Homeowners Property Tax Credit Application HTC 1 Form Homeowners Property Tax Credit Application HTC 1 Form 2023

What is the Homeowners Property Tax Credit Application HTC 1 Form

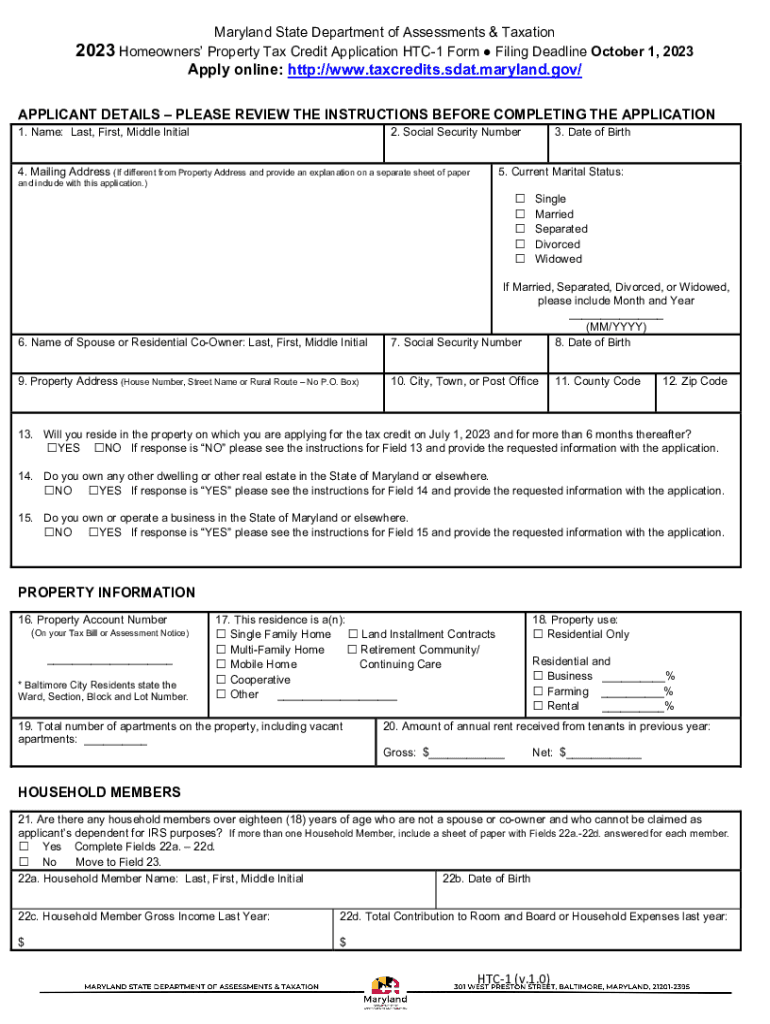

The Homeowners Property Tax Credit Application HTC 1 Form is a crucial document that allows eligible homeowners in the United States to apply for property tax credits. This form is designed to provide financial relief by reducing the property tax burden for qualifying individuals. The application process is typically overseen by state or local tax authorities, and the credits can vary based on income, age, and property value.

How to use the Homeowners Property Tax Credit Application HTC 1 Form

Using the Homeowners Property Tax Credit Application HTC 1 Form involves several steps. First, gather all necessary documentation, including proof of income and property ownership. Next, complete the form accurately, ensuring all information aligns with the supporting documents. After filling out the form, submit it according to the guidelines provided by your local tax authority, either online or via mail. It is important to keep a copy of the submitted form for your records.

Steps to complete the Homeowners Property Tax Credit Application HTC 1 Form

Completing the Homeowners Property Tax Credit Application HTC 1 Form requires careful attention to detail. Follow these steps:

- Review the eligibility criteria to ensure you qualify.

- Collect required documents, such as income statements and property deeds.

- Fill out the form, providing accurate personal and property information.

- Double-check all entries for accuracy and completeness.

- Submit the form through the designated method, either online or by mail.

Eligibility Criteria

Eligibility for the Homeowners Property Tax Credit typically includes factors such as income level, age, and residency status. Homeowners must usually demonstrate that their income falls below a certain threshold and that they occupy the property as their primary residence. Specific criteria can vary by state, so it is essential to consult local guidelines to confirm eligibility.

Required Documents

When applying for the Homeowners Property Tax Credit, several documents are generally required. These may include:

- Proof of income, such as tax returns or pay stubs.

- Documentation of property ownership, such as a deed or mortgage statement.

- Identification, like a driver's license or Social Security number.

Having these documents ready can streamline the application process and help ensure a successful submission.

Form Submission Methods

The Homeowners Property Tax Credit Application HTC 1 Form can typically be submitted through various methods. Most states offer online submission options via their tax authority websites, allowing for a quick and efficient process. Alternatively, homeowners may choose to mail their completed forms or, in some cases, submit them in person at local tax offices. It is important to follow the specific submission guidelines provided by the relevant authorities to avoid delays.

Quick guide on how to complete homeowners property tax credit application htc 1 form homeowners property tax credit application htc 1 form

Complete Homeowners Property Tax Credit Application HTC 1 Form Homeowners Property Tax Credit Application HTC 1 Form effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage Homeowners Property Tax Credit Application HTC 1 Form Homeowners Property Tax Credit Application HTC 1 Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Homeowners Property Tax Credit Application HTC 1 Form Homeowners Property Tax Credit Application HTC 1 Form without hassle

- Locate Homeowners Property Tax Credit Application HTC 1 Form Homeowners Property Tax Credit Application HTC 1 Form and click Get Form to begin.

- Use the tools provided to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Homeowners Property Tax Credit Application HTC 1 Form Homeowners Property Tax Credit Application HTC 1 Form and ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct homeowners property tax credit application htc 1 form homeowners property tax credit application htc 1 form

Create this form in 5 minutes!

How to create an eSignature for the homeowners property tax credit application htc 1 form homeowners property tax credit application htc 1 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Homeowners Property Tax Credit Application HTC 1 Form?

The Homeowners Property Tax Credit Application HTC 1 Form is a document that allows homeowners to apply for property tax credits. This form helps reduce the tax burden for eligible homeowners, making it an essential tool for financial relief. Understanding how to fill out this form correctly can maximize your benefits.

-

How can I access the Homeowners Property Tax Credit Application HTC 1 Form?

You can easily access the Homeowners Property Tax Credit Application HTC 1 Form through our platform. Simply visit our website, navigate to the forms section, and download the HTC 1 Form. This ensures you have the most up-to-date version for your application.

-

What features does airSlate SignNow offer for the Homeowners Property Tax Credit Application HTC 1 Form?

airSlate SignNow offers a range of features for the Homeowners Property Tax Credit Application HTC 1 Form, including eSigning, document sharing, and secure storage. These features streamline the application process, making it easier for homeowners to submit their forms efficiently. Additionally, our platform is user-friendly, ensuring a smooth experience.

-

Is there a cost associated with using airSlate SignNow for the Homeowners Property Tax Credit Application HTC 1 Form?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective. Our pricing plans are tailored to fit various needs, ensuring that you can manage your Homeowners Property Tax Credit Application HTC 1 Form without breaking the bank. We offer different tiers to accommodate both individual and business users.

-

What are the benefits of using airSlate SignNow for my Homeowners Property Tax Credit Application HTC 1 Form?

Using airSlate SignNow for your Homeowners Property Tax Credit Application HTC 1 Form provides numerous benefits, including faster processing times and enhanced security. Our platform ensures that your documents are safely stored and easily accessible. Additionally, the eSigning feature allows for quick approvals, reducing the time spent on paperwork.

-

Can I integrate airSlate SignNow with other applications for my Homeowners Property Tax Credit Application HTC 1 Form?

Absolutely! airSlate SignNow offers integrations with various applications, enhancing your workflow for the Homeowners Property Tax Credit Application HTC 1 Form. Whether you use CRM systems or document management tools, our platform can seamlessly connect, making your application process more efficient.

-

How do I ensure my Homeowners Property Tax Credit Application HTC 1 Form is filled out correctly?

To ensure your Homeowners Property Tax Credit Application HTC 1 Form is filled out correctly, utilize our platform's guided features. We provide tips and prompts to help you complete each section accurately. Additionally, reviewing the form before submission can help catch any errors, ensuring a smooth application process.

Get more for Homeowners Property Tax Credit Application HTC 1 Form Homeowners Property Tax Credit Application HTC 1 Form

- Privacy act consent form 100375428

- Bapplicationb for non immigrant visa the philippine embassy in port bb form

- Student directions build an atom activity answer key form

- Drug use evaluation template form

- Wisconsin dnr 3300 66 form

- Lta form of bluecross lab

- Mail application and all requirements to dmv 1905 lana ave ne salem or 97314 form

- Pa form cdl transportation fill out and sign printable

Find out other Homeowners Property Tax Credit Application HTC 1 Form Homeowners Property Tax Credit Application HTC 1 Form

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe