Charitable Organization Registration Statement Form CO 1 2024-2026

What is the Charitable Organization Registration Statement Form CO 1

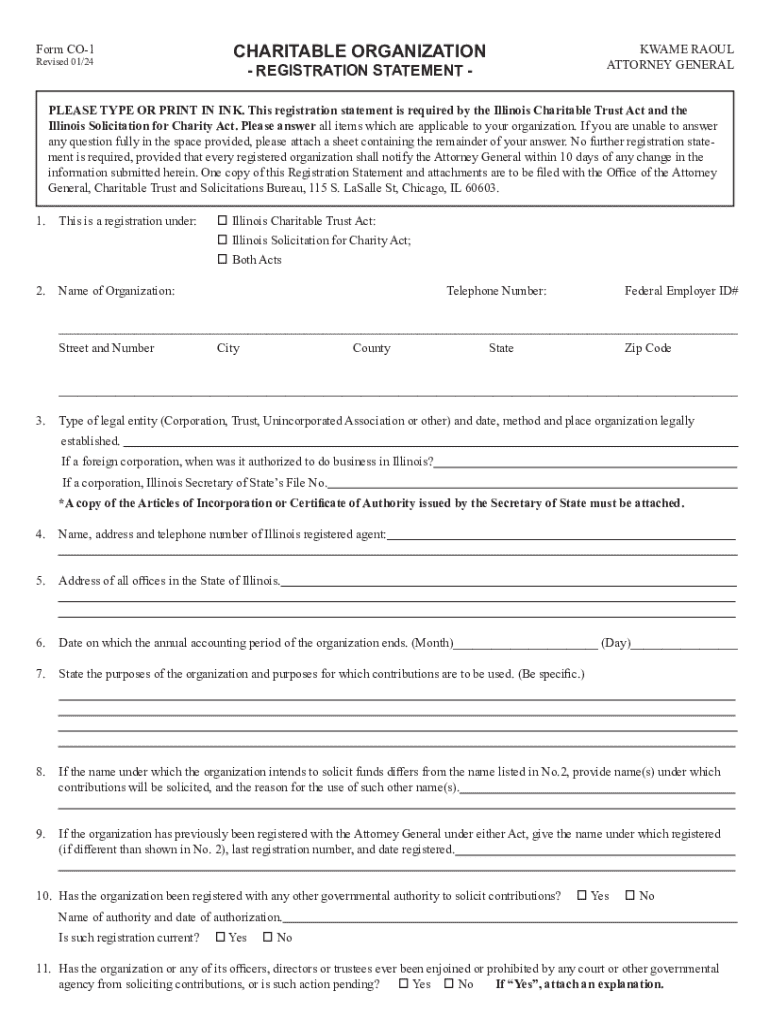

The Charitable Organization Registration Statement Form CO 1 is a document required by the state of Illinois for organizations that wish to solicit charitable contributions. This form serves as a formal declaration of the organization's intent to operate as a charitable entity within the state. It ensures compliance with state regulations and provides transparency to the public regarding the organization's activities and financial practices.

The CO 1 form collects essential information about the organization, including its name, address, purpose, and the names of its officers and directors. By submitting this form, organizations demonstrate their commitment to ethical fundraising practices and accountability to their donors.

How to Obtain the Charitable Organization Registration Statement Form CO 1

The CO 1 form can be obtained directly from the Illinois Secretary of State's website or through their office. Organizations can download a fillable version of the form, which allows for easy completion and submission. In addition, physical copies may be available at designated state offices.

It is important for organizations to ensure they are using the most current version of the form to avoid any issues during the registration process. Regularly checking the state’s official resources can help ensure compliance with any updates or changes to the form.

Steps to Complete the Charitable Organization Registration Statement Form CO 1

Completing the CO 1 form involves several key steps. First, organizations should gather all necessary information, including their mission statement, financial data, and details about their board members. Next, they should carefully fill out each section of the form, ensuring accuracy and completeness.

After completing the form, organizations must review it for any errors or omissions. Once confirmed, the form can be submitted either online or via mail, depending on the preferences of the organization and the submission options available. It is advisable to keep a copy of the completed form for the organization’s records.

Legal Use of the Charitable Organization Registration Statement Form CO 1

The CO 1 form is legally required for any organization in Illinois that seeks to solicit charitable contributions. Failing to complete and submit this form can lead to penalties, including fines and restrictions on fundraising activities. The form ensures that organizations adhere to state laws governing charitable solicitations, promoting transparency and accountability.

Organizations must ensure that they comply with all legal requirements associated with the form, including any necessary disclosures about their financial practices and fundraising efforts. This compliance not only protects the organization but also builds trust with potential donors.

Key Elements of the Charitable Organization Registration Statement Form CO 1

Key elements of the CO 1 form include the organization's name, primary address, purpose, and the names and addresses of its officers and directors. Additionally, the form requires information about the organization’s fiscal year and its financial practices, including how funds will be used and reported.

Organizations must also provide a description of their fundraising activities and any affiliations with other charitable organizations. This information is crucial for ensuring that the organization is transparent about its operations and fundraising goals.

Form Submission Methods

The CO 1 form can be submitted through various methods, including online submission via the Illinois Secretary of State's website, mailing a hard copy to the appropriate office, or delivering it in person. Each method has specific guidelines and requirements that organizations should follow to ensure successful submission.

Online submission is often the most efficient option, allowing for immediate processing and confirmation. Organizations choosing to submit by mail should ensure they send the form to the correct address and consider using a tracking method to confirm delivery.

Quick guide on how to complete charitable organization registration statement form co 1 739223240

Complete Charitable Organization Registration Statement Form CO 1 effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Charitable Organization Registration Statement Form CO 1 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to edit and eSign Charitable Organization Registration Statement Form CO 1 with ease

- Obtain Charitable Organization Registration Statement Form CO 1 and then click Get Form to begin.

- Utilize the features we offer to complete your document.

- Highlight important parts of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a traditional handwritten signature.

- Review the information and then click the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searches, or errors that require printing new document versions. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Charitable Organization Registration Statement Form CO 1 and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct charitable organization registration statement form co 1 739223240

Create this form in 5 minutes!

How to create an eSignature for the charitable organization registration statement form co 1 739223240

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a co1 form and how is it used?

The co1 form is a specific document used for various business transactions, often related to compliance and regulatory requirements. With airSlate SignNow, you can easily create, send, and eSign co1 forms, streamlining your workflow and ensuring that all necessary signatures are collected efficiently.

-

How much does it cost to use airSlate SignNow for co1 forms?

airSlate SignNow offers competitive pricing plans that cater to different business needs, including those who frequently use co1 forms. You can choose from monthly or annual subscriptions, with options that provide access to advanced features for managing your co1 forms effectively.

-

What features does airSlate SignNow offer for managing co1 forms?

airSlate SignNow provides a range of features for co1 forms, including customizable templates, automated workflows, and real-time tracking of document status. These features help ensure that your co1 forms are processed quickly and securely, enhancing overall productivity.

-

Can I integrate airSlate SignNow with other applications for co1 forms?

Yes, airSlate SignNow offers seamless integrations with various applications, allowing you to manage your co1 forms alongside your existing tools. This integration capability enhances your workflow by connecting with CRM systems, cloud storage, and other essential software.

-

What are the benefits of using airSlate SignNow for co1 forms?

Using airSlate SignNow for co1 forms provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform ensures that your documents are signed and stored securely, while also allowing for easy access and management of your co1 forms.

-

Is it easy to eSign a co1 form with airSlate SignNow?

Absolutely! airSlate SignNow makes it incredibly easy to eSign a co1 form. Users can sign documents electronically from any device, ensuring a quick turnaround and eliminating the need for printing or scanning.

-

How does airSlate SignNow ensure the security of my co1 forms?

airSlate SignNow prioritizes the security of your co1 forms by implementing advanced encryption and authentication measures. This ensures that your documents are protected during transmission and storage, giving you peace of mind when handling sensitive information.

Get more for Charitable Organization Registration Statement Form CO 1

- Warranty deed from two individuals to husband and wife maryland form

- Maryland special warranty form

- Md waiver form 497310192

- Maryland release form

- Quitclaim deed by two individuals to llc maryland form

- Warranty deed from two individuals to llc maryland form

- Unconditional waiver and release upon progress payment corporation or llc maryland form

- Maryland intestate form

Find out other Charitable Organization Registration Statement Form CO 1

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure