Pit 110 New Mexico Form

What is the Pit 110 New Mexico Form

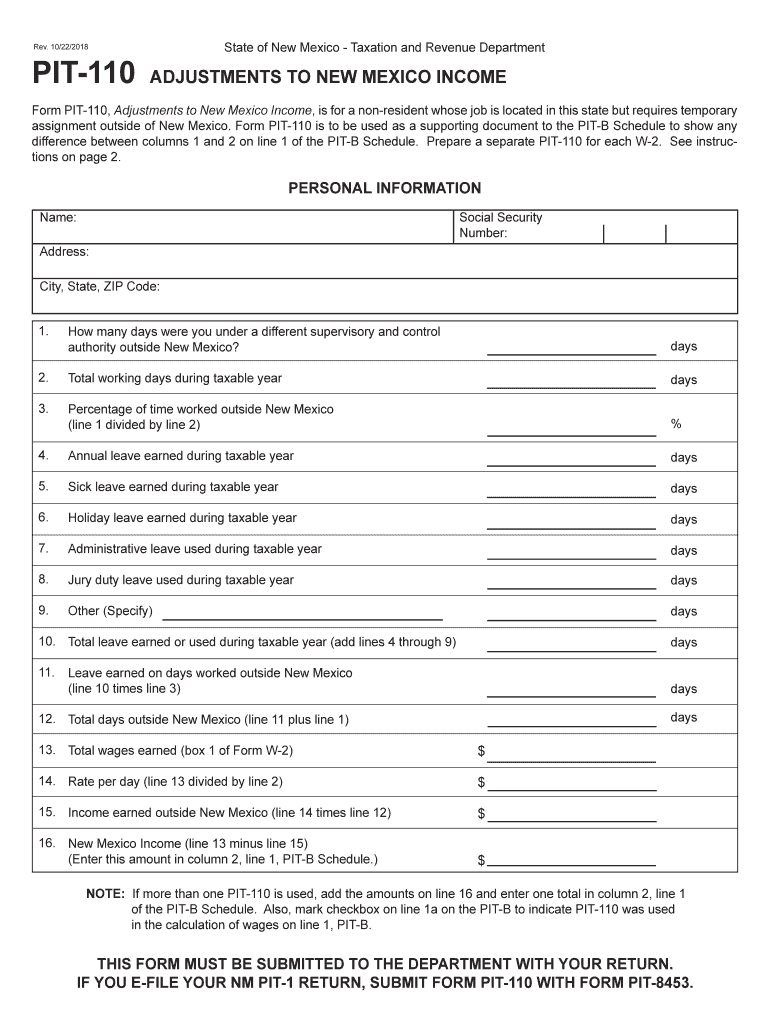

The Pit 110 New Mexico form is a crucial document used for reporting personal income tax in the state of New Mexico. This form is specifically designed for individuals and entities to declare their income, deductions, and credits for the tax year. It is essential for ensuring compliance with state tax regulations and for calculating the amount of tax owed or the refund due. The form captures various income sources, including wages, business income, and investment earnings, and allows taxpayers to apply for applicable deductions and credits.

How to use the Pit 110 New Mexico Form

Using the Pit 110 New Mexico form involves several key steps. First, gather all necessary financial documents, such as W-2s, 1099s, and any records of deductions. Next, download the form from the New Mexico Taxation and Revenue Department's website or obtain a physical copy. Fill out the form accurately, ensuring that all income, deductions, and credits are reported correctly. Once completed, review the form for any errors before submitting it to the appropriate tax authority. It is also advisable to keep a copy of the submitted form for your records.

Steps to complete the Pit 110 New Mexico Form

Completing the Pit 110 New Mexico form requires careful attention to detail. Follow these steps for a smooth process:

- Gather all relevant financial documents, including income statements and receipts for deductions.

- Download or obtain the Pit 110 form.

- Fill in your personal information, including your name, address, and Social Security number.

- Report all sources of income, ensuring accuracy in amounts.

- Apply any deductions and credits that you qualify for.

- Calculate your total tax liability or refund based on the information provided.

- Review the completed form for accuracy before submission.

Legal use of the Pit 110 New Mexico Form

The Pit 110 New Mexico form is legally binding when filled out correctly and submitted to the state tax authorities. It must comply with the New Mexico tax laws and regulations. Failure to accurately report income or to file the form on time can result in penalties and interest charges. It is important to ensure that all information is truthful and complete, as providing false information can lead to legal consequences, including potential criminal charges.

Form Submission Methods

The Pit 110 New Mexico form can be submitted through various methods to accommodate different taxpayer preferences. These methods include:

- Online Submission: Taxpayers can file electronically through the New Mexico Taxation and Revenue Department's online portal.

- Mail: Completed forms can be printed and mailed to the designated tax office.

- In-Person: Individuals may also choose to submit their forms in person at local tax offices.

Filing Deadlines / Important Dates

Filing deadlines for the Pit 110 New Mexico form are typically aligned with federal tax deadlines. Generally, the form must be submitted by April fifteenth of the following year for individual taxpayers. However, it is essential to check for any specific changes or extensions that may apply in a given tax year. Late submissions may incur penalties, so staying informed about deadlines is crucial for compliance.

Quick guide on how to complete nm taxation and revenue department welcome to new

Complete Pit 110 New Mexico Form effortlessly on any device

Web-based document management has become favored by businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to find the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Pit 110 New Mexico Form on any device with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Pit 110 New Mexico Form seamlessly

- Locate Pit 110 New Mexico Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information using tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign function, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose how you would like to send your form—via email, SMS, invitation link, or download it to your computer.

Put an end to misplaced or lost files, lengthy form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Pit 110 New Mexico Form and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nm taxation and revenue department welcome to new

How to create an eSignature for your Nm Taxation And Revenue Department Welcome To New online

How to create an eSignature for your Nm Taxation And Revenue Department Welcome To New in Google Chrome

How to generate an electronic signature for putting it on the Nm Taxation And Revenue Department Welcome To New in Gmail

How to create an electronic signature for the Nm Taxation And Revenue Department Welcome To New right from your smart phone

How to generate an electronic signature for the Nm Taxation And Revenue Department Welcome To New on iOS

How to create an electronic signature for the Nm Taxation And Revenue Department Welcome To New on Android devices

People also ask

-

What is the 110 8453 form used for?

The 110 8453 form is used for electronic signature authorization for specific documents in various industries. This form is essential for ensuring compliance and security when signing important documents digitally.

-

How does airSlate SignNow facilitate the 110 8453 form process?

airSlate SignNow allows users to easily create, send, and eSign the 110 8453 form through its intuitive platform. This solution streamlines the signing process and helps accelerate turnaround times for document approval.

-

Is airSlate SignNow a cost-effective solution for handling the 110 8453 form?

Yes, airSlate SignNow provides a cost-effective solution for businesses that need to manage the 110 8453 form. With its affordable pricing plans, users can save time and money while ensuring a secure signing process.

-

Can I integrate airSlate SignNow with other software for managing the 110 8453 form?

Absolutely! airSlate SignNow offers various integrations with popular software platforms, making it easy to manage the 110 8453 form within your existing workflows. This enhances productivity and reduces manual data entry.

-

What features does airSlate SignNow offer for the 110 8453 form?

airSlate SignNow includes features such as templates, customizable fields, and secure cloud storage specifically for the 110 8453 form. These tools simplify the signing process and enhance user experience.

-

How secure is the eSigning process for the 110 8453 form with airSlate SignNow?

The eSigning process for the 110 8453 form with airSlate SignNow is highly secure, utilizing encryption and authentication features to protect sensitive information. This ensures that your documents remain confidential throughout the signing process.

-

What benefits does airSlate SignNow provide for businesses using the 110 8453 form?

By using airSlate SignNow for the 110 8453 form, businesses benefit from increased efficiency, reduced paper use, and faster turnaround times for document signatures. This ultimately leads to improved business operations.

Get more for Pit 110 New Mexico Form

- Maintenance contract 424639953 form

- Application for government regional officers housing groh new form

- A07 nursing or midwifery english language requirements form

- Application for government regional officers housing groh form

- Application for transfer and mutual exchange public housing form

- Spay neuter contract template 787755656 form

- Speak contract template form

- Speaker contract template form

Find out other Pit 110 New Mexico Form

- Sign Arkansas Application for University Free

- Sign Arkansas Nanny Contract Template Fast

- How To Sign California Nanny Contract Template

- How Do I Sign Colorado Medical Power of Attorney Template

- How To Sign Louisiana Medical Power of Attorney Template

- How Do I Sign Louisiana Medical Power of Attorney Template

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online