Homeowners' Property Tax Credit Application Form HTC 2024-2026

What is the Homeowners' Property Tax Credit Application Form HTC?

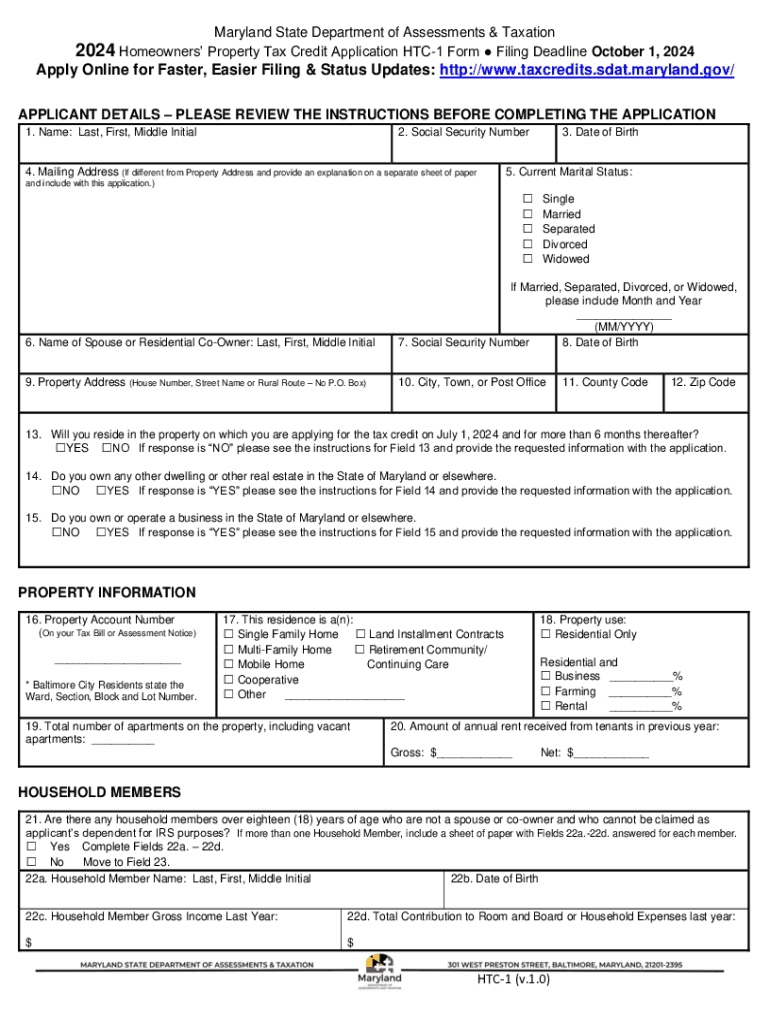

The Homeowners' Property Tax Credit Application Form, often referred to as the HTC-1 form, is a crucial document for Maryland residents seeking financial relief on their property taxes. This credit is designed to assist eligible homeowners by reducing their property tax burden based on income and property value. The form collects essential information about the homeowner's financial status, property details, and residency to determine eligibility for the tax credit.

Eligibility Criteria for the Homeowners' Property Tax Credit

To qualify for the homeowners property tax credit, applicants must meet specific criteria set by the state of Maryland. Generally, eligibility includes:

- Homeownership: The applicant must own and occupy the property as their principal residence.

- Income Limits: The homeowner's gross income must fall below a certain threshold, which is adjusted annually.

- Property Value: The assessed value of the property must meet specific limits to qualify for the credit.

It is essential for applicants to review the latest eligibility guidelines to ensure they meet all requirements before submitting the HTC-1 form.

Steps to Complete the Homeowners' Property Tax Credit Application Form HTC

Filling out the HTC-1 form involves several straightforward steps:

- Gather necessary documents, including proof of income, property tax bills, and identification.

- Complete the HTC-1 form, ensuring all sections are filled out accurately.

- Double-check the information for any errors or omissions.

- Submit the completed form to the appropriate local tax office by the specified deadline.

Completing these steps accurately can help ensure a smooth application process and increase the likelihood of receiving the tax credit.

Required Documents for the Homeowners' Property Tax Credit Application

When applying for the homeowners property tax credit, certain documents are necessary to support the application. Commonly required documents include:

- Proof of income, such as recent pay stubs or tax returns.

- Property tax assessments or bills to verify property ownership.

- Identification documents, such as a driver's license or state ID.

Having these documents ready can expedite the application process and ensure all required information is submitted correctly.

Form Submission Methods for the Homeowners' Property Tax Credit Application

The HTC-1 form can be submitted through various methods, providing flexibility for applicants. Common submission methods include:

- Online submission via the Maryland state tax website, if available.

- Mailing the completed form to the local tax office.

- In-person submission at designated local government offices.

Choosing the appropriate submission method can depend on personal preference and the urgency of the application.

Filing Deadlines for the Homeowners' Property Tax Credit Application

Timely submission of the HTC-1 form is crucial for homeowners seeking the property tax credit. The filing deadlines typically align with the annual tax cycle, and applicants should be aware of the following:

- Annual submission deadline: Usually set for a specific date each year, often in the spring.

- Late applications: Some jurisdictions may allow late applications under certain circumstances, but this varies.

Staying informed about these deadlines can help ensure that homeowners do not miss out on potential tax relief.

Quick guide on how to complete homeowners property tax credit application form htc

Prepare Homeowners' Property Tax Credit Application Form HTC effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Homeowners' Property Tax Credit Application Form HTC on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The easiest way to edit and eSign Homeowners' Property Tax Credit Application Form HTC with minimal effort

- Locate Homeowners' Property Tax Credit Application Form HTC and click on Get Form to begin.

- Use the tools we offer to fill out your form.

- Highlight important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow.

- Generate your eSignature with the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to share your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about missing or lost files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Homeowners' Property Tax Credit Application Form HTC to guarantee exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct homeowners property tax credit application form htc

Create this form in 5 minutes!

How to create an eSignature for the homeowners property tax credit application form htc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the MD homeowners property tax credit?

The MD homeowners property tax credit is a program designed to provide financial relief to eligible homeowners in Maryland by reducing their property tax burden. This credit is based on the homeowner's income and the assessed value of their property, making it an essential resource for those who qualify.

-

How can I apply for the MD homeowners property tax credit?

To apply for the MD homeowners property tax credit, you need to complete the application form available on the Maryland State Department of Assessments and Taxation website. Ensure you have all necessary documentation, including proof of income and property ownership, to facilitate a smooth application process.

-

What are the eligibility requirements for the MD homeowners property tax credit?

Eligibility for the MD homeowners property tax credit typically requires that you own and occupy your home as your principal residence, meet certain income limits, and have a property that is assessed at a specific value. It's important to check the latest guidelines to ensure you meet all criteria.

-

How much can I save with the MD homeowners property tax credit?

The savings from the MD homeowners property tax credit can vary signNowly based on your income and the assessed value of your property. Homeowners may receive a reduction in their property taxes, which can lead to substantial annual savings, depending on individual circumstances.

-

When is the application deadline for the MD homeowners property tax credit?

The application deadline for the MD homeowners property tax credit is typically set for July 1st of each year. It is crucial to submit your application on time to ensure you receive the credit for the upcoming tax year.

-

Can I use airSlate SignNow to eSign my MD homeowners property tax credit application?

Yes, you can use airSlate SignNow to eSign your MD homeowners property tax credit application, making the process quick and efficient. Our platform allows you to securely sign documents online, ensuring that your application is submitted promptly and without hassle.

-

What features does airSlate SignNow offer for managing property tax documents?

airSlate SignNow offers a range of features for managing property tax documents, including customizable templates, secure eSigning, and document tracking. These tools streamline the process of applying for the MD homeowners property tax credit and help you stay organized.

Get more for Homeowners' Property Tax Credit Application Form HTC

- Limited power of attorney where you specify powers with sample powers included new hampshire form

- Limited power of attorney for stock transactions and corporate powers new hampshire form

- Special durable power of attorney for bank account matters new hampshire form

- New hampshire business 497318942 form

- New hampshire property management package new hampshire form

- Sample annual minutes for a new hampshire professional corporation new hampshire form

- Sample bylaws for a new hampshire professional corporation new hampshire form

- Sample corporate records for a new hampshire professional corporation new hampshire form

Find out other Homeowners' Property Tax Credit Application Form HTC

- How Do I Sign Texas Banking Memorandum Of Understanding

- Sign Virginia Banking Profit And Loss Statement Mobile

- Sign Alabama Business Operations LLC Operating Agreement Now

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now