Virginia Form R 1

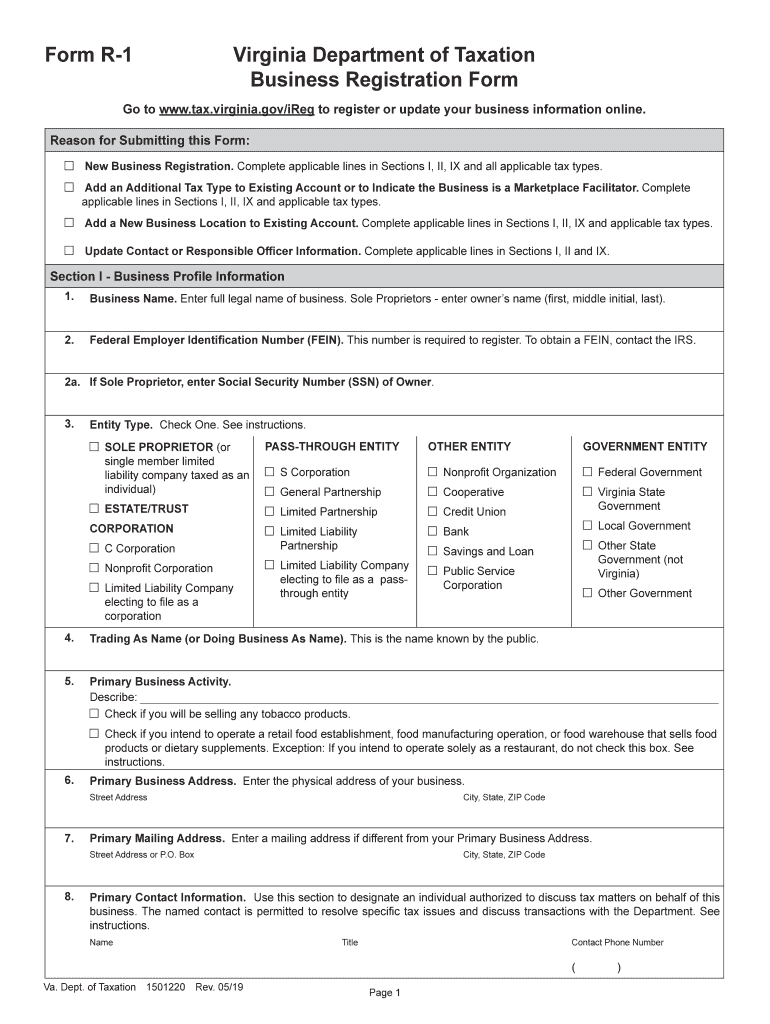

What is the Virginia Form R-1?

The Virginia Form R-1 is a tax document used by individuals and businesses in the state of Virginia to report their income and calculate their tax liability. This form is essential for ensuring compliance with state tax regulations and is typically required for various business entities, including corporations, partnerships, and sole proprietorships. Understanding the purpose and requirements of the Virginia Form R-1 is crucial for accurate tax reporting and avoiding potential penalties.

Steps to Complete the Virginia Form R-1

Completing the Virginia Form R-1 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, such as income statements and expense records. Next, fill out the form by providing your personal information, including your Social Security number or Employer Identification Number (EIN). Report your total income, deductions, and any applicable credits. Finally, double-check your entries for accuracy before submitting the form to the Virginia Department of Taxation.

Legal Use of the Virginia Form R-1

The Virginia Form R-1 is legally binding and must be completed in accordance with state tax laws. It serves as an official declaration of income and tax obligations. To ensure the form's legal validity, it is important to provide truthful and accurate information. Misrepresentation or failure to file can result in penalties, including fines and interest on unpaid taxes. Utilizing a reliable eSignature solution can further enhance the form's legitimacy when submitting electronically.

Form Submission Methods

The Virginia Form R-1 can be submitted through various methods, offering flexibility for taxpayers. Options include:

- Online Submission: Use the Virginia Department of Taxation's online portal to file electronically.

- Mail: Print the completed form and send it to the appropriate address provided by the Virginia Department of Taxation.

- In-Person: Deliver the form directly to a local tax office for processing.

Choosing the right submission method can streamline the filing process and ensure timely compliance with tax deadlines.

Required Documents

To complete the Virginia Form R-1 accurately, certain documents are necessary. These typically include:

- Income statements, such as W-2s or 1099s.

- Records of deductible expenses relevant to your business.

- Any prior year tax returns for reference.

Having these documents on hand will facilitate a smoother completion process and help ensure that all income and deductions are reported correctly.

Filing Deadlines / Important Dates

Filing deadlines for the Virginia Form R-1 are crucial for compliance. Generally, the form is due on May 1 for calendar year filers. It is important to be aware of any extensions or specific deadlines that may apply to your situation. Missing the deadline can lead to penalties and interest on unpaid taxes, making timely submission essential.

Penalties for Non-Compliance

Failure to file the Virginia Form R-1 on time or submitting inaccurate information can result in significant penalties. These may include:

- Late filing penalties, which can accumulate over time.

- Interest on any unpaid taxes, calculated from the due date until payment is made.

- Potential legal action for severe cases of tax evasion or fraud.

Understanding the consequences of non-compliance emphasizes the importance of accurate and timely filing of the Virginia Form R-1.

Quick guide on how to complete business registration application form r 1 virginia tax

Finalize Virginia Form R 1 effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your files promptly without holdups. Handle Virginia Form R 1 across any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and eSign Virginia Form R 1 with ease

- Obtain Virginia Form R 1 and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Verify the details and click the Done button to save your changes.

- Choose your preferred method of sharing your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form navigation, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Virginia Form R 1 to ensure exceptional communication throughout your form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the business registration application form r 1 virginia tax

How to create an eSignature for the Business Registration Application Form R 1 Virginia Tax in the online mode

How to generate an eSignature for your Business Registration Application Form R 1 Virginia Tax in Chrome

How to generate an electronic signature for putting it on the Business Registration Application Form R 1 Virginia Tax in Gmail

How to make an electronic signature for the Business Registration Application Form R 1 Virginia Tax straight from your smartphone

How to make an eSignature for the Business Registration Application Form R 1 Virginia Tax on iOS devices

How to create an eSignature for the Business Registration Application Form R 1 Virginia Tax on Android OS

People also ask

-

What is the Virginia Form R 3, and how can airSlate SignNow help?

The Virginia Form R 3 is a required form for businesses to report their Virginia withholding tax. airSlate SignNow simplifies this process by allowing users to create, send, and eSign the Virginia Form R 3 digitally, ensuring accuracy and efficiency in tax reporting.

-

Is airSlate SignNow a cost-effective tool for managing the Virginia Form R 3?

Yes, airSlate SignNow offers a cost-effective solution for managing the Virginia Form R 3, making it accessible for businesses of any size. With affordable pricing plans, you can streamline your document signing process without breaking the bank.

-

What features does airSlate SignNow offer for the Virginia Form R 3?

airSlate SignNow provides a variety of features for the Virginia Form R 3, including customizable templates, secure eSignatures, and cloud storage. These features help ensure that your documents are not only compliant but also easily accessible when needed.

-

Can I integrate airSlate SignNow with other software for processing the Virginia Form R 3?

Absolutely! airSlate SignNow offers seamless integration with various applications such as CRM and accounting software. This means you can automate your workflow for processing the Virginia Form R 3 and enhance overall productivity.

-

How does airSlate SignNow ensure the security of my Virginia Form R 3 documents?

Security is a top priority for airSlate SignNow. Our platform employs advanced encryption and authentication measures to protect your Virginia Form R 3 documents, ensuring they remain confidential and secure throughout the signing process.

-

Can airSlate SignNow help me track the status of my Virginia Form R 3 submissions?

Yes, airSlate SignNow enables you to track the status of your Virginia Form R 3 submissions in real-time. You will receive notifications and updates when your documents are viewed, signed, or completed, making it easy to manage your filing deadlines.

-

What benefits does using airSlate SignNow offer for small businesses handling the Virginia Form R 3?

Using airSlate SignNow provides numerous benefits for small businesses managing the Virginia Form R 3. It saves time and resources, reduces paperwork errors, and enhances compliance, allowing you to focus on growing your business instead of getting bogged down by paperwork.

Get more for Virginia Form R 1

- Sol driving school form

- Teacher nominationrating form

- Temporary food service facility permit application form

- Property owner authorization for tenant pay plan form wssc

- Mcps form 33545 january 2021request for change of

- 56 loan contract template to edit download ampamp print form

- Gifted ampamp talented nomination form alva public schools

- Maryland kinship care affidavit 402557598 form

Find out other Virginia Form R 1

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF