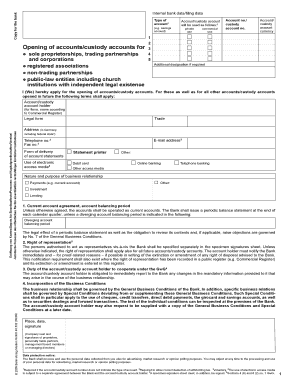

Opening of Accountscustody Accounts for Form

What is the Opening Of Accountscustody Accounts For

The Opening Of Accounts custody accounts for is a formal process that allows individuals or entities to establish a custody account with a financial institution. These accounts are designed to hold and safeguard various types of assets, including securities and cash, on behalf of the account holder. The primary purpose of a custody account is to ensure the secure management and protection of assets while providing services such as transaction settlement, record-keeping, and reporting. This type of account is commonly utilized by investors, corporations, and institutional clients who require professional management of their investments.

Steps to complete the Opening Of Accountscustody Accounts For

Completing the Opening Of Accounts custody accounts for involves several key steps to ensure a smooth and compliant process. Here are the essential steps:

- Gather necessary documentation, including identification, proof of address, and any relevant financial information.

- Choose a financial institution that offers custody services and review their terms and conditions.

- Fill out the application form provided by the institution, ensuring all information is accurate and complete.

- Submit the application along with the required documentation, either online or in person, as per the institution's guidelines.

- Wait for the institution to review and approve the application, which may take several business days.

- Once approved, fund the custody account as per the institution's requirements to activate it.

Required Documents

To successfully open a custody account, specific documentation is required to verify identity and ensure compliance with regulatory standards. Essential documents typically include:

- Government-issued identification, such as a driver's license or passport.

- Proof of address, which may include utility bills or bank statements.

- Tax identification number, such as a Social Security number for individuals or an Employer Identification Number (EIN) for businesses.

- Financial statements or information about the source of funds being deposited.

Eligibility Criteria

Eligibility to open a custody account generally depends on several factors, including the type of account and the financial institution's policies. Common criteria include:

- Being of legal age, typically eighteen years or older, to enter into a binding contract.

- Providing valid identification and proof of address.

- Meeting any minimum funding requirements set by the financial institution.

- Complying with any specific regulations related to the type of assets being held in the custody account.

Legal use of the Opening Of Accountscustody Accounts For

The Opening Of Accounts custody accounts for must be utilized in accordance with applicable laws and regulations. This includes adhering to federal and state securities laws, anti-money laundering regulations, and any other relevant legal frameworks. Proper use of these accounts ensures that assets are managed responsibly and transparently, protecting both the account holder and the financial institution. Misuse of custody accounts can lead to legal penalties, including fines and sanctions.

Form Submission Methods

When opening a custody account, there are various methods available for submitting the required forms and documentation. Common submission methods include:

- Online submission through the financial institution's secure portal, allowing for quick and efficient processing.

- Mailing the completed forms and documents to the institution's designated address.

- In-person submission at a local branch or office of the financial institution, which may provide immediate assistance and verification.

Quick guide on how to complete opening of accountscustody accounts for

Complete [SKS] effortlessly on any device

Online document management has become widely adopted by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the required form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents rapidly without delays. Handle [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to edit and eSign [SKS] with ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all information and click on the Done button to save your changes.

- Choose how you want to send your form, either via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors requiring new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Edit and eSign [SKS] and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Opening Of Accountscustody Accounts For

Create this form in 5 minutes!

How to create an eSignature for the opening of accountscustody accounts for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the primary purpose of a custodian?

The purpose of custody is to safeguard assets, but a custodian may also be responsible for administering accounts, facilitating transactions, and collecting income on investments. While a custodian is responsible for safekeeping a client's assets, it does not make investment decisions for the client.

-

What are the benefits of opening a custodial account?

The main benefit of a custodial account is that parents can take advantage of the gift tax exclusion to fund the account while maintaining control over how the money is invested and spent while the child is a minor (as long as it's for their benefit).

-

What is the difference between a bank account and a custody account?

Regulated banks like JP Morgan are a good place for companies to hold their operating cash (up to the FDIC insured amount), make payments, and manage their day-to-day financial needs. Custodians, on the other hand, are financial institutions that provide safekeeping and asset servicing for their clients.

-

Should I open an UTMA account for my child?

Key benefits of an UGMA/UTMA Unlike college savings plans, there is no penalty if account assets aren't used to pay for college. Once the minor signNowes adulthood, the money is turned over to the minor and the minor will have full control of the assets and can use them for any purpose—educational or otherwise.

-

What is the purpose of custody accounts?

A custodial account is generally created by a parent or grandparent for the benefit of a minor child or grandchild. When you put money into a custodial account, you make a gift to the minor beneficiary of the account, even though the minor does not control the account.

-

What is the difference between a custody account and a brokerage account?

Bank custodians have a fiduciary duty to act in the best interests of their clients, and often take on an advisory role in helping institutional investors manage their finances and meet their goals. Meanwhile, the primary purpose of a brokerage is to facilitate transactions that involve securities (stocks, bonds, etc.)

-

What are the rules for a custodial account?

While the custodian can determine how funds are used, they cannot undo their contribution. Once the minor beneficiary signNowes adulthood, they gain control of the account and can fully access and use the funds. If the minor passes away before signNowing adulthood, the account becomes part of their estate.

-

What can custodial accounts be used for?

The custodian may use the funds for everything from providing a place to live to paying for clothing as long as the beneficiary receives a benefit. A custodial account is much simpler and less expensive to establish than a trust fund.

Get more for Opening Of Accountscustody Accounts For

Find out other Opening Of Accountscustody Accounts For

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors