Form 4952 Instructions 2023

What is the Form 4952 Instructions

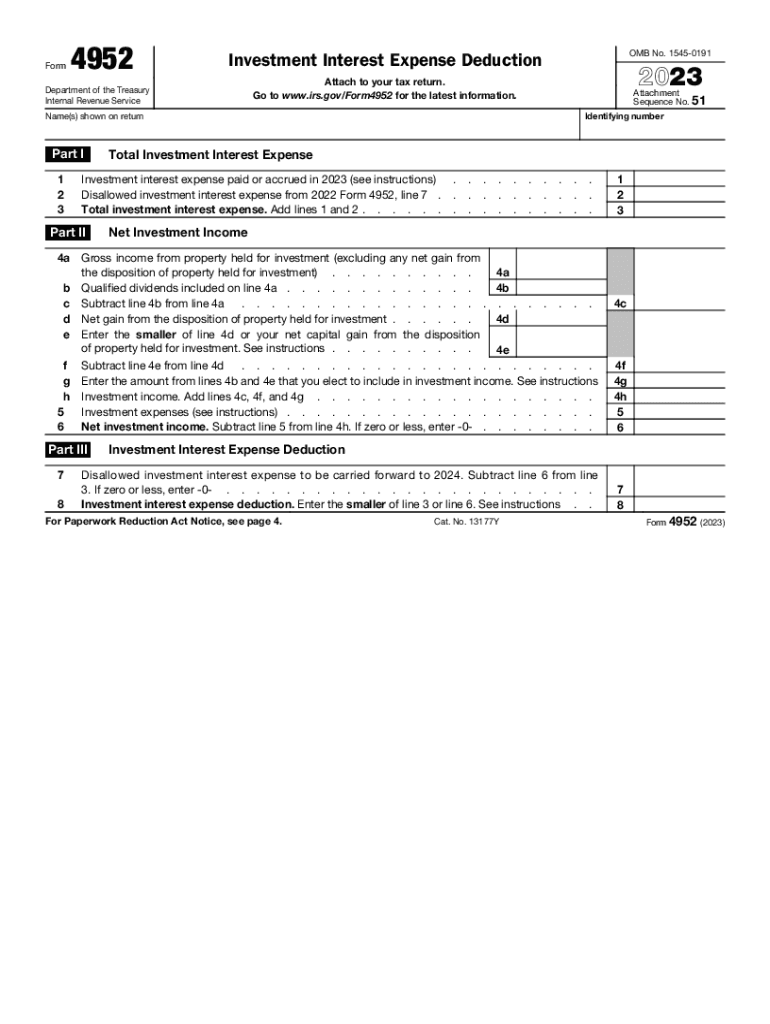

The Form 4952 instructions provide detailed guidance for taxpayers on how to calculate and claim the investment interest deduction. This form is essential for individuals who have incurred interest expenses on loans taken out to purchase investments. The IRS requires taxpayers to report this information accurately to determine the allowable deduction on their tax returns. Understanding the purpose of Form 4952 is crucial for maximizing tax benefits related to investment interest.

How to use the Form 4952 Instructions

Using the Form 4952 instructions involves following a structured approach to ensure compliance with IRS regulations. Taxpayers should begin by gathering all necessary financial documents related to their investment interest. Next, they need to complete the form by providing details about their investment income and interest expenses. The instructions guide users through each section of the form, ensuring that all required information is accurately reported. It is important to review the completed form for any errors before submission.

Steps to complete the Form 4952 Instructions

Completing the Form 4952 requires several key steps:

- Gather documentation of investment interest expenses and income.

- Fill out the personal information section, including name and Social Security number.

- Report the total investment interest expense incurred during the tax year.

- Calculate the allowable deduction based on the investment income reported.

- Review the form for accuracy before filing with the IRS.

Following these steps helps ensure that taxpayers can claim the appropriate deduction, reducing their overall tax liability.

Key elements of the Form 4952 Instructions

Key elements of the Form 4952 instructions include:

- Definition of investment interest and its relevance to taxpayers.

- Instructions for calculating the allowable deduction based on investment income.

- Guidelines for reporting interest expenses accurately.

- Information on how to handle excess investment interest that cannot be deducted in the current year.

These elements are crucial for ensuring taxpayers understand their rights and obligations regarding investment interest deductions.

IRS Guidelines

The IRS provides specific guidelines for completing Form 4952, which include definitions of key terms, eligibility criteria for claiming the investment interest deduction, and examples of acceptable investment interest expenses. Taxpayers are encouraged to refer to these guidelines to ensure compliance with tax laws. Understanding these rules can help prevent errors that may lead to penalties or audits.

Filing Deadlines / Important Dates

Filing deadlines for Form 4952 align with the standard tax return deadlines. Typically, individual taxpayers must submit their tax returns by April 15 of each year. If this date falls on a weekend or holiday, the deadline is extended to the next business day. Taxpayers should be aware of these dates to avoid late filing penalties. Additionally, extensions may be available, but any taxes owed must still be paid by the original deadline to avoid interest charges.

Quick guide on how to complete form 4952 instructions

Effortlessly Prepare Form 4952 Instructions on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to quickly create, modify, and eSign your documents without delays. Manage Form 4952 Instructions on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The most efficient method to modify and eSign Form 4952 Instructions without hassle

- Locate Form 4952 Instructions and click on Get Form to begin.

- Utilize our tools to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you would like to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require reprinting new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign Form 4952 Instructions while ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 4952 instructions

Create this form in 5 minutes!

How to create an eSignature for the form 4952 instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to investment?

airSlate SignNow is a leading eSignature solution that facilitates electronic signatures and document management. By streamlining your document workflows, it allows businesses to optimize their investment in time and resources, ensuring that contracts are executed effectively and efficiently.

-

How can investing in airSlate SignNow improve my business processes?

Investing in airSlate SignNow can signNowly enhance your business processes by automating document workflows and reducing the time spent on manual signature collection. This improved efficiency allows your team to focus on core activities, maximizing the return on your investment.

-

What pricing plans does airSlate SignNow offer for businesses looking to invest?

airSlate SignNow provides flexible pricing plans tailored to meet various business needs. Whether you’re a small startup or a large enterprise, you can find a plan that aligns with your budget and investment strategy, making it a cost-effective solution for managing signatures.

-

What features does airSlate SignNow offer to enhance my investment in document management?

The features of airSlate SignNow, including customizable templates, bulk sending, and real-time tracking, enhance your investment in document management. These tools streamline workflows and provide valuable insights, helping you make data-driven decisions and optimize efficiency.

-

Can I integrate airSlate SignNow with other software to enhance my investment?

Absolutely! airSlate SignNow offers seamless integrations with various third-party applications, such as CRMs and document storage solutions. By integrating these tools, you can maximize your investment by centralizing document workflow and enhancing productivity across your business operations.

-

What benefits does airSlate SignNow provide that justify the investment?

Investing in airSlate SignNow brings numerous benefits, including increased efficiency, reduced operational costs, and improved compliance. With easy-to-use features and robust security, businesses can leverage this solution to foster better customer relations and accelerate their growth.

-

How secure is my investment when using airSlate SignNow?

airSlate SignNow takes the security of your investment very seriously, employing industry-standard encryption and compliance with regulations such as GDPR and HIPAA. This ensures that your documents and sensitive information are protected, allowing you to eSign with confidence.

Get more for Form 4952 Instructions

- Au pair medical certificate form

- 50018 doc forms in

- Da pam 738 750 form

- Property tax appeals when how ampamp why to submit plus a form

- Medical packag statement of work contract template form

- Medical receptionist contract template form

- Flea market vendor contract template form

- Fleet management contract template form

Find out other Form 4952 Instructions

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy

- How Do I eSignature Nebraska Real Estate Lease Agreement

- eSignature Nebraska Real Estate Living Will Now

- Can I eSignature Michigan Police Credit Memo

- eSignature Kentucky Sports Lease Agreement Template Easy

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast