Decline in Value Reassessment Application Prop 8 Property Tax Fidelitytitle Form

What is the Decline in Value Reassessment Application Prop 8 Property Tax Fidelitytitle

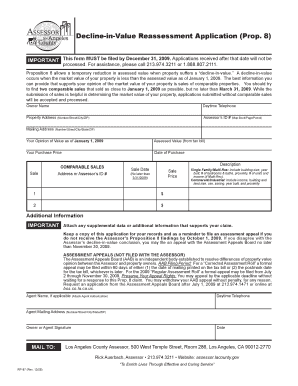

The Decline in Value Reassessment Application under Proposition 8 is a crucial form for property owners in California. This application allows individuals to request a reassessment of their property’s value if they believe it has declined. Proposition 8, enacted in 1978, provides a mechanism for property owners to potentially lower their property tax assessments during periods of economic downturn or market decline. This reassessment can lead to significant savings on property taxes, making it an important tool for homeowners and businesses alike.

Steps to complete the Decline in Value Reassessment Application Prop 8 Property Tax Fidelitytitle

Completing the Decline in Value Reassessment Application involves several key steps:

- Gather necessary documentation, including your property tax bill and any evidence of decline in market value.

- Obtain the application form from your local county assessor's office or their website.

- Fill out the application form accurately, providing all required information about your property.

- Attach supporting documents that substantiate your claim of decreased value.

- Submit the completed application to your county assessor's office by the designated deadline.

Eligibility Criteria

To qualify for the Decline in Value Reassessment Application, property owners must meet specific eligibility criteria:

- The property must be located in California.

- The owner must demonstrate a decline in market value as of January 1 of the assessment year.

- The application must be submitted within the appropriate timeframe, typically by November 30 of the assessment year.

Required Documents

When submitting the Decline in Value Reassessment Application, it is essential to include the following documents:

- A copy of the most recent property tax bill.

- Evidence of the property's current market value, such as recent sales data or appraisals.

- Any additional documentation that supports the claim of a decline in value.

Form Submission Methods

The Decline in Value Reassessment Application can typically be submitted through various methods, including:

- Online submission via the county assessor's website, if available.

- Mailing the completed application to the local county assessor's office.

- In-person delivery at the county assessor’s office during business hours.

Application Process & Approval Time

The application process for the Decline in Value Reassessment typically follows these stages:

- Submission of the application and supporting documents.

- Review by the county assessor’s office, which may involve additional inquiries or requests for information.

- Notification of the outcome, usually within a few weeks to a few months, depending on the county's workload.

Quick guide on how to complete decline in value reassessment application prop 8 property tax fidelitytitle

Effortlessly Complete [SKS] on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers an excellent environmentally-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly and without hold-ups. Handle [SKS] on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

Easily Modify and eSign [SKS] with Minimal Effort

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Mark important sections of the documents or redact sensitive information using the tools provided by airSlate SignNow specifically for this purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, text message (SMS), invite link, or downloading it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Edit and eSign [SKS] to ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Decline in Value Reassessment Application Prop 8 Property Tax Fidelitytitle

Create this form in 5 minutes!

How to create an eSignature for the decline in value reassessment application prop 8 property tax fidelitytitle

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Decline in Value Reassessment Application Prop 8 Property Tax Fidelitytitle?

The Decline in Value Reassessment Application Prop 8 Property Tax Fidelitytitle is a process that allows property owners to request a reassessment of their property taxes when the market value of their property has decreased. This application can help reduce your property tax burden, ensuring you only pay taxes based on the current value of your property.

-

How can airSlate SignNow assist with the Decline in Value Reassessment Application Prop 8 Property Tax Fidelitytitle?

airSlate SignNow provides a streamlined platform for completing and eSigning the Decline in Value Reassessment Application Prop 8 Property Tax Fidelitytitle. Our easy-to-use interface allows you to fill out the necessary forms quickly and securely, ensuring that your application is submitted without delays.

-

What are the costs associated with using airSlate SignNow for the Decline in Value Reassessment Application Prop 8 Property Tax Fidelitytitle?

airSlate SignNow offers a cost-effective solution for managing your Decline in Value Reassessment Application Prop 8 Property Tax Fidelitytitle. Our pricing plans are designed to fit various budgets, providing you with the tools you need without breaking the bank. You can choose from monthly or annual subscriptions based on your usage.

-

What features does airSlate SignNow offer for the Decline in Value Reassessment Application Prop 8 Property Tax Fidelitytitle?

Our platform includes features such as customizable templates, secure eSigning, and document tracking, all tailored to facilitate the Decline in Value Reassessment Application Prop 8 Property Tax Fidelitytitle. These features ensure that your application process is efficient and compliant with legal standards.

-

Are there any integrations available with airSlate SignNow for the Decline in Value Reassessment Application Prop 8 Property Tax Fidelitytitle?

Yes, airSlate SignNow integrates seamlessly with various applications and services to enhance your experience with the Decline in Value Reassessment Application Prop 8 Property Tax Fidelitytitle. You can connect with popular tools like Google Drive, Dropbox, and CRM systems to streamline your document management process.

-

What benefits can I expect from using airSlate SignNow for my property tax applications?

Using airSlate SignNow for your Decline in Value Reassessment Application Prop 8 Property Tax Fidelitytitle offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform simplifies the application process, allowing you to focus on other important aspects of property management.

-

Is airSlate SignNow secure for handling sensitive property tax documents?

Absolutely! airSlate SignNow prioritizes the security of your documents, including the Decline in Value Reassessment Application Prop 8 Property Tax Fidelitytitle. We utilize advanced encryption and security protocols to ensure that your sensitive information remains protected throughout the entire process.

Get more for Decline in Value Reassessment Application Prop 8 Property Tax Fidelitytitle

Find out other Decline in Value Reassessment Application Prop 8 Property Tax Fidelitytitle

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure