Nm Rpd 41375 Form

What is the Nm Rpd 41375

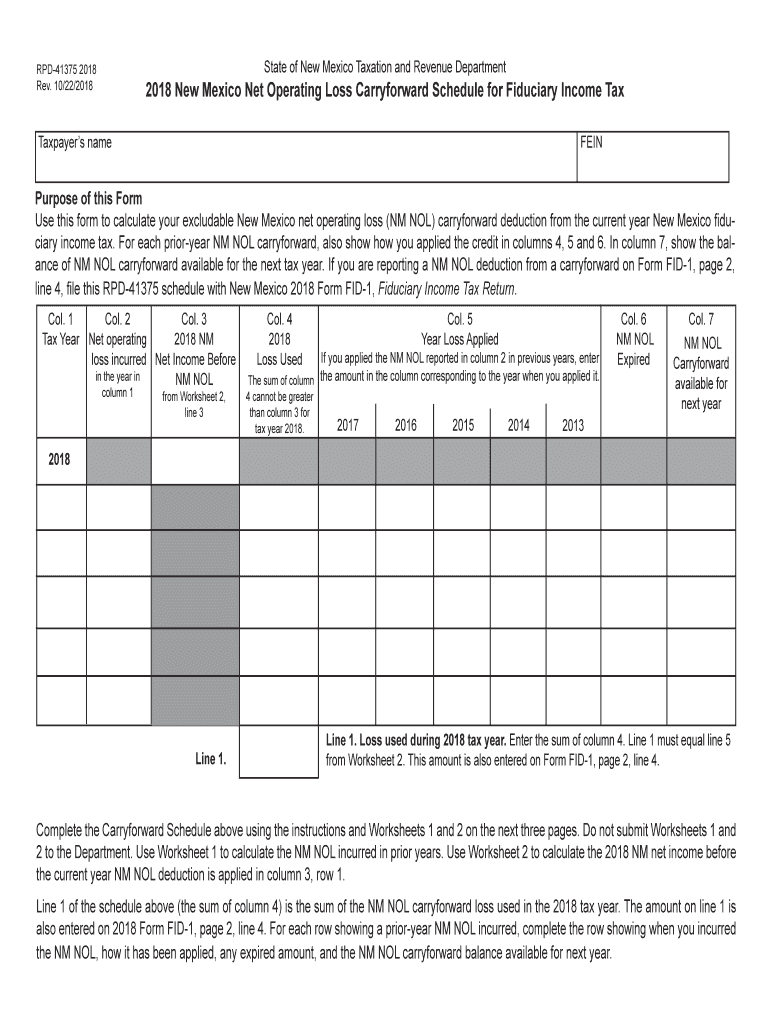

The Nm Rpd 41375 is a specific form used in New Mexico for reporting certain tax-related information. This form is essential for individuals and businesses to ensure compliance with state tax regulations. It typically involves the disclosure of income, deductions, and other relevant financial data necessary for accurate tax assessments. Understanding the purpose and requirements of the Nm Rpd 41375 is crucial for anyone required to file it, as it directly impacts tax obligations and potential refunds.

How to Use the Nm Rpd 41375

Using the Nm Rpd 41375 involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and previous tax returns. Next, carefully fill out the form, ensuring that all information is accurate and complete. It is important to follow the specific instructions provided with the form to avoid errors that could lead to penalties or delays. Once completed, the form can be submitted either online or via mail, depending on your preference and the guidelines set forth by the New Mexico taxation authority.

Steps to Complete the Nm Rpd 41375

Completing the Nm Rpd 41375 requires attention to detail. Start by entering your personal information, including your name, address, and taxpayer identification number. Next, report your income sources and any applicable deductions. Ensure that you double-check all figures for accuracy. After filling out all sections, review the form for completeness and clarity. Finally, sign and date the form before submitting it according to the specified submission methods. This careful approach helps ensure compliance and minimizes the risk of issues with your tax return.

Legal Use of the Nm Rpd 41375

The Nm Rpd 41375 is legally binding when completed correctly and submitted in accordance with New Mexico state laws. It serves as an official document that reflects your financial activities and tax obligations. To ensure its legal standing, it is essential to comply with all relevant tax regulations and guidelines. The form must be signed by the taxpayer or an authorized representative, and any false information could lead to penalties or legal repercussions.

Required Documents for the Nm Rpd 41375

When preparing to complete the Nm Rpd 41375, it is important to gather all required documents. This typically includes W-2 forms, 1099 forms, and any other statements that detail your income. Additionally, documentation for deductions, such as receipts for business expenses or charitable contributions, should also be collected. Having these documents on hand will facilitate a smoother completion process and help ensure that all information reported is accurate and verifiable.

Form Submission Methods for the Nm Rpd 41375

The Nm Rpd 41375 can be submitted through various methods, providing flexibility for taxpayers. Individuals can choose to file the form online through the New Mexico taxation authority's website, which often allows for quicker processing. Alternatively, the form can be mailed to the appropriate tax office or submitted in person at designated locations. Each submission method has its own guidelines, so it is important to follow the instructions carefully to ensure timely and accurate processing.

Penalties for Non-Compliance with the Nm Rpd 41375

Failing to comply with the requirements of the Nm Rpd 41375 can result in significant penalties. Common repercussions include fines, interest on unpaid taxes, and potential legal action. It is crucial to file the form accurately and on time to avoid these penalties. Understanding the implications of non-compliance emphasizes the importance of diligent record-keeping and timely submission of all tax-related documents.

Quick guide on how to complete 2018 new mexico net operating loss carryforward schedule for fiduciary income tax

Prepare Nm Rpd 41375 effortlessly on any device

Web-based document management has become increasingly favored by organizations and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documentation, enabling you to locate the correct form and securely preserve it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage Nm Rpd 41375 on any platform with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Nm Rpd 41375 with ease

- Obtain Nm Rpd 41375 and click Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize relevant portions of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to deliver your form, whether by email, text message (SMS), invite link, or downloading it to your computer.

Eliminate worries about lost or misplaced documents, cumbersome form searches, or errors that necessitate printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you prefer. Modify and eSign Nm Rpd 41375 and ensure outstanding communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2018 new mexico net operating loss carryforward schedule for fiduciary income tax

How to create an electronic signature for your 2018 New Mexico Net Operating Loss Carryforward Schedule For Fiduciary Income Tax online

How to create an eSignature for your 2018 New Mexico Net Operating Loss Carryforward Schedule For Fiduciary Income Tax in Chrome

How to create an electronic signature for putting it on the 2018 New Mexico Net Operating Loss Carryforward Schedule For Fiduciary Income Tax in Gmail

How to create an eSignature for the 2018 New Mexico Net Operating Loss Carryforward Schedule For Fiduciary Income Tax right from your mobile device

How to create an electronic signature for the 2018 New Mexico Net Operating Loss Carryforward Schedule For Fiduciary Income Tax on iOS devices

How to make an eSignature for the 2018 New Mexico Net Operating Loss Carryforward Schedule For Fiduciary Income Tax on Android

People also ask

-

What is rpd41375 and how does it relate to airSlate SignNow?

Rpd41375 is a unique identifier for our airSlate SignNow services, which enable businesses to easily send and eSign documents. This solution is designed to streamline workflows and enhance document management for organizations of all sizes.

-

What features does airSlate SignNow offer with rpd41375?

With rpd41375, airSlate SignNow includes features such as customizable templates, advanced security measures, and real-time tracking of documents. These features ensure that your eSigning process is efficient, secure, and tailored to your business needs.

-

How much does airSlate SignNow cost under the rpd41375 plan?

The rpd41375 plan for airSlate SignNow offers competitive pricing based on the size and requirements of your organization. We provide flexible subscription models, so businesses can select the option that best fits their budget while benefiting from our eSigning capabilities.

-

What are the benefits of using airSlate SignNow with rpd41375?

Using airSlate SignNow under rpd41375 offers several benefits including enhanced efficiency, reduced turnaround times, and improved accuracy in document handling. Businesses can also cut costs associated with paper-based processes, leading to a more sustainable operation.

-

Can airSlate SignNow integrate with other software when using rpd41375?

Yes, airSlate SignNow under rpd41375 supports integrations with various third-party applications. This ensures that your existing workflows can seamlessly incorporate our eSigning capabilities, enhancing productivity across your organization.

-

Is rpd41375 suitable for small businesses as well as enterprises?

Absolutely! The rpd41375 plan is designed to cater to both small businesses and large enterprises. Regardless of your company's size, airSlate SignNow can scale to meet your document signing needs effectively.

-

How secure is the airSlate SignNow service provided under rpd41375?

AirSlate SignNow prioritizes security, especially under the rpd41375 plan. We implement robust encryption, multi-factor authentication, and compliance with data protection regulations to ensure that your documents are safe during the signing process.

Get more for Nm Rpd 41375

- Efb emc assessment checklist efb electromagnetic compatibility emc assessment form

- Louisville fsdo air tour safety standards worksheet faa form

- Privacy act statement this statement is provided pursuant to the privacy act of 1974 5 usc 552a the form

- Federal registervol 71 no 20tuesday january 31 nhtsa nhtsa form

- Hyperglycemia high blood glucoseada american diabetes associdiabetesamerican dental associationhyperglycemia high blood form

- Form 818b post tensioned slab on grade

- Standard vendor contract template form

- Standard work contract template form

Find out other Nm Rpd 41375

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation