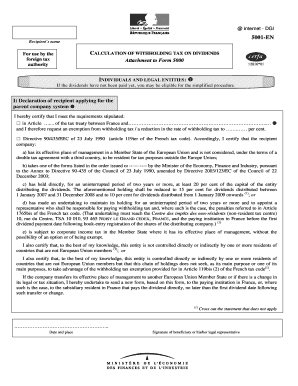

Form 5001 2006

What is the Form 5001

The Form 5001 is a specific document used primarily for tax and legal purposes within the United States. It serves to collect essential information from individuals or entities, ensuring compliance with various regulations. Understanding the purpose of this form is crucial for accurate completion and submission.

How to use the Form 5001

Using the Form 5001 involves a straightforward process. First, ensure you have the most recent version of the form, which can typically be obtained from the issuing authority. Next, fill out the required fields accurately, providing all necessary information. Once completed, the form can be submitted electronically or via traditional mail, depending on the requirements set forth by the relevant agency.

Steps to complete the Form 5001

Completing the Form 5001 requires attention to detail. Follow these steps:

- Download the latest version of the form from the official source.

- Read the instructions carefully to understand each section.

- Fill in your personal or business information as required.

- Review the form for accuracy and completeness.

- Sign and date the form where indicated.

- Submit the form according to the specified method.

Legal use of the Form 5001

The Form 5001 is legally binding when completed correctly and submitted in accordance with relevant laws. It is essential to ensure that all information provided is truthful and accurate to avoid potential legal issues. Using a reliable electronic signature solution can enhance the legal standing of the submitted document.

Key elements of the Form 5001

Key elements of the Form 5001 include:

- Identification of the individual or entity submitting the form.

- Detailed information regarding the purpose of the form.

- Signature and date fields to validate the submission.

- Instructions for submission and any necessary attachments.

Form Submission Methods

The Form 5001 can be submitted through various methods, depending on the requirements of the issuing authority. Common submission methods include:

- Online submission via a dedicated portal.

- Mailing a physical copy to the designated address.

- In-person submission at the appropriate office.

Filing Deadlines / Important Dates

Filing deadlines for the Form 5001 can vary based on the specific purpose of the form. It is essential to be aware of these deadlines to avoid penalties. Check with the issuing authority for the most accurate and up-to-date information regarding submission timelines.

Quick guide on how to complete form 5001

Complete Form 5001 effortlessly on any device

Digital document management has gained popularity among companies and individuals. It offers a superb eco-friendly substitute to conventional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly and without delays. Manage Form 5001 on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Form 5001 with ease

- Locate Form 5001 and click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Generate your signature using the Sign function, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, either by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Update and eSign Form 5001 while ensuring effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 5001

Create this form in 5 minutes!

How to create an eSignature for the form 5001

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 5001 and how can airSlate SignNow help?

Form 5001 is a key document for various administrative processes, and airSlate SignNow makes it easy to electronically sign and send this form. Our platform streamlines the process of filling out and managing form 5001, reducing paperwork and increasing efficiency for your business.

-

How much does it cost to use airSlate SignNow for form 5001?

airSlate SignNow offers flexible pricing plans to accommodate different business needs, including those focused on form 5001 management. Our plans are designed to provide a cost-effective solution, ensuring that your investment aligns with the volume of documents you need to process.

-

Can I integrate airSlate SignNow with other applications while handling form 5001?

Yes, airSlate SignNow seamlessly integrates with a variety of applications, allowing you to manage form 5001 alongside your existing tools. This integration ensures a smooth workflow and enhances productivity by reducing the need for manual data entry.

-

What features does airSlate SignNow offer for managing form 5001?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure cloud storage to simplify the management of form 5001. These tools empower your team to efficiently handle document signing and track progress in real-time.

-

Is airSlate SignNow secure for handling sensitive form 5001 documents?

Absolutely! airSlate SignNow prioritizes security and complies with industry standards to ensure the safe handling of your form 5001 documents. Our platform uses encryption and secure storage methods to protect your sensitive information throughout the signing process.

-

How does airSlate SignNow improve the efficiency of processing form 5001?

airSlate SignNow streamlines the signing process for form 5001, signNowly improving efficiency by reducing turnaround times. By automating workflows and enabling real-time collaboration, your team can focus on more important tasks rather than getting bogged down by paperwork.

-

Can I track the status of my form 5001 sent through airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking capabilities for all documents, including form 5001. You will receive notifications and updates as your document progresses, giving you peace of mind and control over the signing process.

Get more for Form 5001

Find out other Form 5001

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free