Fillable Sch Tc 58 Form

What is the Fillable Sch Tc 58

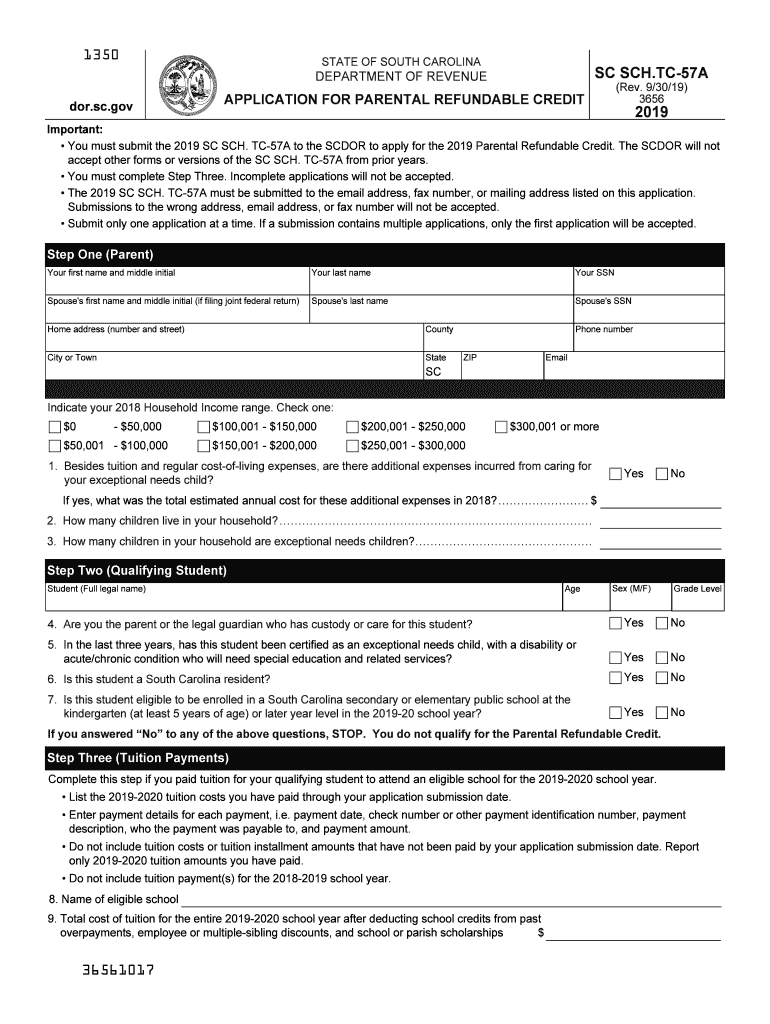

The Fillable Sch Tc 58 is a specific form used in South Carolina for tax purposes. It is designed to assist taxpayers in reporting certain types of income or deductions. This form is essential for individuals who need to provide detailed information regarding their financial activities to ensure accurate tax reporting. Understanding the purpose of this form is crucial for compliance with state tax regulations.

How to use the Fillable Sch Tc 58

Using the Fillable Sch Tc 58 involves several straightforward steps. First, ensure you have the most recent version of the form, which can typically be found on the South Carolina Department of Revenue website. Once you have the form, fill it out by entering your personal information, including your name, address, and Social Security number. Next, provide the necessary financial details as required by the form. After completing the form, review it for accuracy before submission.

Steps to complete the Fillable Sch Tc 58

Completing the Fillable Sch Tc 58 requires careful attention to detail. Follow these steps:

- Download the form from the official South Carolina Department of Revenue website.

- Fill in your personal information, including your name and address.

- Enter the required financial details, ensuring all numbers are accurate.

- Review the form thoroughly to check for any errors or omissions.

- Save the completed form for your records and for submission.

Legal use of the Fillable Sch Tc 58

The Fillable Sch Tc 58 holds legal significance as it is used to report income and deductions to the South Carolina Department of Revenue. Proper completion and submission of this form ensure compliance with state tax laws. Failure to use the form correctly can lead to penalties or issues with tax filings. Therefore, it is essential to adhere to all guidelines and requirements associated with this form.

Required Documents

When completing the Fillable Sch Tc 58, certain documents may be required to support the information provided. These may include:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Receipts for deductible expenses.

- Any other relevant financial documents that substantiate your claims.

Form Submission Methods

The Fillable Sch Tc 58 can be submitted through various methods to ensure it reaches the appropriate tax authorities. Taxpayers can choose to submit the form online through the South Carolina Department of Revenue's e-filing system, or they may opt to mail the completed form to the designated address. In-person submission may also be available at local tax offices, depending on the specific guidelines in place.

Quick guide on how to complete form tc 57a south carolina department of revenue scgov

Complete Fillable Sch Tc 58 effortlessly across any device

Web-based document management has become more sought after by organizations and individuals. It offers an excellent eco-friendly substitute to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the resources you require to create, edit, and eSign your papers swiftly and without delays. Manage Fillable Sch Tc 58 on any device using airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to edit and eSign Fillable Sch Tc 58 effortlessly

- Locate Fillable Sch Tc 58 and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow has designed specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a standard wet ink signature.

- Review all the details and then click on the Done button to save your updates.

- Select your preferred method for sending your form, whether by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements with a few clicks from any device you choose. Edit and eSign Fillable Sch Tc 58 to ensure exceptional communication at any step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form tc 57a south carolina department of revenue scgov

How to generate an electronic signature for the Form Tc 57a South Carolina Department Of Revenue Scgov in the online mode

How to create an eSignature for your Form Tc 57a South Carolina Department Of Revenue Scgov in Google Chrome

How to create an eSignature for signing the Form Tc 57a South Carolina Department Of Revenue Scgov in Gmail

How to create an electronic signature for the Form Tc 57a South Carolina Department Of Revenue Scgov from your smartphone

How to generate an electronic signature for the Form Tc 57a South Carolina Department Of Revenue Scgov on iOS

How to create an eSignature for the Form Tc 57a South Carolina Department Of Revenue Scgov on Android OS

People also ask

-

What is the sc sch tc 57a and how does it relate to airSlate SignNow?

The sc sch tc 57a refers to a specific document type that businesses often need to sign electronically. With airSlate SignNow, users can easily create, send, and eSign sc sch tc 57a documents securely and efficiently, ensuring compliance and streamlining their workflow.

-

How can airSlate SignNow help me manage sc sch tc 57a documents?

airSlate SignNow provides a user-friendly platform that allows you to manage sc sch tc 57a documents from anywhere. By utilizing our robust features, such as templates and automated reminders, you can simplify the signing process, ensuring that documents are completed promptly and efficiently.

-

What are the pricing options for using airSlate SignNow for sc sch tc 57a?

airSlate SignNow offers competitive pricing plans tailored to meet various business needs, including the handling of sc sch tc 57a documents. Our flexible subscription plans allow businesses to choose the features they need, ensuring cost-effectiveness and value for money.

-

Are there any integrations available for managing sc sch tc 57a with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing your ability to manage sc sch tc 57a documents. Popular integrations include CRM systems, cloud storage, and productivity tools, making it easier to streamline your workflow and enhance collaboration.

-

What features does airSlate SignNow offer for sc sch tc 57a eSigning?

airSlate SignNow includes features such as customizable templates, advanced security, and mobile access specifically designed for sc sch tc 57a eSigning. These features ensure that your signing process is not only efficient but also secure, complying with legal standards.

-

How does airSlate SignNow ensure the security of sc sch tc 57a documents?

airSlate SignNow prioritizes the security of your sc sch tc 57a documents with end-to-end encryption and strict compliance with industry regulations. This commitment to security protects sensitive information throughout the document signing process, giving you peace of mind.

-

Can I track the status of sc sch tc 57a documents sent via airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking for your sc sch tc 57a documents. You can easily monitor whether the document has been sent, viewed, or signed, enhancing your ability to manage and follow up on important tasks.

Get more for Fillable Sch Tc 58

- Tax type tax type code florida eservices form

- Medicare enrolment application department of human services humanservices gov form

- Christchurch city council application for code com 700928428 form

- Form met 1 rev 0821 do not write in this areause

- Form lf 5 form lf 5 litter control fee return

- Securing your tax clearance certificate form

- New jersey amended resident income tax return form nj 1040x new jersey amended resident income tax return form nj 1040x

- Nj 1040 form ftp directory listing

Find out other Fillable Sch Tc 58

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe