Homeowners Property Tax Credit Application HTC 1 FormFiling Deadline September 1, Homeowners Property Tax Credit Application HTC 2020

Understanding the Homeowners Property Tax Credit Application HTC 1

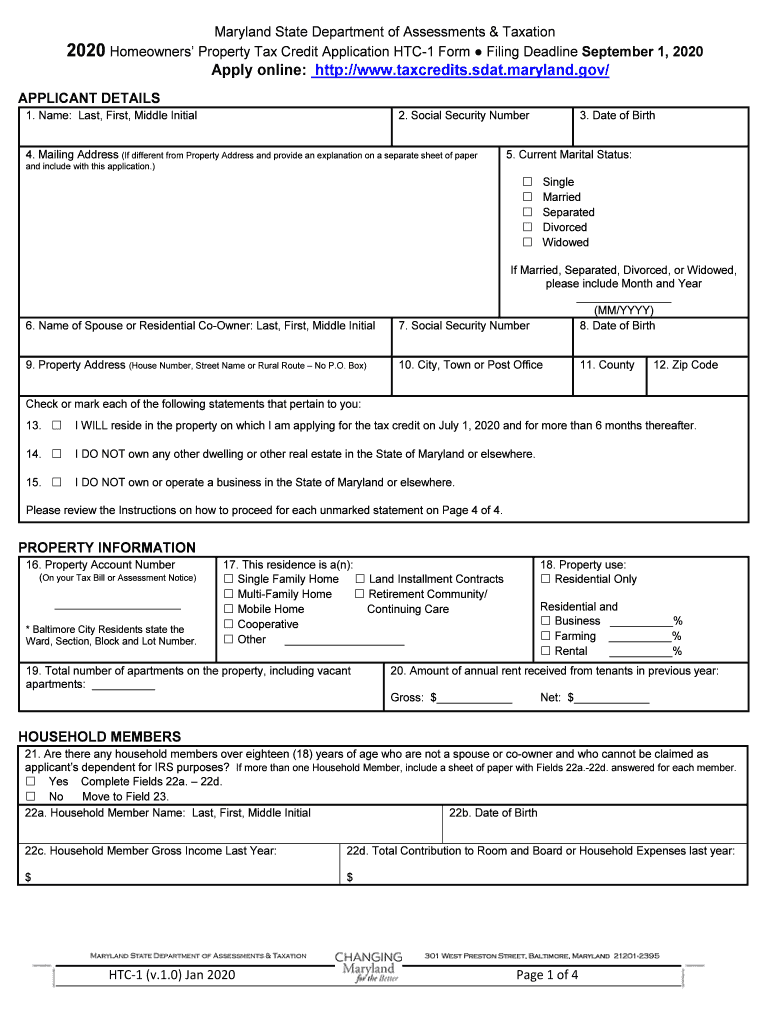

The Homeowners Property Tax Credit Application, commonly referred to as the HTC 1 form, is designed for homeowners seeking financial relief through property tax credits. This form allows eligible individuals to apply for a reduction in their property taxes, which can provide significant savings. The application is typically available through state tax offices and is crucial for those who meet specific criteria, including income thresholds and property ownership status.

Steps to Complete the Homeowners Property Tax Credit Application HTC 1

Filling out the HTC 1 form involves several key steps to ensure accuracy and compliance. Begin by gathering necessary documentation, such as proof of income, property ownership details, and any other relevant financial information. Next, carefully fill out each section of the form, ensuring that all information is complete and accurate. After completing the form, review it thoroughly to avoid errors, and then submit it by the specified deadline, which is September 1 for most jurisdictions.

Eligibility Criteria for the Homeowners Property Tax Credit Application HTC 1

To qualify for the Homeowners Property Tax Credit, applicants must meet certain eligibility criteria. Generally, this includes being a homeowner, residing in the property as a primary residence, and meeting specific income limits set by the state. Additionally, some states may have age or disability requirements that could further define eligibility. It is essential to review these criteria carefully to ensure that you qualify before submitting the HTC 1 form.

Required Documents for the Homeowners Property Tax Credit Application HTC 1

When preparing to submit the HTC 1 form, applicants should collect several important documents. These typically include:

- Proof of income, such as tax returns or pay stubs

- Documentation of property ownership, including a deed or mortgage statement

- Identification, such as a driver's license or social security number

Having these documents ready will streamline the application process and help ensure that the form is completed accurately.

Form Submission Methods for the Homeowners Property Tax Credit Application HTC 1

Applicants have various options for submitting the HTC 1 form. Most states allow for online submissions through their official tax websites, which can be a convenient option. Alternatively, forms can often be mailed to the appropriate tax office or submitted in person at designated locations. It is important to verify the submission methods available in your state to ensure timely processing of your application.

Important Filing Deadlines for the Homeowners Property Tax Credit Application HTC 1

The filing deadline for the Homeowners Property Tax Credit Application HTC 1 is typically September 1. Meeting this deadline is crucial, as late submissions may result in disqualification from receiving the credit for that tax year. Homeowners should set reminders and prepare their applications well in advance to avoid any last-minute issues that could prevent them from obtaining the financial relief they need.

Quick guide on how to complete homeowners property tax credit application htc 1 formfiling deadline september 1 homeowners property tax credit application htc

Effortlessly prepare Homeowners Property Tax Credit Application HTC 1 FormFiling Deadline September 1, Homeowners Property Tax Credit Application HTC on any device

The management of online documents has gained traction among companies and individuals alike. It presents an ideal environmentally friendly substitute for traditional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to swiftly create, modify, and electronically sign your documents without delays. Handle Homeowners Property Tax Credit Application HTC 1 FormFiling Deadline September 1, Homeowners Property Tax Credit Application HTC on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest method to adjust and electronically sign Homeowners Property Tax Credit Application HTC 1 FormFiling Deadline September 1, Homeowners Property Tax Credit Application HTC with ease

- Obtain Homeowners Property Tax Credit Application HTC 1 FormFiling Deadline September 1, Homeowners Property Tax Credit Application HTC and click Get Form to commence.

- Utilize the tools we offer to complete your form.

- Emphasize essential sections of your documents or redact sensitive information using the tools that airSlate SignNow specifically provides for that purpose.

- Generate your electronic signature with the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Choose how you wish to share your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new versions. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and electronically sign Homeowners Property Tax Credit Application HTC 1 FormFiling Deadline September 1, Homeowners Property Tax Credit Application HTC to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct homeowners property tax credit application htc 1 formfiling deadline september 1 homeowners property tax credit application htc

Create this form in 5 minutes!

How to create an eSignature for the homeowners property tax credit application htc 1 formfiling deadline september 1 homeowners property tax credit application htc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Homeowners Property Tax Credit Application HTC 1 FormFiling Deadline September 1?

The Homeowners Property Tax Credit Application HTC 1 FormFiling Deadline September 1 is the last date by which homeowners must submit their applications to qualify for property tax credits. Meeting this deadline is crucial to ensure you receive the financial benefits available to you as a homeowner.

-

How can airSlate SignNow help with the Homeowners Property Tax Credit Application HTC 1 FormFiling Deadline September 1?

airSlate SignNow provides an efficient platform for completing and submitting the Homeowners Property Tax Credit Application HTC 1 Form. With our user-friendly interface, you can easily fill out the form and eSign it, ensuring you meet the September 1 deadline without hassle.

-

What features does airSlate SignNow offer for the Homeowners Property Tax Credit Application HTC 1 Form?

Our platform offers features such as document templates, eSignature capabilities, and secure cloud storage, all tailored to streamline the Homeowners Property Tax Credit Application HTC 1 Form process. These features help you manage your application efficiently and securely.

-

Is there a cost associated with using airSlate SignNow for the Homeowners Property Tax Credit Application HTC 1 Form?

Yes, airSlate SignNow offers various pricing plans to suit different needs. Our cost-effective solutions ensure that you can easily manage your Homeowners Property Tax Credit Application HTC 1 Form without breaking the bank, especially when meeting the September 1 deadline.

-

What are the benefits of using airSlate SignNow for my Homeowners Property Tax Credit Application HTC 1 Form?

Using airSlate SignNow for your Homeowners Property Tax Credit Application HTC 1 Form simplifies the application process, saves time, and reduces errors. Our platform ensures that you can submit your application confidently before the September 1 deadline.

-

Can I integrate airSlate SignNow with other tools for my Homeowners Property Tax Credit Application HTC 1 Form?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to enhance your workflow while managing your Homeowners Property Tax Credit Application HTC 1 Form. This integration helps you keep all your documents organized and accessible.

-

What should I do if I miss the Homeowners Property Tax Credit Application HTC 1 FormFiling Deadline September 1?

If you miss the Homeowners Property Tax Credit Application HTC 1 FormFiling Deadline September 1, you may lose your eligibility for the tax credit for that year. It's essential to stay informed about deadlines and utilize tools like airSlate SignNow to ensure timely submissions in the future.

Get more for Homeowners Property Tax Credit Application HTC 1 FormFiling Deadline September 1, Homeowners Property Tax Credit Application HTC

- Media survey form

- Provisions for testamentary charitable remainder unitrust for one life form

- Request for complete performance evaluation

- Belated condolence form

- Wills and estateslaw 101 fundamentals of the law form

- Street address data standard working draft 20 fgdc form

- Invitation to bridal shower form

- This might help fat to halt accumulating in your system form

Find out other Homeowners Property Tax Credit Application HTC 1 FormFiling Deadline September 1, Homeowners Property Tax Credit Application HTC

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online