Stax 1 Form

What is the Stax 1?

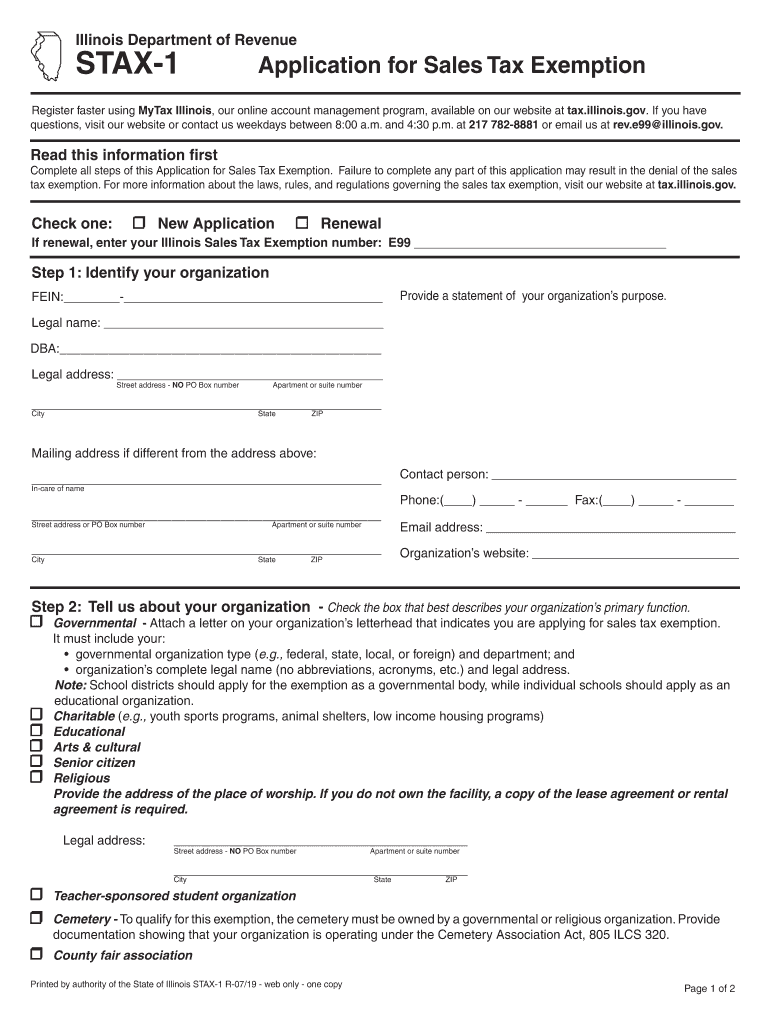

The Stax 1, or the Illinois Application for Sales Tax Exemption, is a crucial form for businesses and organizations seeking to claim sales tax exemptions in Illinois. This form is primarily used by entities that qualify for tax-exempt status, such as non-profit organizations, government agencies, and certain educational institutions. By completing the Stax 1, eligible applicants can avoid paying sales tax on purchases related to their exempt activities.

Steps to complete the Stax 1

Filling out the Stax 1 requires careful attention to detail to ensure compliance with Illinois tax regulations. Here are the essential steps:

- Gather necessary documents, including proof of tax-exempt status.

- Provide accurate information about the organization, including its legal name and address.

- Clearly state the reason for the exemption, specifying the type of exempt activity.

- Ensure all signatures are included, as missing signatures can delay processing.

- Review the completed form for accuracy before submission.

Eligibility Criteria

To qualify for the Stax 1 exemption, applicants must meet specific eligibility criteria set by the Illinois Department of Revenue. Generally, the following categories may qualify:

- Non-profit organizations that operate exclusively for charitable, religious, or educational purposes.

- Government entities at the federal, state, or local levels.

- Certain educational institutions recognized by the state.

It is essential to verify that your organization falls within these categories before applying.

Required Documents

When submitting the Stax 1, applicants must provide supporting documentation to validate their exempt status. Commonly required documents include:

- A copy of the organization’s IRS determination letter, if applicable.

- Proof of the organization’s tax-exempt status, such as a certificate or letter from the Illinois Department of Revenue.

- Any additional documentation that supports the claim for exemption.

Form Submission Methods

The Stax 1 can be submitted through various methods to accommodate different preferences. Applicants can choose to:

- Submit the form online through the Illinois Department of Revenue's website.

- Mail the completed form to the appropriate address specified by the department.

- Deliver the form in person at designated state offices.

Each method has its own processing times and requirements, so it is advisable to check the latest guidelines from the Illinois Department of Revenue.

Legal use of the Stax 1

The legal framework surrounding the Stax 1 is governed by Illinois tax laws. Proper use of this form ensures that eligible organizations can benefit from tax exemptions without facing penalties. It is important to understand that misuse of the exemption can lead to legal repercussions, including fines or back taxes. Therefore, applicants should ensure they fully comply with all legal requirements when completing and submitting the form.

Quick guide on how to complete stax 1 application for sales tax exemption

Prepare Stax 1 effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without interruptions. Manage Stax 1 on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centered process today.

How to modify and eSign Stax 1 with ease

- Find Stax 1 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and has the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to share your form, by email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Stax 1 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the stax 1 application for sales tax exemption

How to make an eSignature for the Stax 1 Application For Sales Tax Exemption in the online mode

How to make an eSignature for the Stax 1 Application For Sales Tax Exemption in Chrome

How to create an eSignature for signing the Stax 1 Application For Sales Tax Exemption in Gmail

How to generate an eSignature for the Stax 1 Application For Sales Tax Exemption straight from your smartphone

How to create an electronic signature for the Stax 1 Application For Sales Tax Exemption on iOS devices

How to make an eSignature for the Stax 1 Application For Sales Tax Exemption on Android

People also ask

-

What is the process for obtaining an Illinois sales tax exemption online?

To obtain an Illinois sales tax exemption online, you must complete the required exemption certificate and submit it through an authorized platform. Using airSlate SignNow simplifies this process, allowing you to easily eSign and send your documents securely. This ensures that your request is processed efficiently without the hassle of physical paperwork.

-

How can airSlate SignNow help with my Illinois sales tax exemption application?

airSlate SignNow provides an efficient solution to manage your Illinois sales tax exemption applications. Our platform allows for easy document creation, eSigning, and secure sharing, ensuring a streamlined process. By utilizing our service, you can complete your application faster and with greater accuracy.

-

Are there any fees associated with using airSlate SignNow for Illinois sales tax exemption?

airSlate SignNow offers a range of pricing plans to accommodate various business needs. While there may be a subscription fee, the cost is generally offset by time savings and increased efficiency in processing Illinois sales tax exemption requests. We also offer a free trial for new users to explore our features.

-

Can I integrate airSlate SignNow with other business tools for my sales tax exemption process?

Yes, airSlate SignNow integrates seamlessly with various business tools, enhancing your workflow when handling Illinois sales tax exemption online. Integrations with platforms such as Google Drive, Salesforce, and Dropbox allow for easy access and management of your documents. This ensures a more cohesive experience across your business operations.

-

What features does airSlate SignNow offer for managing Illinois sales tax exemption forms?

airSlate SignNow comes equipped with features specifically designed to facilitate the management of Illinois sales tax exemption forms. These include customizable templates, templates for exemption certificates, secure eSigning, and automated workflows. Such features help ensure that your documents are completed correctly and processed timely.

-

How secure is my data when applying for Illinois sales tax exemption online?

Security is a top priority for airSlate SignNow. Our platform employs industry-standard encryption protocols to protect your data while applying for Illinois sales tax exemption online. You can rest assured that your sensitive information is handled with the utmost care and security.

-

What benefits does airSlate SignNow offer for obtaining Illinois sales tax exemption?

Using airSlate SignNow for your Illinois sales tax exemption provides numerous benefits, including enhanced speed and efficiency in document processing. Our user-friendly interface simplifies the paperwork involved, reducing errors and saving time. Additionally, the ability to track the status of your documents in real-time offers peace of mind.

Get more for Stax 1

- Illinois statewide forms approved dissolution of marriagecivil union divorce no children

- 12 08 27 norway supreme court review of oslo district form

- Personal guarantee of rental agreement legalformsorg

- New occupant statement 425574239 form

- River bend ranch fay ranches form

- Asset manager property inspection report 4 property address form

- Consignment form 495565864

- Contact us at pods for moving options ampamp storage services form

Find out other Stax 1

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure

- Help Me With eSign Texas Plumbing Business Plan Template

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure

- eSign Alabama Real Estate Quitclaim Deed Mobile