New Jersey Amended Resident Income Tax Return, Form NJ 1040X New Jersey Amended Resident Income Tax Return, Form NJ 1040X 2022

What is the New Jersey Amended Resident Income Tax Return, Form NJ 1040X

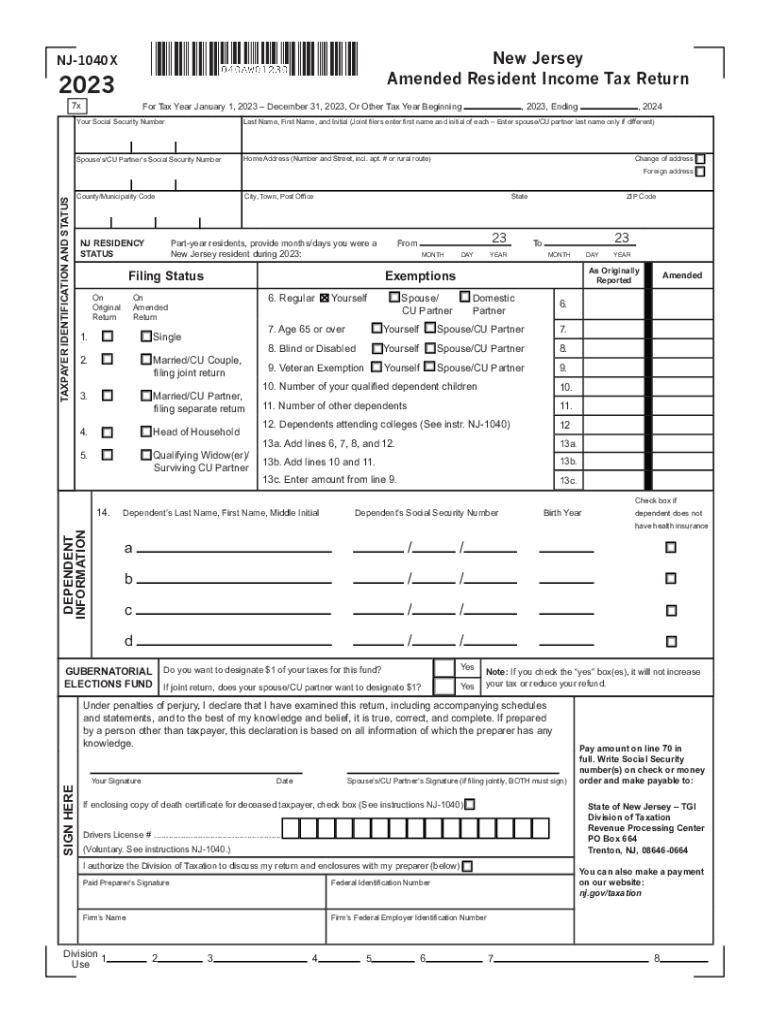

The New Jersey Amended Resident Income Tax Return, Form NJ 1040X, is a tax form used by residents of New Jersey to correct errors or make changes to previously filed income tax returns. This form allows taxpayers to adjust their reported income, deductions, or credits, ensuring that their tax obligations are accurate. It is essential for individuals who have discovered mistakes after filing their original return or who need to report additional income or deductions that were not included initially.

How to use the New Jersey Amended Resident Income Tax Return, Form NJ 1040X

To use the New Jersey Amended Resident Income Tax Return, Form NJ 1040X, taxpayers should first obtain the form from the New Jersey Division of Taxation website or other authorized sources. After filling out the form with the corrected information, individuals should ensure that all relevant documentation, such as W-2s or 1099s, is included. Once completed, the amended return must be submitted according to the guidelines provided by the New Jersey Division of Taxation, either electronically or by mail.

Steps to complete the New Jersey Amended Resident Income Tax Return, Form NJ 1040X

Completing the New Jersey Amended Resident Income Tax Return, Form NJ 1040X involves several key steps:

- Gather all necessary documents, including your original tax return and any supporting documentation for changes.

- Fill out the NJ 1040X form, clearly indicating the corrections made in each section.

- Provide a detailed explanation for each change in the designated area of the form.

- Review the completed form for accuracy and completeness.

- Submit the amended return either electronically through approved software or by mailing it to the appropriate address provided by the New Jersey Division of Taxation.

Key elements of the New Jersey Amended Resident Income Tax Return, Form NJ 1040X

Key elements of the New Jersey Amended Resident Income Tax Return, Form NJ 1040X include:

- Identification information, such as your name, address, and Social Security number.

- Details of the original return, including filing status and income reported.

- Sections for reporting changes to income, deductions, and credits.

- A section for providing explanations for each amendment made.

- Signature and date fields to validate the amended return.

Filing Deadlines / Important Dates

Filing deadlines for the New Jersey Amended Resident Income Tax Return, Form NJ 1040X, typically align with the state’s tax filing deadlines. Taxpayers should file the amended return within three years from the original due date of the return or within two years from the date the tax was paid, whichever is later. It is crucial to check the New Jersey Division of Taxation's website for any updates or changes to these deadlines.

Eligibility Criteria

Eligibility to file the New Jersey Amended Resident Income Tax Return, Form NJ 1040X, generally includes individuals who have previously filed a New Jersey resident income tax return and need to make corrections. This form is available to all residents who meet the state’s tax obligations and have discovered discrepancies in their original filings. Taxpayers should ensure that they meet all requirements set forth by the New Jersey Division of Taxation before submitting their amended return.

Quick guide on how to complete new jersey amended resident income tax return form nj 1040x new jersey amended resident income tax return form nj 1040x

Prepare New Jersey Amended Resident Income Tax Return, Form NJ 1040X New Jersey Amended Resident Income Tax Return, Form NJ 1040X effortlessly on any device

The management of documents online has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly without delays. Manage New Jersey Amended Resident Income Tax Return, Form NJ 1040X New Jersey Amended Resident Income Tax Return, Form NJ 1040X on any platform with the airSlate SignNow Android or iOS applications and enhance any document-based procedure today.

How to edit and eSign New Jersey Amended Resident Income Tax Return, Form NJ 1040X New Jersey Amended Resident Income Tax Return, Form NJ 1040X effortlessly

- Locate New Jersey Amended Resident Income Tax Return, Form NJ 1040X New Jersey Amended Resident Income Tax Return, Form NJ 1040X and click on Get Form to initiate.

- Utilize the tools provided to fill out your document.

- Emphasize relevant sections of the documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information and click on the Done button to save your modifications.

- Choose your preferred method to share your form, whether via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious searching for forms, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from whichever device you choose. Edit and eSign New Jersey Amended Resident Income Tax Return, Form NJ 1040X New Jersey Amended Resident Income Tax Return, Form NJ 1040X and ensure outstanding communication at every phase of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct new jersey amended resident income tax return form nj 1040x new jersey amended resident income tax return form nj 1040x

Create this form in 5 minutes!

How to create an eSignature for the new jersey amended resident income tax return form nj 1040x new jersey amended resident income tax return form nj 1040x

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the New Jersey Amended Resident Income Tax Return, Form NJ 1040X?

The New Jersey Amended Resident Income Tax Return, Form NJ 1040X is a form used by residents of New Jersey to amend their previously filed state income tax returns. This form allows taxpayers to correct errors, update income details, or claim missed deductions. It's essential for ensuring that your tax filings are accurate and up-to-date.

-

Who needs to file the New Jersey Amended Resident Income Tax Return, Form NJ 1040X?

You should file the New Jersey Amended Resident Income Tax Return, Form NJ 1040X if you discover discrepancies in your original tax return, such as incorrect income, filing status, or deductions. Any resident needing to amend their tax returns from prior years should utilize this form to make necessary corrections. Promptly amending your return can help prevent penalties and interest from accumulating.

-

What are the benefits of using airSlate SignNow for filing the New Jersey Amended Resident Income Tax Return, Form NJ 1040X?

Using airSlate SignNow for your New Jersey Amended Resident Income Tax Return, Form NJ 1040X streamlines the eSigning and document sending process, making it simple and efficient. The platform is designed to enhance productivity, save time, and reduce hassles associated with paper forms. Additionally, its user-friendly interface ensures that you can easily manage your amendments.

-

How much does it cost to file the New Jersey Amended Resident Income Tax Return, Form NJ 1040X with airSlate SignNow?

The cost of using airSlate SignNow for filing the New Jersey Amended Resident Income Tax Return, Form NJ 1040X varies depending on the subscription plan you choose. Generally, it offers cost-effective solutions designed to fit the needs of both individuals and businesses. For precise pricing details, you can visit our website and explore the tailored packages available.

-

Can I integrate airSlate SignNow with my existing accounting software to file the New Jersey Amended Resident Income Tax Return, Form NJ 1040X?

Yes, airSlate SignNow provides integration capabilities with various accounting software, making it easier to manage your financial documents. This integration helps streamline the process of filing your New Jersey Amended Resident Income Tax Return, Form NJ 1040X by enabling seamless data transfers and eSignature functionalities. Check our integrations page for a complete list of compatible software.

-

Is eSigning legally valid for the New Jersey Amended Resident Income Tax Return, Form NJ 1040X?

Absolutely! eSigning your New Jersey Amended Resident Income Tax Return, Form NJ 1040X using airSlate SignNow is legally valid and compliant with state regulations. Electronic signatures carry the same weight as traditional handwritten signatures under New Jersey law, ensuring that your amendments are legally binding.

-

How long does it take to process the New Jersey Amended Resident Income Tax Return, Form NJ 1040X after submission?

The processing time for the New Jersey Amended Resident Income Tax Return, Form NJ 1040X can vary, but typically it may take between 8 to 12 weeks once submitted. Factors such as the volume of submissions and any additional documentation required can affect processing times. Submitting your return electronically through airSlate SignNow can help expedite the process.

Get more for New Jersey Amended Resident Income Tax Return, Form NJ 1040X New Jersey Amended Resident Income Tax Return, Form NJ 1040X

- The honorablegwen marshallclerk of the circuit cou form

- The undersigned herby informs all concerned that the undersigned will terminate that certain

- Release of garnishment form

- Power of attorney for marriage sample 626637623 form

- In the seventeenth judicial circuit in and for br form

- Pennsylvania court forms and other information

- Anna von reitz 251883442 form

- Exhibit a worker eligibility verification affidavit for form

Find out other New Jersey Amended Resident Income Tax Return, Form NJ 1040X New Jersey Amended Resident Income Tax Return, Form NJ 1040X

- How Can I Electronic signature Tennessee Sublease Agreement Template

- Electronic signature Maryland Roommate Rental Agreement Template Later

- Electronic signature Utah Storage Rental Agreement Easy

- Electronic signature Washington Home office rental agreement Simple

- Electronic signature Michigan Email Cover Letter Template Free

- Electronic signature Delaware Termination Letter Template Now

- How Can I Electronic signature Washington Employee Performance Review Template

- Electronic signature Florida Independent Contractor Agreement Template Now

- Electronic signature Michigan Independent Contractor Agreement Template Now

- Electronic signature Oregon Independent Contractor Agreement Template Computer

- Electronic signature Texas Independent Contractor Agreement Template Later

- Electronic signature Florida Employee Referral Form Secure

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast