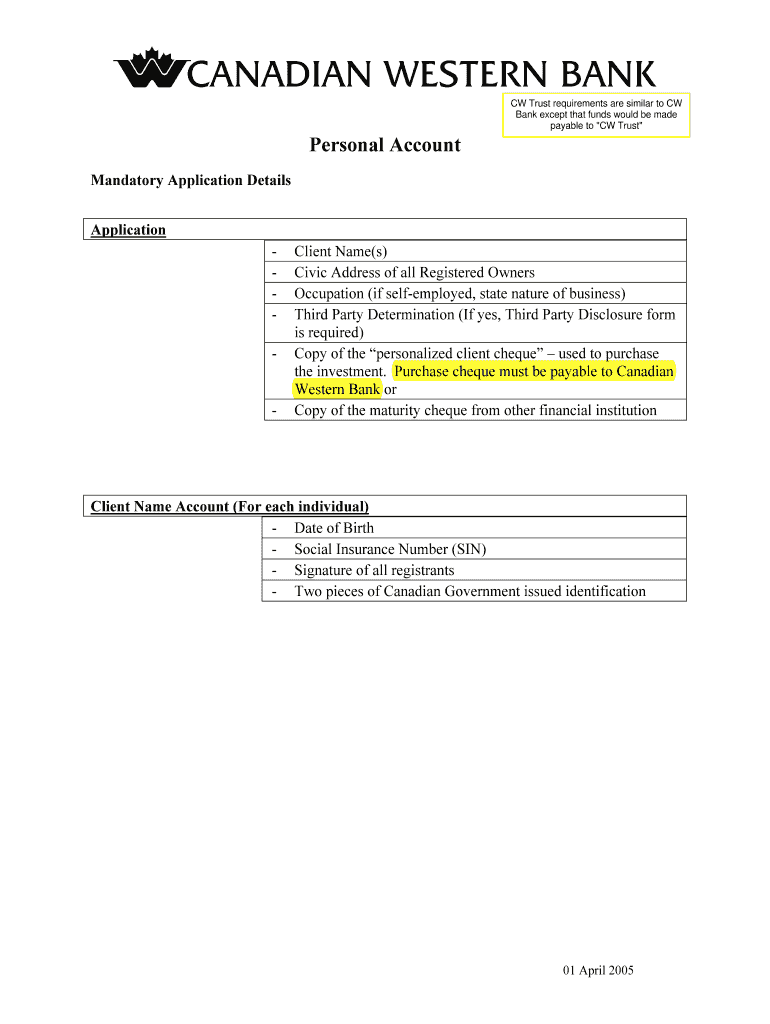

CW Trust Requirements Are Similar to CW Form

Understanding the CW Trust Requirements

The CW Trust requirements outline the necessary criteria for establishing a trust that qualifies under the CW designation. These requirements are designed to ensure that the trust operates within the legal framework set forth by the IRS and state laws. Key components include the identification of beneficiaries, the appointment of a trustee, and the formal documentation of the trust's purpose and terms. The trust must also comply with specific regulations regarding asset management and distribution, ensuring that it serves its intended purpose effectively.

Steps to Complete the CW Trust Requirements

To fulfill the CW Trust requirements, follow these essential steps:

- Determine the type of trust you wish to establish, ensuring it aligns with CW guidelines.

- Select a qualified trustee who will manage the trust assets and adhere to legal obligations.

- Draft a trust document that outlines the terms, including the beneficiaries and distribution methods.

- Fund the trust by transferring assets into it, ensuring proper documentation for each asset.

- Review and finalize the trust document with legal counsel to ensure compliance with state laws.

Key Elements of the CW Trust Requirements

Several critical elements must be included in the CW Trust requirements. These include:

- Trustee Responsibilities: The trustee must manage the trust assets prudently and in the best interest of the beneficiaries.

- Beneficiary Designation: Clearly identify all beneficiaries who will receive benefits from the trust.

- Trust Purpose: Define the specific purpose of the trust, whether for estate planning, asset protection, or other reasons.

- Compliance with IRS Regulations: Ensure that the trust adheres to relevant IRS guidelines to maintain its tax-exempt status.

Legal Use of the CW Trust Requirements

The CW Trust requirements have specific legal implications that must be understood by all parties involved. Establishing a trust under these guidelines can provide significant benefits, such as asset protection and tax advantages. However, failure to comply with the requirements can lead to legal challenges or loss of tax benefits. It is essential to consult with a legal expert to navigate the complexities of trust law and ensure that all legal obligations are met.

State-Specific Rules for the CW Trust Requirements

Each state may have unique rules and regulations regarding the establishment and management of trusts. It is crucial to research the specific requirements in your state to ensure compliance. Factors such as trust registration, taxation, and reporting obligations can vary significantly. Consulting with a local attorney who specializes in estate planning can help clarify these state-specific rules and ensure that your trust meets all necessary legal standards.

Examples of Using the CW Trust Requirements

Practical examples of the CW Trust requirements can illustrate their application in real-life scenarios. For instance, an individual may establish a CW Trust to manage their estate and provide for their children after their passing. In this case, the trust document would specify the distribution of assets, appoint a trustee, and outline the responsibilities of the trustee. Another example could involve using a CW Trust for charitable purposes, where the trust benefits a specific charity while providing tax deductions for the grantor.

Quick guide on how to complete cw trust requirements are similar to cw

Easily prepare [SKS] on any device

Digital document management is increasingly popular among both organizations and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without delays. Manage [SKS] on any device with airSlate SignNow Android or iOS applications and streamline any document-related process today.

Effortlessly modify and eSign [SKS]

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we offer to fill out your form efficiently.

- Emphasize important sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Generate your eSignature utilizing the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choosing. Modify and eSign [SKS] while ensuring excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to CW Trust Requirements Are Similar To CW

Create this form in 5 minutes!

How to create an eSignature for the cw trust requirements are similar to cw

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the CW Trust Requirements Are Similar To CW?

The CW Trust Requirements Are Similar To CW in that they both emphasize the importance of compliance and security in document management. Understanding these requirements helps businesses ensure that their eSigning processes meet legal standards. airSlate SignNow provides features that align with these requirements, making it easier for users to stay compliant.

-

How does airSlate SignNow ensure compliance with CW Trust Requirements Are Similar To CW?

airSlate SignNow ensures compliance with CW Trust Requirements Are Similar To CW by implementing robust security measures and encryption protocols. Our platform is designed to protect sensitive information while facilitating seamless eSigning. This commitment to security helps businesses maintain trust with their clients.

-

What pricing plans does airSlate SignNow offer for businesses concerned about CW Trust Requirements Are Similar To CW?

airSlate SignNow offers a variety of pricing plans tailored to meet the needs of businesses focused on CW Trust Requirements Are Similar To CW. Our plans are designed to be cost-effective while providing essential features for document management and eSigning. You can choose a plan that best fits your organization's size and requirements.

-

What features does airSlate SignNow provide to meet CW Trust Requirements Are Similar To CW?

airSlate SignNow provides features such as secure document storage, customizable workflows, and audit trails to meet CW Trust Requirements Are Similar To CW. These features ensure that all documents are handled securely and that every action is tracked for compliance purposes. This makes it easier for businesses to manage their eSigning processes effectively.

-

Can airSlate SignNow integrate with other tools to support CW Trust Requirements Are Similar To CW?

Yes, airSlate SignNow can integrate with various tools and platforms to support CW Trust Requirements Are Similar To CW. Our integrations with popular applications enhance workflow efficiency and ensure that all documents are processed in compliance with necessary regulations. This flexibility allows businesses to streamline their operations.

-

What benefits does airSlate SignNow offer for businesses focused on CW Trust Requirements Are Similar To CW?

The benefits of using airSlate SignNow for businesses focused on CW Trust Requirements Are Similar To CW include improved efficiency, enhanced security, and reduced operational costs. Our platform simplifies the eSigning process, allowing teams to focus on their core activities while ensuring compliance. This ultimately leads to better customer satisfaction and trust.

-

How does airSlate SignNow handle document security in relation to CW Trust Requirements Are Similar To CW?

airSlate SignNow prioritizes document security by employing advanced encryption and authentication methods, which align with CW Trust Requirements Are Similar To CW. This ensures that all signed documents are secure and tamper-proof. Our commitment to security helps businesses protect sensitive information and maintain compliance.

Get more for CW Trust Requirements Are Similar To CW

Find out other CW Trust Requirements Are Similar To CW

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free