to teamcharity forms form templatesjotformcharity forms form templatesjotformcharity forms

Prepare Give Your Tax Deductible Donation To TEAMCharity Forms Form TemplatesJotFormCharity Forms Form TemplatesJotFormCharity Forms For effortlessly on any device

Online document handling has gained popularity among companies and individuals. It serves as a suitable eco-friendly substitute for conventional printed and signed papers, enabling you to obtain the correct template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Give Your Tax Deductible Donation To TEAMCharity Forms Form TemplatesJotFormCharity Forms Form TemplatesJotFormCharity Forms For on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign Give Your Tax Deductible Donation To TEAMCharity Forms Form TemplatesJotFormCharity Forms Form TemplatesJotFormCharity Forms For with ease

- Locate Give Your Tax Deductible Donation To TEAMCharity Forms Form TemplatesJotFormCharity Forms Form TemplatesJotFormCharity Forms For and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your updates.

- Choose how you wish to send your form, either by email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Alter and eSign Give Your Tax Deductible Donation To TEAMCharity Forms Form TemplatesJotFormCharity Forms Form TemplatesJotFormCharity Forms For and ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct give your tax deductible donation to teamcharity forms form templatesjotformcharity forms form templatesjotformcharity forms

Create this form in 5 minutes!

How to create an eSignature for the give your tax deductible donation to teamcharity forms form templatesjotformcharity forms form templatesjotformcharity forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are TEAMCharity Forms Form TemplatesJotForm?

TEAMCharity Forms Form TemplatesJotForm are customizable templates designed to help organizations collect tax-deductible donations efficiently. By using these templates, you can streamline the donation process and ensure compliance with tax regulations, making it easier for your supporters to contribute.

-

How can I give my tax-deductible donation to TEAMCharity Forms Form TemplatesJotForm?

To give your tax-deductible donation to TEAMCharity Forms Form TemplatesJotForm, simply select the template that suits your needs, fill in the required information, and submit your donation. The process is user-friendly and designed to facilitate quick contributions.

-

Are there any costs associated with using TEAMCharity Forms Form TemplatesJotForm?

While some features of TEAMCharity Forms Form TemplatesJotForm may be free, there are premium options available that offer additional functionalities. Pricing varies based on the features you choose, ensuring you can find a solution that fits your budget while still allowing you to give your tax-deductible donation.

-

What features do TEAMCharity Forms Form TemplatesJotForm offer?

TEAMCharity Forms Form TemplatesJotForm come with a variety of features, including customizable fields, automated email confirmations, and secure payment processing. These features enhance the donation experience for both the organization and the donor, making it easier to give your tax-deductible donation.

-

Can I integrate TEAMCharity Forms Form TemplatesJotForm with other platforms?

Yes, TEAMCharity Forms Form TemplatesJotForm can be integrated with various platforms such as payment gateways, CRM systems, and email marketing tools. This integration allows for seamless data management and enhances your ability to track donations and donor engagement.

-

How do TEAMCharity Forms Form TemplatesJotForm benefit my organization?

Using TEAMCharity Forms Form TemplatesJotForm can signNowly benefit your organization by simplifying the donation process and improving donor experience. This leads to increased donations and helps you effectively manage and acknowledge contributions, ensuring that donors feel appreciated for their tax-deductible donations.

-

Is it easy to customize TEAMCharity Forms Form TemplatesJotForm?

Absolutely! TEAMCharity Forms Form TemplatesJotForm are designed for easy customization, allowing you to tailor the forms to match your organization's branding and specific needs. This flexibility ensures that you can create a unique experience for donors when they give their tax-deductible donation.

Get more for Give Your Tax Deductible Donation To TEAMCharity Forms Form TemplatesJotFormCharity Forms Form TemplatesJotFormCharity Forms For

- Mytaxlawyerorgfresh start program boronoffer in compromise fresh start program in borontax relief form

- Instructions for forms 1099 sa and 5498 sa internal

- Sports medicine department pre participation physical forms

- Sports medicine department pre participation physical forms

- Form sj 833a download fillable pdf or fill online civil union

- Boe 266 los angeles form

- 2021 california los angeles tax form

- Pdf termination of employment at end of drop participation form

Find out other Give Your Tax Deductible Donation To TEAMCharity Forms Form TemplatesJotFormCharity Forms Form TemplatesJotFormCharity Forms For

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word