Ny it 203 Form

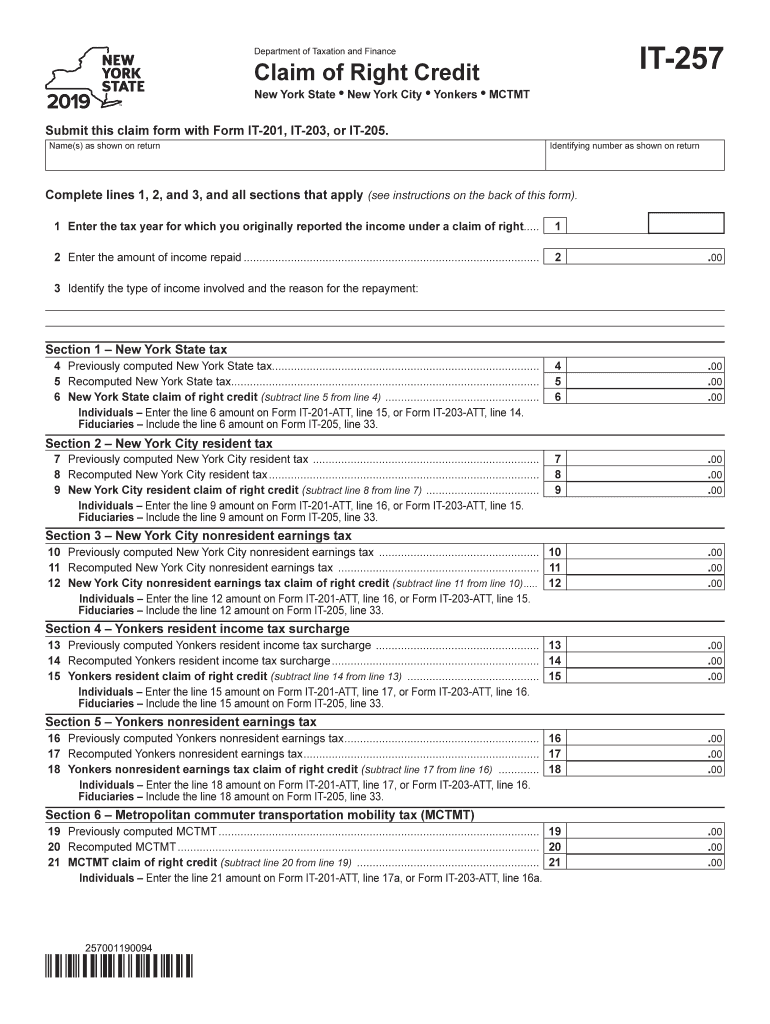

What is the NY IT 257 Form?

The NY IT 257 form is a tax document used by residents of New York State to claim a credit for taxes paid to other jurisdictions. This form is essential for individuals who have income that is taxed both in New York and another state, allowing them to avoid double taxation. The form provides a structured way to report the amount of tax paid to other states and calculate the credit to be applied against New York State taxes owed.

Steps to Complete the NY IT 257 Form

Completing the NY IT 257 form involves several key steps:

- Gather necessary documents, including W-2s and tax returns from other states.

- Fill out your personal information at the top of the form, ensuring accuracy.

- Report the total income earned in New York and the other jurisdictions.

- Calculate the credit by entering the tax paid to other states as detailed in the instructions.

- Review the form for any errors and ensure all required signatures are included.

Legal Use of the NY IT 257 Form

The NY IT 257 form is legally binding when filled out correctly and submitted to the New York State Department of Taxation and Finance. It is crucial to ensure that all information reported is accurate and complete to avoid penalties. The form must be filed by the due date to ensure eligibility for the tax credit, and it should be retained for your records in case of an audit.

Filing Deadlines / Important Dates

Filing deadlines for the NY IT 257 form typically align with the general tax filing deadlines in New York State. For most individuals, the deadline is April fifteenth each year. However, if you are unable to meet this deadline, you may file for an extension, but it is essential to pay any taxes owed by the original due date to avoid interest and penalties.

Required Documents

When completing the NY IT 257 form, you will need to provide specific documentation to support your claims. Required documents include:

- W-2 forms from all employers.

- Tax returns from other states where income was earned.

- Proof of taxes paid to those jurisdictions, such as payment receipts or tax statements.

Who Issues the Form

The NY IT 257 form is issued by the New York State Department of Taxation and Finance. This department is responsible for administering state tax laws and ensuring compliance among taxpayers. It is advisable to consult their official resources for the most current version of the form and any updates to the filing process.

Quick guide on how to complete form it 2572019claim of right creditit257 taxnygov

Effortlessly Prepare Ny It 203 Form on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers a wonderful eco-friendly substitute for traditional printed and signed paperwork, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and efficiently. Manage Ny It 203 Form on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to Edit and Electronically Sign Ny It 203 Form with Ease

- Find Ny It 203 Form and click Get Form to begin.

- Utilize the tools available to fill out your form.

- Select important sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes just moments and carries the same legal validity as a traditional wet ink signature.

- Review the details and then hit the Done button to save your modifications.

- Decide how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing additional copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Ny It 203 Form and ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 2572019claim of right creditit257 taxnygov

How to make an electronic signature for your Form It 2572019claim Of Right Creditit257 Taxnygov in the online mode

How to make an electronic signature for the Form It 2572019claim Of Right Creditit257 Taxnygov in Chrome

How to generate an eSignature for signing the Form It 2572019claim Of Right Creditit257 Taxnygov in Gmail

How to generate an electronic signature for the Form It 2572019claim Of Right Creditit257 Taxnygov from your smartphone

How to create an electronic signature for the Form It 2572019claim Of Right Creditit257 Taxnygov on iOS

How to generate an electronic signature for the Form It 2572019claim Of Right Creditit257 Taxnygov on Android OS

People also ask

-

What is airSlate SignNow and how does it relate to 'it 257 right'?

airSlate SignNow is a powerful eSignature solution that empowers businesses to send and sign documents easily. When you implement 'it 257 right,' you can streamline your document workflows, ensuring a seamless signing experience for your team and clients.

-

How much does airSlate SignNow cost and how does it ensure 'it 257 right'?

airSlate SignNow offers flexible pricing plans that cater to different business needs, providing excellent value for a robust eSignature solution. Investing in our service means you're doing 'it 257 right' by choosing an affordable, efficient way to manage your document processes.

-

What features does airSlate SignNow offer to help with 'it 257 right’?

airSlate SignNow includes features like customizable templates, advanced security options, and real-time tracking. By leveraging these features, you can ensure that you're doing 'it 257 right', enhancing both productivity and compliance.

-

How can airSlate SignNow improve my business workflow while doing 'it 257 right'?

airSlate SignNow simplifies your document handling, allowing for quicker turnaround times and reducing administrative overhead. By adopting our solution, you're doing 'it 257 right,' which helps increase efficiency and focus on what matters most.

-

Is airSlate SignNow compatible with other applications for doing 'it 257 right'?

Yes, airSlate SignNow integrates seamlessly with numerous applications including CRM and document management systems. By ensuring compatibility, you can do 'it 257 right' by enhancing your existing workflows with minimal disruption.

-

What benefits can I expect from using airSlate SignNow with 'it 257 right'?

By utilizing airSlate SignNow, you can expect faster document turnaround times, improved customer satisfaction, and reduced paperwork. This not only reflects your commitment to doing 'it 257 right' but also positions your business as modern and efficient.

-

How secure is my information with airSlate SignNow when doing 'it 257 right'?

airSlate SignNow prioritizes the security of your documents with advanced encryption and compliance with industry regulations. By choosing us, you are doing 'it 257 right' by ensuring the safety and confidentiality of your important data.

Get more for Ny It 203 Form

- W 4 form federal

- Form 4952 instructions

- Harmonised application form application for scheng

- Self employed contract template form

- Self employed delivery driver contract template form

- Self employed driver contract template form

- Self employed for service contract template form

- Self employed hairdresser contract template form

Find out other Ny It 203 Form

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself