Correcting a Return NM Taxation and Revenue Department Form

What is the Correcting A Return NM Taxation And Revenue Department?

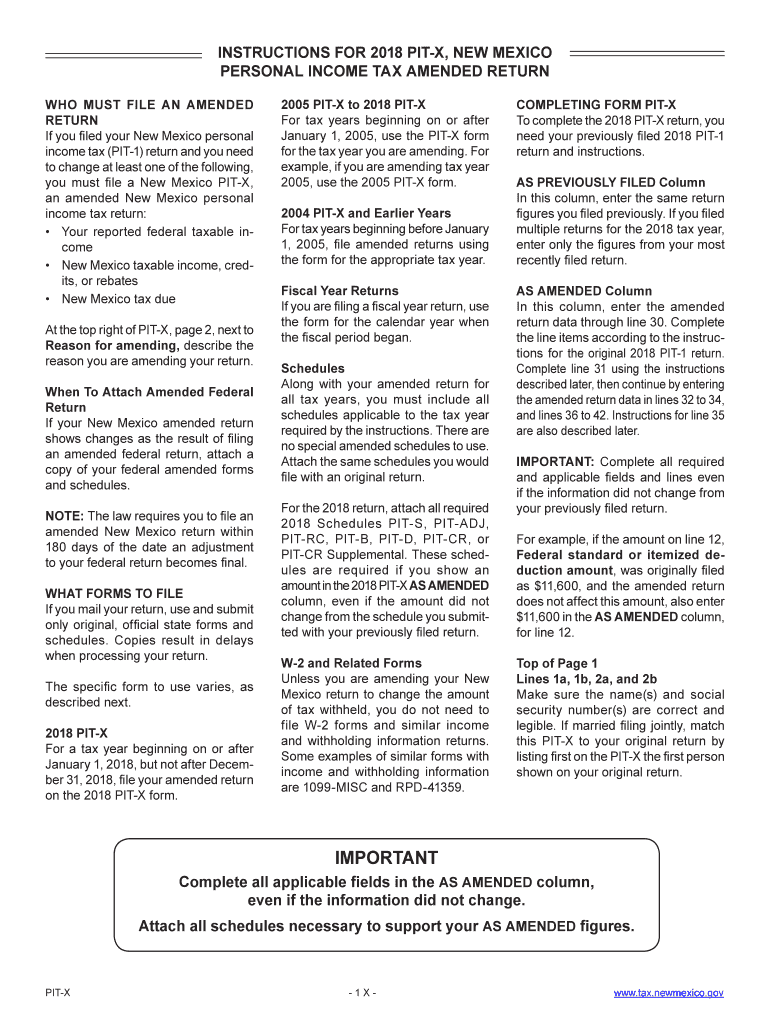

The Correcting A Return form is a crucial document provided by the New Mexico Taxation and Revenue Department. It is designed for taxpayers who need to amend their previously filed tax returns. This form allows individuals and businesses to correct errors, update information, or claim additional deductions or credits that were not included in the original submission. Understanding the purpose and significance of this form is essential for ensuring compliance with state tax laws.

Steps to Complete the Correcting A Return NM Taxation And Revenue Department

Completing the Correcting A Return form involves several important steps:

- Gather Required Information: Collect all relevant documents, including your original tax return and any supporting documentation for the changes you intend to make.

- Obtain the Correct Form: Ensure you have the latest version of the Correcting A Return form from the New Mexico Taxation and Revenue Department's official website.

- Fill Out the Form: Carefully complete the form, providing accurate information for both the original return and the corrections being made.

- Review Your Changes: Double-check all entries for accuracy to avoid further complications.

- Submit the Form: Follow the submission guidelines, ensuring that you send the form to the appropriate address or submit it electronically if that option is available.

Legal Use of the Correcting A Return NM Taxation And Revenue Department

The Correcting A Return form is legally recognized as a valid means for taxpayers to amend their tax filings in New Mexico. By submitting this form, individuals acknowledge their responsibility to provide accurate tax information and comply with state regulations. The legal framework surrounding this form ensures that corrections are processed appropriately, helping to maintain the integrity of the state’s tax system.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Correcting A Return form. Typically, taxpayers must submit the correction within a specific timeframe after the original return was filed. Failure to adhere to these deadlines may result in penalties or denial of the corrections. Always check the New Mexico Taxation and Revenue Department's official resources for the most current deadlines applicable to your situation.

Required Documents

When completing the Correcting A Return form, certain documents are essential to support your corrections. These may include:

- Your original tax return.

- Any relevant W-2s, 1099s, or other income statements.

- Documentation for any deductions or credits being claimed.

- Proof of payment for any additional taxes owed.

Penalties for Non-Compliance

Failing to file the Correcting A Return form when necessary can lead to significant penalties. Taxpayers may face fines, interest on unpaid taxes, or even legal action in severe cases. Understanding the consequences of non-compliance emphasizes the importance of timely and accurate submissions to the New Mexico Taxation and Revenue Department.

Quick guide on how to complete correcting a return nm taxation and revenue department

Effortlessly Prepare Correcting A Return NM Taxation And Revenue Department on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents efficiently, without any delays. Manage Correcting A Return NM Taxation And Revenue Department on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to Edit and eSign Correcting A Return NM Taxation And Revenue Department with Ease

- Obtain Correcting A Return NM Taxation And Revenue Department and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize signNow sections of your documents or conceal sensitive information with the features that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click the Done button to save your changes.

- Decide how you wish to send your form, whether by email, SMS, or shared link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device you choose. Edit and eSign Correcting A Return NM Taxation And Revenue Department and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the correcting a return nm taxation and revenue department

How to make an eSignature for your Correcting A Return Nm Taxation And Revenue Department in the online mode

How to generate an eSignature for the Correcting A Return Nm Taxation And Revenue Department in Chrome

How to generate an electronic signature for putting it on the Correcting A Return Nm Taxation And Revenue Department in Gmail

How to generate an eSignature for the Correcting A Return Nm Taxation And Revenue Department right from your smart phone

How to make an eSignature for the Correcting A Return Nm Taxation And Revenue Department on iOS devices

How to make an eSignature for the Correcting A Return Nm Taxation And Revenue Department on Android OS

People also ask

-

What is nmsttaxrfd and how does it work with airSlate SignNow?

The term nmsttaxrfd refers to a specific tax-related document management process. airSlate SignNow simplifies this process by allowing users to easily send, sign, and manage nmsttaxrfd documents electronically, ensuring a streamlined workflow and faster turnaround times.

-

How much does airSlate SignNow cost for managing nmsttaxrfd documents?

airSlate SignNow offers a range of pricing plans that cater to different business needs, making it an affordable solution for managing nmsttaxrfd documents. Depending on the features you require, you can choose from various subscription options that fit your budget.

-

What features does airSlate SignNow provide for nmsttaxrfd document management?

airSlate SignNow offers robust features for nmsttaxrfd document management, including templates, secure eSigning, and tracking capabilities. These tools ensure that your nmsttaxrfd documents are signed quickly and securely while maintaining compliance with legal standards.

-

Can airSlate SignNow integrate with other software for nmsttaxrfd processes?

Yes, airSlate SignNow seamlessly integrates with a variety of applications that can enhance your nmsttaxrfd processes. Popular integrations include CRM systems, cloud storage solutions, and productivity tools, allowing for a more efficient document management system.

-

What are the main benefits of using airSlate SignNow for nmsttaxrfd documents?

The main benefits of using airSlate SignNow for nmsttaxrfd documents include increased efficiency, reduced paper usage, and enhanced security. These advantages help businesses save time and money while ensuring that their nmsttaxrfd documentation is handled properly.

-

Is airSlate SignNow compliant with regulations for nmsttaxrfd documents?

Absolutely! airSlate SignNow prioritizes compliance by adhering to industry regulations for nmsttaxrfd documents. This includes following eSignature laws, ensuring data protection, and providing secure storage for sensitive information.

-

How can I start using airSlate SignNow for my nmsttaxrfd needs?

Getting started with airSlate SignNow for your nmsttaxrfd needs is easy. Simply sign up for a free trial on their website, explore the features, and begin sending and signing your nmsttaxrfd documents within minutes.

Get more for Correcting A Return NM Taxation And Revenue Department

- Maryland statement of charges form fill online printable

- Complaint and summons against tenant in breach of lease mdcourts gov form

- Receipt and waiver of mechanics39 lien rights triad builders form

- Motion to continue 673878409 form

- Pdf illinois probationcourt services employmentpromotion application form

- Il sup ct rule 204 subpoena for a foreign action cover form

- Fillable online ccg n645 01 04 10 cook county clerk of form

- 12th judicial circuit courtcourt servicesfamily gal form

Find out other Correcting A Return NM Taxation And Revenue Department

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF