Tax Type Tax Type Code Florida EServices 2017

What is the Tax Type Tax Type Code Florida EServices

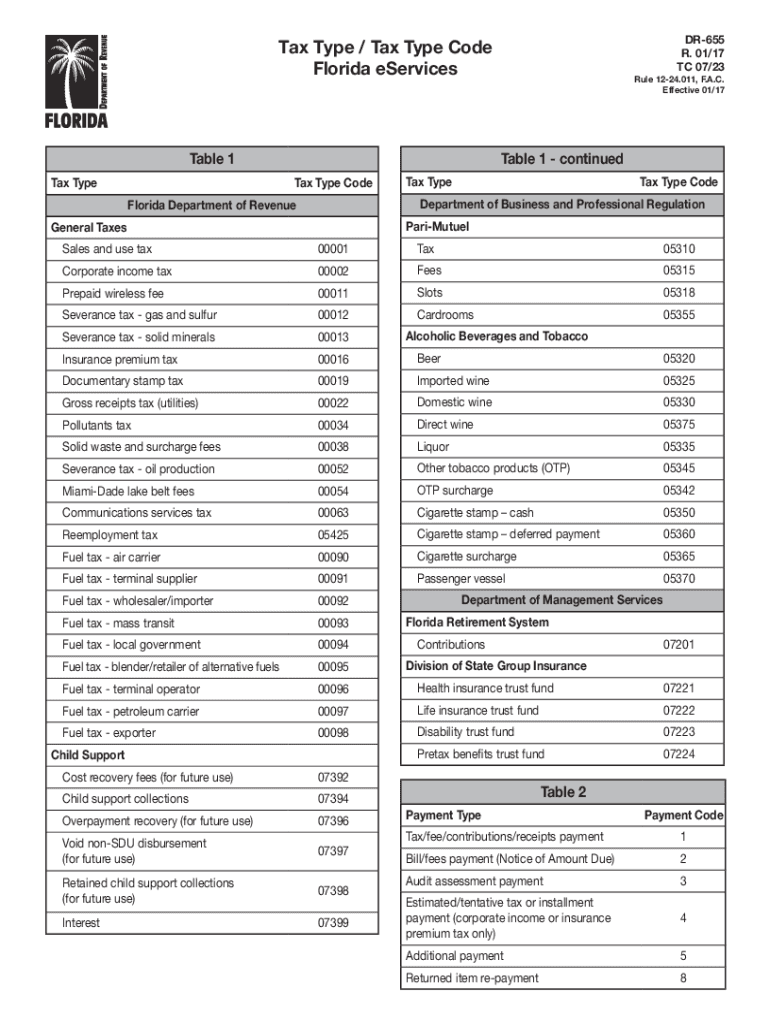

The Tax Type Tax Type Code Florida EServices refers to a specific classification used within the Florida tax system. This code helps identify the type of tax being reported or paid, ensuring accurate processing by the Florida Department of Revenue. It encompasses various tax categories, including sales tax, corporate income tax, and other state-specific taxes. Understanding this code is essential for businesses and individuals to comply with state tax regulations and avoid potential penalties.

How to use the Tax Type Tax Type Code Florida EServices

Using the Tax Type Tax Type Code Florida EServices involves entering the appropriate code when filing tax forms or making payments online. Taxpayers must ensure they select the correct code corresponding to their tax obligations. This process typically occurs through the Florida Department of Revenue's online portal, where users can navigate to the tax section and input the necessary information. Accurate usage of the code streamlines the tax filing process and helps maintain compliance with state laws.

Steps to complete the Tax Type Tax Type Code Florida EServices

To complete the Tax Type Tax Type Code Florida EServices, follow these steps:

- Access the Florida Department of Revenue's online portal.

- Select the appropriate tax type from the available options.

- Enter the corresponding Tax Type Code accurately.

- Fill out all required fields on the form.

- Review the information for accuracy before submission.

- Submit the form electronically or save it for future reference.

Following these steps ensures that taxpayers properly file their taxes and meet state requirements.

Key elements of the Tax Type Tax Type Code Florida EServices

Key elements of the Tax Type Tax Type Code Florida EServices include:

- Identification: Each code uniquely identifies a specific tax type.

- Compliance: Using the correct code is crucial for adhering to state tax regulations.

- Reporting: Codes facilitate accurate reporting of tax liabilities.

- Tracking: They assist in tracking payments and filings within the state system.

Understanding these elements helps taxpayers navigate the complexities of the Florida tax system more effectively.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Type Tax Type Code Florida EServices vary depending on the specific tax type. Generally, businesses must file sales tax returns monthly or quarterly, while corporate income tax returns are typically due on the first day of the fourth month following the end of the fiscal year. It is essential for taxpayers to be aware of these dates to avoid late fees and penalties. Keeping a calendar of important tax deadlines can help ensure timely compliance.

Required Documents

When using the Tax Type Tax Type Code Florida EServices, several documents may be required, including:

- Previous tax returns for reference.

- Income statements and financial records.

- Sales records for sales tax filings.

- Any relevant correspondence from the Florida Department of Revenue.

Having these documents ready can facilitate a smoother filing process and help ensure all necessary information is submitted accurately.

Penalties for Non-Compliance

Non-compliance with the Tax Type Tax Type Code Florida EServices can lead to significant penalties. These may include:

- Late filing fees, which can accumulate over time.

- Interest on unpaid taxes, increasing the total amount owed.

- Potential audits by the Florida Department of Revenue.

Understanding these penalties underscores the importance of timely and accurate tax filing, helping taxpayers avoid unnecessary financial burdens.

Quick guide on how to complete tax type tax type code florida eservices

Effortlessly Complete Tax Type Tax Type Code Florida EServices on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely save them online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents quickly and without delays. Manage Tax Type Tax Type Code Florida EServices on any device using the airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to Modify and Electronically Sign Tax Type Tax Type Code Florida EServices with Ease

- Locate Tax Type Tax Type Code Florida EServices and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of your documents or obscure sensitive information with the tools available through airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select how you wish to send your form: via email, SMS, invitation link, or download it to your computer.

Eliminate the concerns of lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow caters to all your document management needs in just a few clicks from your preferred device. Modify and electronically sign Tax Type Tax Type Code Florida EServices, ensuring seamless communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax type tax type code florida eservices

Create this form in 5 minutes!

How to create an eSignature for the tax type tax type code florida eservices

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Tax Type Tax Type Code Florida EServices?

The Tax Type Tax Type Code Florida EServices refers to a specific code used in Florida for tax reporting purposes. This code helps businesses manage their tax obligations electronically and streamlines the payment process. Understanding this code is essential for compliance and efficient tax filing.

-

How does airSlate SignNow support Tax Type Tax Type Code Florida EServices?

airSlate SignNow offers features specifically designed to facilitate the management of Tax Type Tax Type Code Florida EServices. Our platform allows users to easily send and eSign documents related to tax filings, ensuring accuracy and compliance with Florida tax regulations. This enhances overall efficiency and reduces the risk of errors.

-

What are the pricing options for airSlate SignNow with regard to Tax Type Tax Type Code Florida EServices?

airSlate SignNow provides flexible pricing plans suitable for businesses of all sizes dealing with Tax Type Tax Type Code Florida EServices. Our competitive pricing ensures you receive an effective eSigning solution without breaking the bank. You can choose a plan that fits your budget and operational needs.

-

Can I integrate airSlate SignNow with my accounting software for managing Tax Type Tax Type Code Florida EServices?

Yes, airSlate SignNow can be easily integrated with popular accounting software to streamline your processes related to Tax Type Tax Type Code Florida EServices. This integration allows for seamless data flow between platforms, helping you maintain accurate records and simplifying your tax compliance efforts.

-

What benefits does airSlate SignNow provide for handling Tax Type Tax Type Code Florida EServices?

By using airSlate SignNow for handling Tax Type Tax Type Code Florida EServices, businesses can enjoy increased efficiency and reduced paperwork. Our platform supports quick document turnaround, helps in maintaining a clear audit trail, and ensures that all signatures are legally compliant. This leads to improved operational productivity and compliance accuracy.

-

Is airSlate SignNow suitable for small businesses managing Tax Type Tax Type Code Florida EServices?

Absolutely! airSlate SignNow is an ideal solution for small businesses managing Tax Type Tax Type Code Florida EServices. Our user-friendly platform enables small teams to navigate tax documents effortlessly, reducing administrative burdens and allowing you to focus on what really matters: growing your business.

-

How secure is airSlate SignNow for handling Tax Type Tax Type Code Florida EServices?

Security is a priority at airSlate SignNow. Our platform employs advanced encryption and security measures to protect your documents and data related to Tax Type Tax Type Code Florida EServices. This ensures compliance with industry standards and provides peace of mind as you manage sensitive tax information.

Get more for Tax Type Tax Type Code Florida EServices

- Service crest transfer form

- Childrens carnival fancy dress parade entry form

- Exhibit a amr corporation website form

- Student conduct appeal form date stamp london met student zone

- Overseas doc form

- Wsib intent object form

- Updated cursillo application form ottawa anglican cursillo

- Township of algoqnuin highlands fire service volunteer application form

Find out other Tax Type Tax Type Code Florida EServices

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form