DONATION FORM

What is the Donation Form

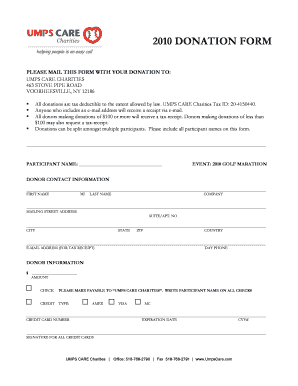

The Donation Form is a document used by individuals or organizations to formally record contributions made to charitable causes. This form typically captures essential information such as the donor's name, contact details, the amount donated, and the purpose of the donation. It serves as a record for both the donor and the recipient organization, ensuring transparency and accountability in charitable giving.

How to Use the Donation Form

Using the Donation Form involves several straightforward steps. First, the donor fills out the form with their personal information, including name and address. Next, the donor specifies the donation amount and the intended use of the funds. After completing the form, it should be submitted to the receiving organization, either electronically or via traditional mail. This process helps ensure that donations are properly acknowledged and documented.

Steps to Complete the Donation Form

Completing the Donation Form requires attention to detail to ensure accuracy. Follow these steps:

- Provide your full name and contact information.

- Indicate the amount you wish to donate.

- Specify the purpose of your donation, if applicable.

- Sign and date the form to validate your contribution.

- Submit the form to the organization through the designated method.

Legal Use of the Donation Form

The Donation Form is legally significant as it provides a record of charitable contributions, which may be necessary for tax purposes. Donors can use this form to claim deductions on their income tax returns, provided the receiving organization is a qualified charity. It is important to retain a copy of the completed form for personal records and to ensure compliance with IRS regulations regarding charitable donations.

Required Documents

When filling out the Donation Form, certain documents may be required to verify the donation. Typically, these include:

- A copy of the donor's identification, such as a driver's license or passport.

- Proof of the donation amount, which may be a receipt or bank statement.

- Any additional documentation requested by the receiving organization, such as a letter of intent.

Form Submission Methods

The Donation Form can be submitted through various methods, depending on the preferences of the organization receiving the donation. Common submission methods include:

- Online submission via the organization's website.

- Mailing a printed copy of the form to the organization's address.

- In-person delivery at the organization's office or during an event.

Quick guide on how to complete donation form

Complete [SKS] effortlessly on every device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can easily access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to design, modify, and electronically sign your documents promptly without delays. Handle [SKS] on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign [SKS] without hassle

- Find [SKS] and click Get Form to begin.

- Leverage the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information using tools that airSlate SignNow supplies specifically for that purpose.

- Generate your signature with the Sign tool, which takes moments and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to DONATION FORM

Create this form in 5 minutes!

How to create an eSignature for the donation form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a DONATION FORM and how can it benefit my organization?

A DONATION FORM is a digital document that allows organizations to collect contributions easily and securely. By using airSlate SignNow, you can streamline the donation process, making it more efficient for both your organization and your donors. This not only enhances user experience but also increases the likelihood of receiving donations.

-

How much does it cost to use the DONATION FORM feature?

The pricing for using the DONATION FORM feature with airSlate SignNow is competitive and designed to fit various budgets. We offer flexible plans that cater to different organizational needs, ensuring you get the best value for your investment. You can choose a plan that suits your volume of donations and required features.

-

Can I customize my DONATION FORM?

Yes, airSlate SignNow allows you to fully customize your DONATION FORM to match your organization's branding and specific requirements. You can add your logo, adjust colors, and include fields that are relevant to your donation process. This personalization helps create a more engaging experience for your donors.

-

Is the DONATION FORM secure for my donors?

Absolutely! The DONATION FORM created with airSlate SignNow is designed with security in mind. We utilize advanced encryption and compliance measures to ensure that all donor information is protected, giving your supporters peace of mind when making contributions.

-

What integrations are available for the DONATION FORM?

airSlate SignNow offers various integrations that enhance the functionality of your DONATION FORM. You can connect with popular payment processors, CRM systems, and email marketing tools to streamline your donation workflow. This integration capability helps you manage donations more effectively and maintain donor relationships.

-

How can I track donations made through the DONATION FORM?

Tracking donations made through your DONATION FORM is simple with airSlate SignNow. Our platform provides detailed analytics and reporting features that allow you to monitor donation activity in real-time. This insight helps you understand donor behavior and optimize your fundraising strategies.

-

Can I use the DONATION FORM for recurring donations?

Yes, airSlate SignNow supports the creation of DONATION FORMs that facilitate recurring donations. This feature allows donors to set up automatic contributions, ensuring a steady stream of support for your organization. It simplifies the donation process for your supporters and helps you maintain consistent funding.

Get more for DONATION FORM

Find out other DONATION FORM

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online