Q2 Form

What is the Q2 Form

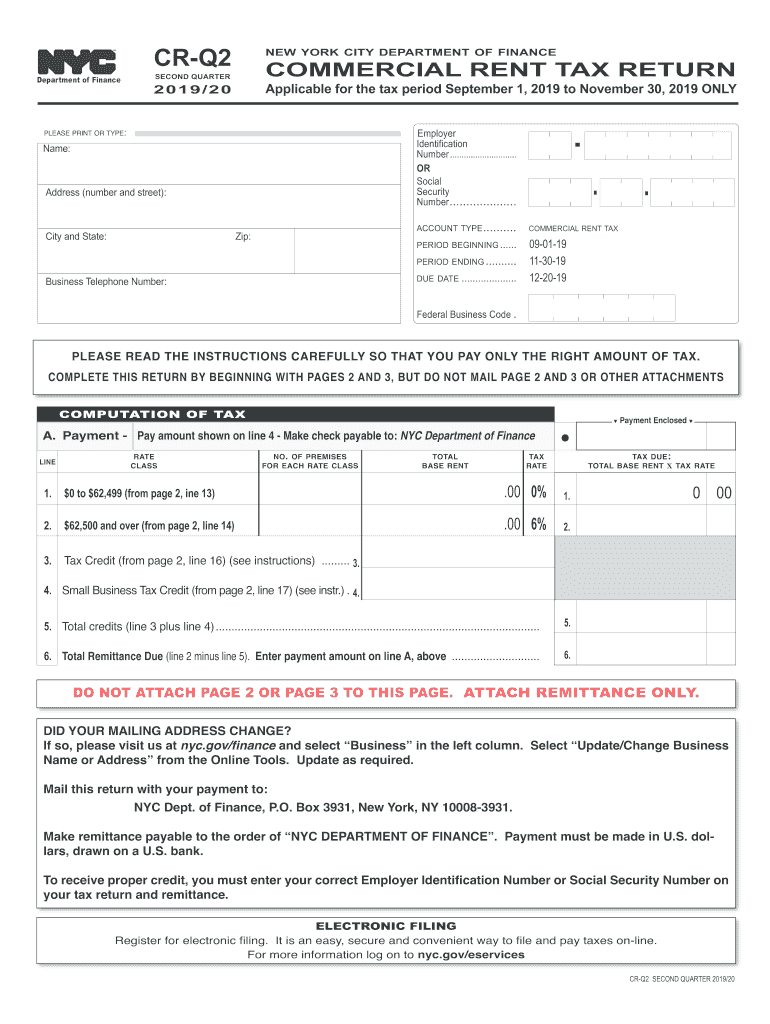

The Q2 form, specifically the NYC Commercial Rent Tax Return (CR Q2), is a tax document that businesses in New York City must complete if they meet certain criteria related to their commercial rent payments. This form is essential for reporting the amount of commercial rent paid during the second quarter of the fiscal year. It ensures compliance with local tax regulations and helps determine the tax liability for businesses operating within the city.

How to use the Q2 Form

Using the Q2 form involves several steps to ensure accurate completion and submission. First, gather all necessary financial information, including total rent paid during the quarter and any applicable deductions. Next, fill out the form with precise details, ensuring that all figures are accurate. After completing the form, review it for any errors before submitting it to the appropriate tax authority. Utilizing digital tools can streamline this process, allowing for easier data entry and eSignature capabilities.

Steps to complete the Q2 Form

Completing the Q2 form involves a systematic approach:

- Collect all relevant documents, including lease agreements and payment records.

- Fill in the business information section, including the name, address, and tax identification number.

- Report the total commercial rent paid during the quarter in the designated section.

- Include any applicable deductions or exemptions, if eligible.

- Review all entries for accuracy and completeness.

- Sign and date the form, ensuring compliance with eSignature regulations if submitting electronically.

Legal use of the Q2 Form

The Q2 form is legally binding when filled out correctly and submitted to the appropriate authorities. To ensure its validity, businesses must comply with local tax laws and regulations governing commercial rent tax. Utilizing a reliable eSignature solution, like signNow, can enhance the legitimacy of the document by providing a digital certificate and ensuring compliance with legal frameworks such as ESIGN and UETA.

Filing Deadlines / Important Dates

Filing deadlines for the Q2 form are crucial for businesses to avoid penalties. Typically, the Q2 return must be filed by a specific date following the end of the quarter. It is important to check the current tax calendar for the exact due date, as it may vary from year to year. Late submissions can result in additional fees and interest charges, making timely filing essential for compliance.

Required Documents

To successfully complete the Q2 form, certain documents are required. These include:

- Lease agreements that outline the terms of rental payments.

- Payment records for the commercial rent paid during the quarter.

- Any documentation supporting deductions or exemptions claimed on the form.

Having these documents readily available will facilitate accurate reporting and compliance with tax regulations.

Penalties for Non-Compliance

Failing to file the Q2 form on time or submitting inaccurate information can lead to significant penalties. Businesses may face fines, interest on unpaid taxes, and potential legal repercussions. It is important to adhere to filing requirements and deadlines to avoid these consequences, ensuring that all information provided is accurate and complete.

Quick guide on how to complete applicable for the tax period september 1 2019 to november 30 2019 only

Easily Prepare Q2 Form on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documentation, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Handle Q2 Form on any device using the airSlate SignNow apps for Android or iOS and enhance any document-based task today.

Effortlessly Modify and eSign Q2 Form

- Obtain Q2 Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with the tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a customary wet ink signature.

- Review the information and click on the Done button to save your updates.

- Select your preferred method for sharing your form, either by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or missing files, tedious form searches, or mistakes requiring you to print new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Q2 Form while ensuring excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the applicable for the tax period september 1 2019 to november 30 2019 only

How to create an electronic signature for the Applicable For The Tax Period September 1 2019 To November 30 2019 Only in the online mode

How to generate an electronic signature for the Applicable For The Tax Period September 1 2019 To November 30 2019 Only in Google Chrome

How to make an eSignature for signing the Applicable For The Tax Period September 1 2019 To November 30 2019 Only in Gmail

How to generate an electronic signature for the Applicable For The Tax Period September 1 2019 To November 30 2019 Only from your mobile device

How to generate an eSignature for the Applicable For The Tax Period September 1 2019 To November 30 2019 Only on iOS devices

How to generate an eSignature for the Applicable For The Tax Period September 1 2019 To November 30 2019 Only on Android OS

People also ask

-

What is a Q2 return and how does it relate to airSlate SignNow?

A Q2 return refers to the tax return for the second quarter of the fiscal year, which businesses need to file for compliance. With airSlate SignNow, you can easily eSign and send important tax documents, including your Q2 return, ensuring that your submissions are timely and secure.

-

How does airSlate SignNow facilitate Q2 return filing?

airSlate SignNow simplifies the Q2 return filing process by allowing you to prepare and eSign your tax documents within minutes. The platform ensures that all signatures are legally binding and that your documents are securely stored, making it easy to retrieve and submit your Q2 return.

-

What features does airSlate SignNow offer for document management related to Q2 returns?

airSlate SignNow provides a range of features essential for managing your Q2 returns, such as document templates, customizable workflows, and single-click eSigning. These features help streamline your document preparation, making it easier to manage multiple Q2 returns efficiently.

-

Is airSlate SignNow cost-effective for small businesses handling Q2 returns?

Yes, airSlate SignNow is a cost-effective solution for small businesses preparing their Q2 returns. The affordable pricing plans are designed to fit various budgets, ensuring that even smaller organizations can access quality eSigning and document management tools.

-

Can I integrate airSlate SignNow with my accounting software for Q2 returns?

Absolutely! airSlate SignNow offers seamless integrations with popular accounting software, allowing you to sync your financial data and easily generate your Q2 return documents. This integration helps ensure accuracy and saves time during your filing process.

-

What security measures does airSlate SignNow have in place for Q2 returns?

airSlate SignNow prioritizes security with advanced encryption and secure cloud storage for all documents, including your Q2 return filings. These measures protect your sensitive information, ensuring that it is safe from unauthorized access.

-

How quickly can I complete my Q2 return using airSlate SignNow?

Using airSlate SignNow, you can complete your Q2 return in just a few minutes. The user-friendly interface allows you to upload, edit, and eSign your documents quickly, reducing the time spent on paperwork signNowly.

Get more for Q2 Form

- Places to go and things to donorththe seattle times form

- Final energy code single family residential form

- Palm beach county school district approve new boundary form

- Board pledge form 274067040

- Application form polaris maritime services

- Senior portrait contract template form

- Senior photography contract template form

- Senior rep contract template form

Find out other Q2 Form

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample

- How To Sign West Virginia Lease agreement contract

- How Do I Sign Colorado Lease agreement template

- Sign Iowa Lease agreement template Free

- Sign Missouri Lease agreement template Later

- Sign West Virginia Lease agreement template Computer

- Sign Nevada Lease template Myself

- Sign North Carolina Loan agreement Simple

- Sign Maryland Month to month lease agreement Fast

- Help Me With Sign Colorado Mutual non-disclosure agreement

- Sign Arizona Non disclosure agreement sample Online

- Sign New Mexico Mutual non-disclosure agreement Simple

- Sign Oklahoma Mutual non-disclosure agreement Simple

- Sign Utah Mutual non-disclosure agreement Free