Form MET 1 Rev 0821 DO NOT WRITE in THIS AREAUSE 2021

What is the Form MET 1 Rev 0821 DO NOT WRITE IN THIS AREAUSE

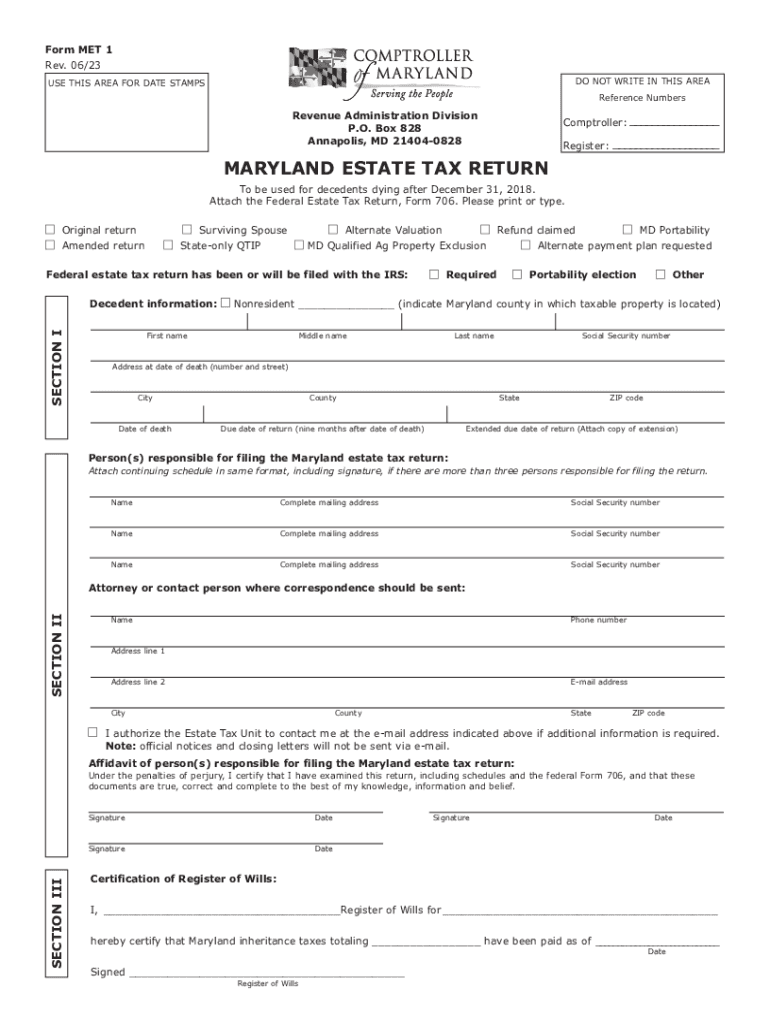

The Form MET 1 Rev 0821 is an official document used in specific regulatory or administrative processes. It is designed for particular purposes that may include applications, compliance, or reporting. Understanding the context and requirements for this form is crucial for proper completion and submission.

This form may be required by certain governmental agencies or organizations, and it is essential to ensure that it is filled out accurately to avoid delays or issues in processing.

How to use the Form MET 1 Rev 0821 DO NOT WRITE IN THIS AREAUSE

Using the Form MET 1 Rev 0821 involves several steps to ensure that all necessary information is accurately provided. Begin by carefully reading the instructions that accompany the form. This will help clarify the purpose of each section and the information needed.

Fill out the form completely, ensuring that all required fields are addressed. It is important to double-check for any errors or omissions before submitting the form. If applicable, gather any supporting documents that may be necessary for submission alongside the form.

Steps to complete the Form MET 1 Rev 0821 DO NOT WRITE IN THIS AREAUSE

Completing the Form MET 1 Rev 0821 requires a systematic approach. Follow these steps for successful completion:

- Review the form carefully to understand its purpose and requirements.

- Gather all necessary information and documentation that may be needed.

- Fill in each section of the form, ensuring clarity and accuracy.

- Double-check your entries for any mistakes or missing information.

- Attach any required supporting documents.

- Submit the form according to the specified submission methods.

Key elements of the Form MET 1 Rev 0821 DO NOT WRITE IN THIS AREAUSE

The Form MET 1 Rev 0821 contains several key elements that are essential for its proper use. These elements typically include:

- Identification Information: This includes personal or business details that identify the individual or entity submitting the form.

- Purpose of the Form: A section that outlines the specific reason for submitting the form.

- Signature Section: A place for the individual to sign, confirming the accuracy of the information provided.

- Submission Instructions: Clear guidelines on how to submit the form, including any deadlines or specific requirements.

Legal use of the Form MET 1 Rev 0821 DO NOT WRITE IN THIS AREAUSE

The legal use of the Form MET 1 Rev 0821 is governed by the regulations set forth by the relevant authority requiring the form. It is critical to understand the legal implications of submitting this form, as inaccuracies or incomplete submissions may lead to penalties or legal challenges.

Ensure compliance with all applicable laws and regulations when using this form. This may involve consulting with legal professionals or regulatory bodies to clarify any uncertainties regarding its use.

Form Submission Methods

The Form MET 1 Rev 0821 can typically be submitted through various methods, depending on the requirements set by the issuing authority. Common submission methods include:

- Online Submission: Many forms can be submitted electronically via a designated website or portal.

- Mail: Physical copies of the form can be mailed to the appropriate address as specified in the instructions.

- In-Person Submission: Some forms may allow for submission directly at designated offices or locations.

Quick guide on how to complete form met 1 rev 0821 do not write in this areause

Effortlessly Prepare Form MET 1 Rev 0821 DO NOT WRITE IN THIS AREAUSE on Any Device

Digital document management has gained popularity among both organizations and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to find the right template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Form MET 1 Rev 0821 DO NOT WRITE IN THIS AREAUSE on any platform using airSlate SignNow apps for Android or iOS and enhance any document-related procedure today.

How to Edit and eSign Form MET 1 Rev 0821 DO NOT WRITE IN THIS AREAUSE with Ease

- Obtain Form MET 1 Rev 0821 DO NOT WRITE IN THIS AREAUSE and click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize essential sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you want to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or errors that necessitate printing new copies of documents. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Form MET 1 Rev 0821 DO NOT WRITE IN THIS AREAUSE and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form met 1 rev 0821 do not write in this areause

Create this form in 5 minutes!

How to create an eSignature for the form met 1 rev 0821 do not write in this areause

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form MET 1 Rev 0821 DO NOT WRITE IN THIS AREAUSE?

The Form MET 1 Rev 0821 DO NOT WRITE IN THIS AREAUSE is an essential document designed for efficient electronic signing and processing. It helps streamline your workflow by allowing businesses to securely send and eSign documents online. Using this form minimizes errors and speeds up the approval process.

-

How can airSlate SignNow help me manage the Form MET 1 Rev 0821 DO NOT WRITE IN THIS AREAUSE?

airSlate SignNow offers a comprehensive solution to manage the Form MET 1 Rev 0821 DO NOT WRITE IN THIS AREAUSE. Our platform allows you to upload, edit, and send this form for signing, ensuring compliance with your organizational standards. You can also track the status of the form in real-time for better project management.

-

Is there a cost associated with using the Form MET 1 Rev 0821 DO NOT WRITE IN THIS AREAUSE on airSlate SignNow?

Yes, while airSlate SignNow provides various pricing plans to meet your needs, the use of the Form MET 1 Rev 0821 DO NOT WRITE IN THIS AREAUSE is included in our offerings. We recommend reviewing our plans to choose the one that best suits your budget and features required for your business.

-

What are the benefits of using airSlate SignNow for the Form MET 1 Rev 0821 DO NOT WRITE IN THIS AREAUSE?

Using airSlate SignNow for the Form MET 1 Rev 0821 DO NOT WRITE IN THIS AREAUSE brings several benefits, including increased efficiency and reduced turnaround time. The platform simplifies the signing process, allowing you to complete transactions faster. Additionally, it offers secure storage and easy access to your documents at any time.

-

Can I integrate the Form MET 1 Rev 0821 DO NOT WRITE IN THIS AREAUSE with other applications?

Absolutely! airSlate SignNow offers integration capabilities that allow you to connect the Form MET 1 Rev 0821 DO NOT WRITE IN THIS AREAUSE with various third-party applications. This enables seamless sharing of information across platforms, enhancing your workflow and productivity.

-

How does airSlate SignNow ensure the security of the Form MET 1 Rev 0821 DO NOT WRITE IN THIS AREAUSE?

Security is a priority at airSlate SignNow. We implement advanced encryption protocols and compliance measures to protect the Form MET 1 Rev 0821 DO NOT WRITE IN THIS AREAUSE and ensure that your documents are safe during transmission and storage. Additionally, our platform adheres to industry standards for data protection.

-

Is it easy to get started with the Form MET 1 Rev 0821 DO NOT WRITE IN THIS AREAUSE on airSlate SignNow?

Yes, getting started with the Form MET 1 Rev 0821 DO NOT WRITE IN THIS AREAUSE on airSlate SignNow is quick and user-friendly. After signing up for an account, you can easily upload the form, set it up for eSignature, and begin sending it for signing in just a few clicks.

Get more for Form MET 1 Rev 0821 DO NOT WRITE IN THIS AREAUSE

Find out other Form MET 1 Rev 0821 DO NOT WRITE IN THIS AREAUSE

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile