12816 065001ENRecipients Name Use by the Foreign T 2024-2026

Understanding Form 5001

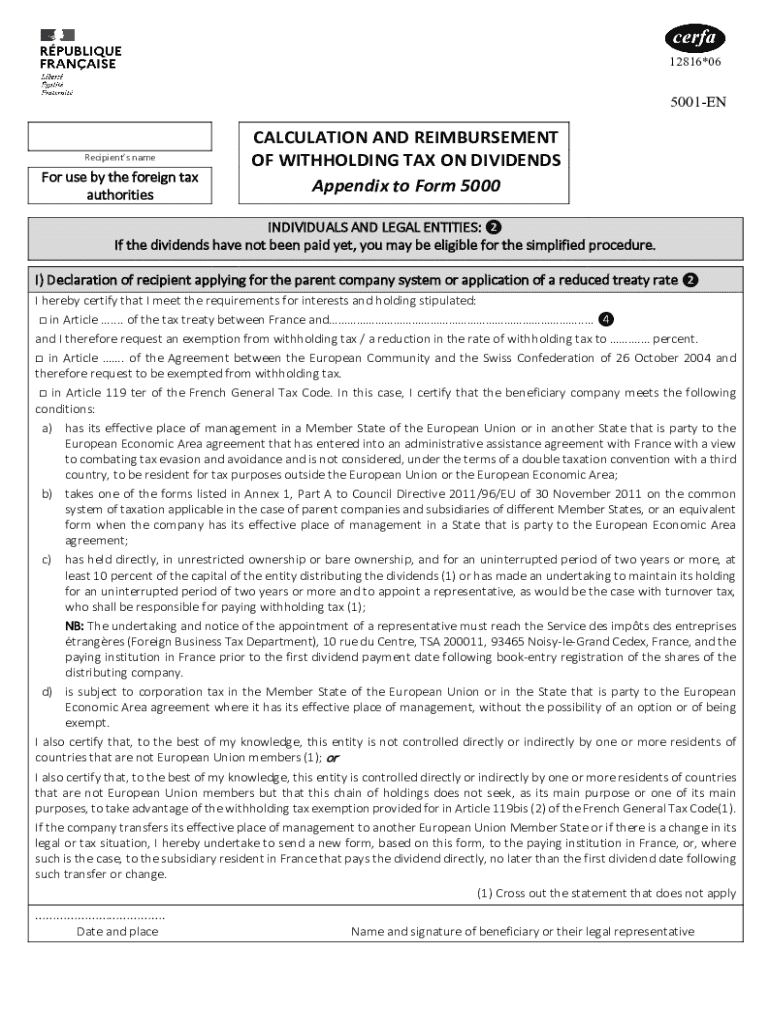

Form 5001, officially known as the 12816×065001EN, is a document used primarily for tax purposes. This form is essential for individuals and businesses that need to report specific financial information to the IRS. It is particularly relevant for recipients of foreign payments, ensuring compliance with U.S. tax regulations. Understanding the purpose and requirements of Form 5001 is crucial for accurate reporting and avoiding potential penalties.

Steps to Complete Form 5001

Completing Form 5001 involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including your personal identification details and any relevant financial data pertaining to foreign payments. Next, carefully fill out each section of the form, ensuring that all entries are accurate and complete. It is advisable to double-check your entries for any errors before submission. Finally, submit the form according to the specified guidelines, whether online or via mail.

Legal Use of Form 5001

Form 5001 serves a legal purpose in the U.S. tax system, particularly for reporting foreign income. It is crucial for maintaining compliance with IRS regulations, as failure to file or inaccuracies can lead to legal repercussions. Understanding the legal implications of this form helps ensure that individuals and businesses meet their tax obligations while minimizing the risk of audits or penalties.

Required Documents for Form 5001

To successfully complete Form 5001, certain documents are required. These may include your Social Security number or Employer Identification Number, details of the foreign payments received, and any supporting documentation that verifies the income reported. Having these documents ready will streamline the filing process and help ensure that the form is completed accurately.

Filing Methods for Form 5001

Form 5001 can be submitted through various methods, including online submission, mail, or in-person delivery. Online submission is often the fastest and most efficient method, allowing for quicker processing times. If you choose to file by mail, ensure that you send the form to the correct IRS address to avoid delays. In-person submissions may be available at certain IRS offices, providing another option for filers who prefer face-to-face assistance.

IRS Guidelines for Form 5001

The IRS provides specific guidelines for completing and submitting Form 5001. These guidelines include instructions on how to fill out the form, deadlines for submission, and information on penalties for non-compliance. Familiarizing yourself with these guidelines is essential for ensuring that your filing meets all requirements and avoids potential issues with the IRS.

Quick guide on how to complete 12816065001enrecipients name use by the foreign t

Complete 12816 065001ENRecipients Name Use By The Foreign T effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers a superior environmentally friendly option to traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and electronically sign your documents swiftly without any hold-ups. Manage 12816 065001ENRecipients Name Use By The Foreign T on any device using airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

How to edit and electronically sign 12816 065001ENRecipients Name Use By The Foreign T with ease

- Locate 12816 065001ENRecipients Name Use By The Foreign T and click on Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize key parts of your documents or redact sensitive information using features specifically designed by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require new copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign 12816 065001ENRecipients Name Use By The Foreign T to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 12816065001enrecipients name use by the foreign t

Create this form in 5 minutes!

How to create an eSignature for the 12816065001enrecipients name use by the foreign t

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 5001 and how can airSlate SignNow help?

Form 5001 is a document used for various business processes. With airSlate SignNow, you can easily create, send, and eSign form 5001, streamlining your workflow and ensuring compliance. Our platform simplifies the management of this form, making it accessible and efficient for your team.

-

How much does it cost to use airSlate SignNow for form 5001?

airSlate SignNow offers competitive pricing plans that cater to different business needs. The cost to use our platform for managing form 5001 varies based on the features you choose. We provide a cost-effective solution that ensures you get the best value for your investment.

-

What features does airSlate SignNow offer for form 5001?

Our platform includes features such as customizable templates, real-time tracking, and secure eSigning for form 5001. These tools enhance your document management process, allowing for quick edits and approvals. With airSlate SignNow, you can ensure that your form 5001 is handled efficiently.

-

Can I integrate airSlate SignNow with other applications for form 5001?

Yes, airSlate SignNow offers seamless integrations with various applications to enhance your workflow for form 5001. You can connect with CRM systems, cloud storage, and other productivity tools. This integration capability ensures that your document processes remain streamlined and efficient.

-

What are the benefits of using airSlate SignNow for form 5001?

Using airSlate SignNow for form 5001 provides numerous benefits, including increased efficiency, reduced turnaround time, and enhanced security. Our platform allows you to manage documents digitally, minimizing paper usage and improving accessibility. This leads to a more sustainable and productive business environment.

-

Is airSlate SignNow secure for handling form 5001?

Absolutely! airSlate SignNow prioritizes security, ensuring that your form 5001 and other documents are protected. We use advanced encryption and compliance measures to safeguard your data, giving you peace of mind while managing sensitive information.

-

How can I get started with airSlate SignNow for form 5001?

Getting started with airSlate SignNow for form 5001 is simple. You can sign up for a free trial on our website, allowing you to explore our features and capabilities. Once you're ready, you can choose a plan that fits your needs and start managing your form 5001 efficiently.

Get more for 12816 065001ENRecipients Name Use By The Foreign T

Find out other 12816 065001ENRecipients Name Use By The Foreign T

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast