Form Dr8453

What is the Form Dr8453

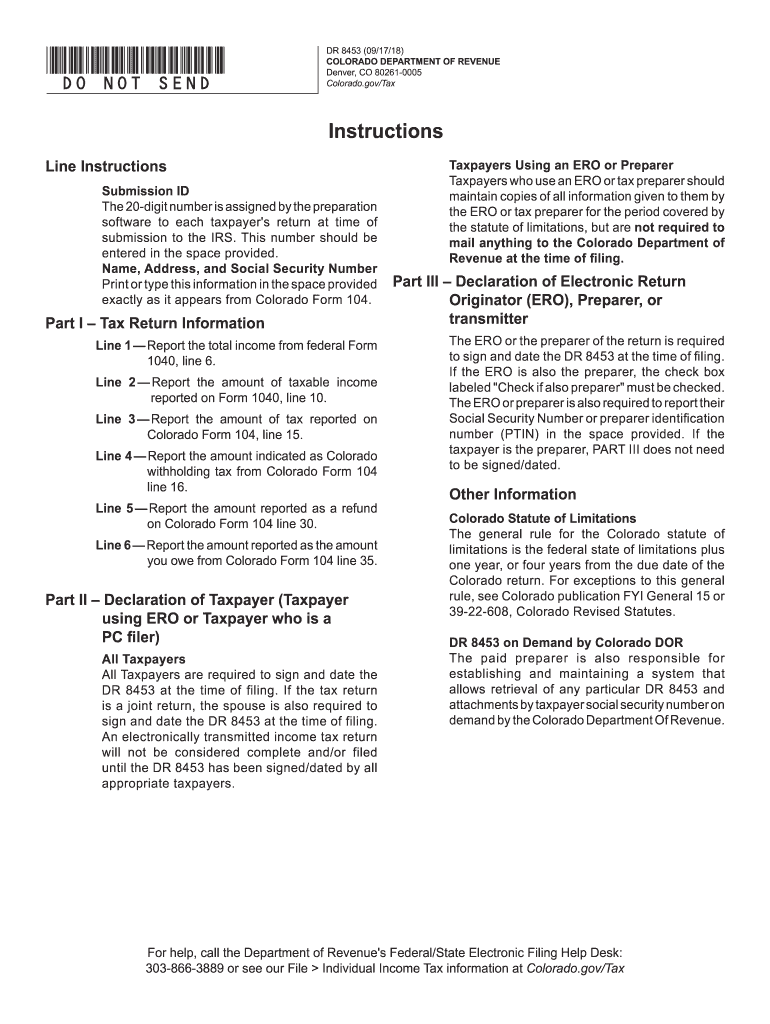

The Colorado DR8453 form is a tax document used by individuals and businesses in the state of Colorado. This form serves as a declaration of the taxpayer's intent to file an electronic return. It is crucial for ensuring that the e-filed return is legally recognized and compliant with state regulations. The form requires specific information, including the taxpayer's name, Social Security number, and details about the tax return being filed. Understanding the purpose of the DR8453 is essential for anyone looking to file their taxes electronically in Colorado.

How to use the Form Dr8453

Using the Colorado DR8453 form involves a few key steps. First, ensure that you have all necessary information and documents ready, including your tax return details. Next, complete the form accurately, filling in all required fields. Once the form is filled out, it must be signed electronically. This electronic signature is critical as it confirms your consent to file the return electronically. Finally, submit the form along with your e-filed tax return to the appropriate tax authority. Following these steps ensures compliance and smooth processing of your tax filings.

Steps to complete the Form Dr8453

Completing the Colorado DR8453 form requires careful attention to detail. Here are the steps to follow:

- Gather all necessary documents, including your tax return and identification information.

- Access the DR8453 form through a reliable digital platform.

- Fill in your personal information, including your name and Social Security number.

- Provide details about your tax return, such as the type of return and any relevant amounts.

- Review the information for accuracy to avoid any errors.

- Sign the form electronically, ensuring that your signature is valid.

- Submit the completed form along with your electronic tax return.

Legal use of the Form Dr8453

The legal use of the Colorado DR8453 form is governed by specific regulations that ensure its validity. When filled out correctly and submitted with an electronic tax return, the form acts as a legally binding document. It is essential to comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). These laws affirm that electronic signatures and documents hold the same legal weight as traditional paper documents, provided that the signer has given consent and the process meets established standards.

Key elements of the Form Dr8453

Several key elements are essential for the proper completion of the Colorado DR8453 form. These include:

- Taxpayer Information: Name, Social Security number, and address.

- Return Information: Type of tax return being filed and any relevant amounts.

- Signature: An electronic signature that confirms your consent to file electronically.

- Date: The date when the form is signed and submitted.

Ensuring that all these elements are accurately filled out is crucial for the form's acceptance and legal standing.

Form Submission Methods (Online / Mail / In-Person)

The Colorado DR8453 form can be submitted in various ways, depending on the taxpayer's preference and the requirements of the tax authority. The primary method is online submission, where the form is completed and signed electronically before being sent with the e-filed tax return. Alternatively, if electronic filing is not an option, the form can be printed and mailed to the appropriate tax office. In-person submission is also possible at designated tax offices, although this method is less common. Understanding these submission methods helps ensure that taxpayers choose the most efficient option for their needs.

Quick guide on how to complete dr 8453 091718

Easily Prepare Form Dr8453 on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with everything necessary to create, adjust, and electronically sign your documents swiftly without unnecessary delays. Manage Form Dr8453 on any device through airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The simplest method to adjust and electronically sign Form Dr8453 effortlessly

- Obtain Form Dr8453 and click Get Form to begin.

- Utilize the features we provide to complete your document.

- Emphasize key parts of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for those purposes.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal authority as a traditional handwritten signature.

- Review all the information and click the Done button to save your modifications.

- Choose how you wish to send your form: via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form hunting, or errors that necessitate reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form Dr8453 and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dr 8453 091718

How to create an electronic signature for the Dr 8453 091718 in the online mode

How to create an electronic signature for your Dr 8453 091718 in Google Chrome

How to make an electronic signature for signing the Dr 8453 091718 in Gmail

How to create an electronic signature for the Dr 8453 091718 straight from your smartphone

How to generate an eSignature for the Dr 8453 091718 on iOS devices

How to create an electronic signature for the Dr 8453 091718 on Android

People also ask

-

What is Form Dr8453 and how can airSlate SignNow help with it?

Form Dr8453 is an IRS form used to authorize an electronic signature for tax returns. With airSlate SignNow, you can easily fill out, sign, and send Form Dr8453 electronically, ensuring a smooth and compliant process for your tax submissions.

-

Is airSlate SignNow suitable for filing Form Dr8453?

Absolutely! airSlate SignNow is designed to meet the needs of businesses and individuals alike, making it a perfect solution for filing Form Dr8453. The platform ensures that your document is securely signed and stored, simplifying your tax filing experience.

-

What features does airSlate SignNow offer for managing Form Dr8453?

airSlate SignNow provides various features that enhance the management of Form Dr8453, including customizable templates, advanced security options, and the ability to track document status. These features ensure that your electronic signatures are legally binding and that your documents are handled efficiently.

-

How much does it cost to use airSlate SignNow for Form Dr8453 submissions?

airSlate SignNow offers flexible pricing plans, enabling you to choose one that suits your needs for filing Form Dr8453. Plans are designed to be cost-effective, ensuring you receive great value while simplifying your document management processes.

-

Can I integrate airSlate SignNow with other software for Form Dr8453?

Yes, airSlate SignNow seamlessly integrates with various software solutions, allowing you to streamline the process of filling out and submitting Form Dr8453. This integration capability enhances workflow efficiency and saves you time during tax season.

-

What are the security measures in place for Form Dr8453 on airSlate SignNow?

Security is a top priority at airSlate SignNow, especially for sensitive documents like Form Dr8453. The platform uses advanced encryption, secure cloud storage, and compliance with industry standards to protect your information throughout the signing process.

-

How does airSlate SignNow simplify the signing process for Form Dr8453?

airSlate SignNow simplifies the signing process for Form Dr8453 by providing an intuitive interface that guides users through each step. You can easily invite signers, track document status, and receive notifications, making the entire process efficient and user-friendly.

Get more for Form Dr8453

- Statement of business or professional activities t2125 and form

- Activity bus evacuation drill report form schoolwires

- Permission to work and volunteering for asylum seekers form

- Dcaa brief contract template form

- Deal contract template form

- Pet care contract template form

- Pet custody transfer of dog ownership contract template form

- Pet contract template form

Find out other Form Dr8453

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF