4#25 %$12462# 10310 Arthur Boulevard 6 , 2019-2026

Understanding Modal Credit

Modal credit refers to a type of credit offered to businesses, enabling them to manage their financial operations more effectively. This form of credit is often used in business transactions where companies need to maintain liquidity while managing expenses. Modal credit can be essential for businesses looking to expand their operations or manage cash flow during slower periods.

Key Elements of Modal Credit

When considering modal credit, several key elements are important to understand:

- Credit Limit: This is the maximum amount of credit that a lender is willing to extend to a business.

- Interest Rates: The cost of borrowing can vary based on the lender and the creditworthiness of the business.

- Repayment Terms: Modal credit typically comes with specific repayment schedules that businesses must adhere to.

- Eligibility Criteria: Businesses may need to meet certain criteria to qualify for modal credit, such as revenue thresholds or credit scores.

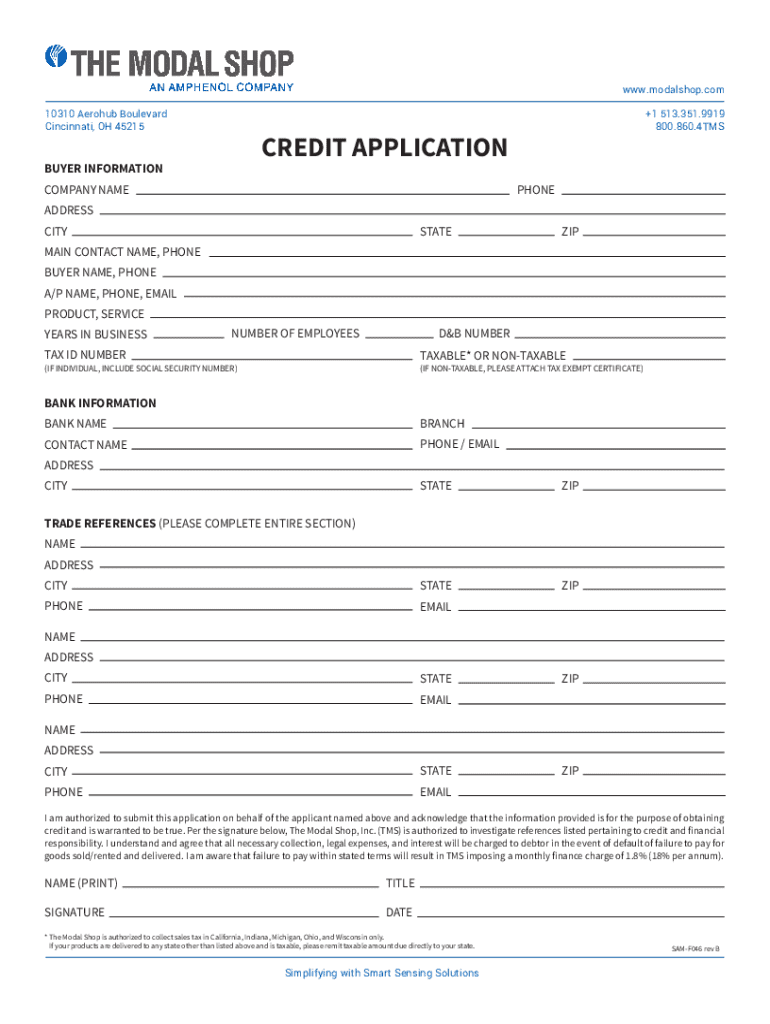

Application Process for Modal Credit

The application process for modal credit generally involves several steps:

- Gather Required Documents: Businesses need to compile financial statements, tax returns, and other relevant documents.

- Complete the Credit Approval Form: This form collects essential information about the business and its financial health.

- Submit the Application: Applications can often be submitted online or in person, depending on the lender.

- Await Approval: The lender will review the application and determine whether to approve the credit request.

Legal Use of Modal Credit

Understanding the legal implications of modal credit is crucial for businesses. Modal credit agreements are legally binding contracts that outline the terms of the credit arrangement. Businesses should ensure they understand their rights and obligations under these agreements to avoid potential legal issues.

Examples of Modal Credit in Use

Modal credit can be applied in various scenarios, including:

- Inventory Purchases: Businesses may use modal credit to finance the purchase of inventory, ensuring they have enough stock to meet customer demand.

- Operational Expenses: Companies might rely on modal credit to cover day-to-day operational costs, such as payroll and utilities.

- Expansion Projects: Modal credit can provide the necessary funds for businesses looking to expand their operations or invest in new projects.

Eligibility Criteria for Modal Credit

To qualify for modal credit, businesses typically need to meet specific eligibility criteria, which may include:

- Business Type: Certain lenders may only work with specific types of business entities, such as LLCs or corporations.

- Credit History: A strong credit history can improve the chances of approval and lead to better terms.

- Financial Stability: Lenders often look for evidence of financial stability, such as consistent revenue and profit margins.

Quick guide on how to complete 425 1246210310 arthur boulevard6

Complete 4#25 %$12462# 10310 Arthur Boulevard 6 , effortlessly on any device

Online document management has gained traction with businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily find the appropriate form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage 4#25 %$12462# 10310 Arthur Boulevard 6 , on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The simplest way to modify and eSign 4#25 %$12462# 10310 Arthur Boulevard 6 , with ease

- Find 4#25 %$12462# 10310 Arthur Boulevard 6 , and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Mark important sections of your documents or redact sensitive information using the tools that airSlate SignNow specifically provides for this purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign 4#25 %$12462# 10310 Arthur Boulevard 6 , to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 425 1246210310 arthur boulevard6

Create this form in 5 minutes!

How to create an eSignature for the 425 1246210310 arthur boulevard6

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is modal credit in airSlate SignNow?

Modal credit refers to the flexible payment options available for using airSlate SignNow's services. This feature allows businesses to manage their expenses effectively while utilizing our eSigning solutions. By leveraging modal credit, users can optimize their cash flow and ensure they have access to essential document management tools.

-

How does modal credit affect pricing for airSlate SignNow?

Modal credit can signNowly impact the pricing structure for airSlate SignNow users. By choosing modal credit options, businesses can spread their payments over time, making it easier to budget for eSigning services. This approach ensures that companies can access our features without a large upfront investment.

-

What features are included with modal credit in airSlate SignNow?

When utilizing modal credit with airSlate SignNow, users gain access to a comprehensive suite of features. These include document templates, advanced eSigning capabilities, and integration with various applications. Modal credit ensures that businesses can fully leverage these features without financial strain.

-

What are the benefits of using modal credit for eSigning?

Using modal credit for eSigning with airSlate SignNow offers several benefits, including improved cash flow management and access to premium features. This payment option allows businesses to prioritize their document signing needs without immediate financial pressure. Additionally, it enhances operational efficiency by streamlining the signing process.

-

Can I integrate modal credit with other tools?

Yes, modal credit can be integrated with various tools and applications that airSlate SignNow supports. This integration allows businesses to enhance their workflows and improve productivity. By combining modal credit with other software solutions, users can create a seamless document management experience.

-

Is modal credit suitable for small businesses?

Absolutely! Modal credit is particularly beneficial for small businesses looking to manage their expenses effectively. By utilizing this payment option, small enterprises can access airSlate SignNow's powerful eSigning features without the burden of high upfront costs, making it an ideal solution for budget-conscious organizations.

-

How do I apply for modal credit with airSlate SignNow?

Applying for modal credit with airSlate SignNow is a straightforward process. Interested users can visit our website and fill out the application form for modal credit. Once approved, businesses can start enjoying the benefits of flexible payment options while using our eSigning services.

Get more for 4#25 %$12462# 10310 Arthur Boulevard 6 ,

- Load tender and rate confirmation form

- Njcaa hardship request 1 hocking college hocking form

- Njcaa hardship form

- Automobile insurance motor vehicle inspection report completecar form

- Ssi awards letterpdffillercom form

- Form dv 24 objection to direction to attend programme justice govt

- Classification questionnaire sunysuffolk form

- Chapter chapter test the union in peril form

Find out other 4#25 %$12462# 10310 Arthur Boulevard 6 ,

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT