Ky Quarterly Form

What is the Kentucky Quarterly?

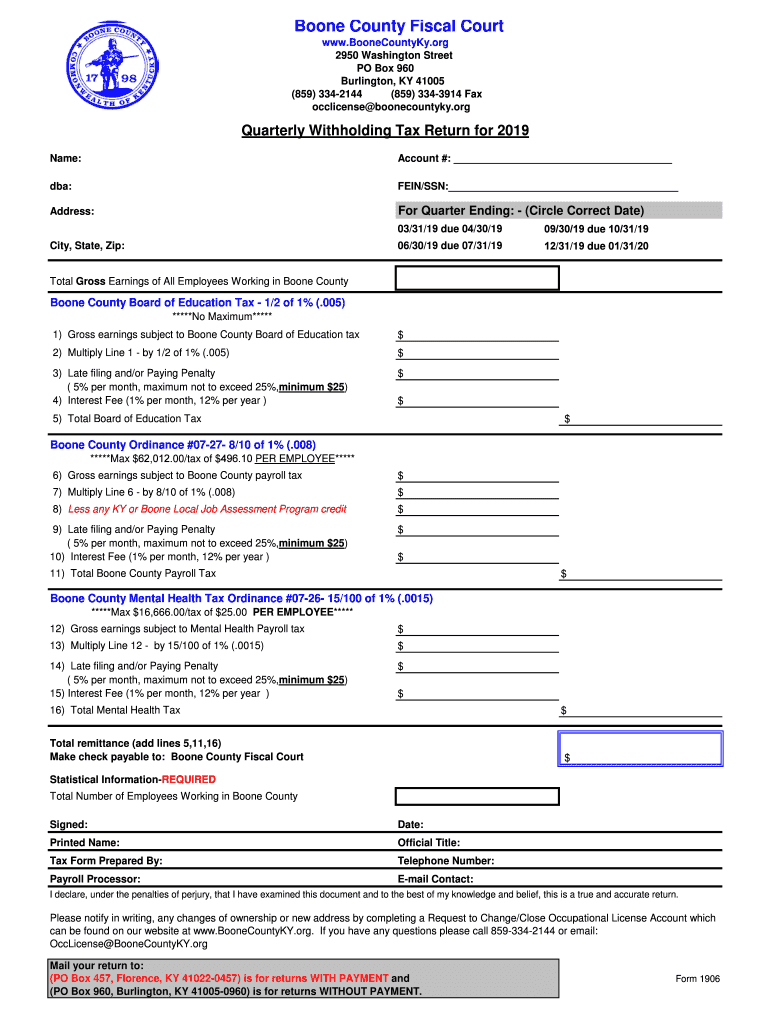

The Kentucky Quarterly refers to the state-specific tax return that employers must file to report their withholding tax obligations. This form is essential for businesses operating in Kentucky, as it helps ensure compliance with state tax laws. The Kentucky withholding return is typically filed on a quarterly basis, allowing employers to report wages paid and taxes withheld from employees. Understanding this form is crucial for maintaining accurate records and fulfilling tax responsibilities.

Steps to Complete the Kentucky Quarterly

Completing the Kentucky Quarterly return involves several key steps:

- Gather necessary information, including employee wages and the amount of state tax withheld.

- Obtain the correct version of the Kentucky withholding return form, which can be accessed online or through state resources.

- Fill out the form accurately, ensuring all required fields are completed, including employer information and tax amounts.

- Review the completed form for any errors or omissions before submission.

- Submit the form by the designated deadline, either electronically or via mail, depending on your preference.

Legal Use of the Kentucky Quarterly

The Kentucky Quarterly return is legally binding when completed and submitted in accordance with state regulations. It serves as an official record of an employer's tax obligations and compliance. To ensure its legal standing, employers must adhere to the guidelines set forth by the state, including accurate reporting of wages and taxes. Failure to comply with these regulations can result in penalties and interest charges.

Filing Deadlines / Important Dates

Employers must be aware of specific deadlines for filing the Kentucky Quarterly return. Generally, the return is due on the last day of the month following the end of each quarter. The quarterly periods are as follows:

- First quarter: January 1 to March 31, due by April 30

- Second quarter: April 1 to June 30, due by July 31

- Third quarter: July 1 to September 30, due by October 31

- Fourth quarter: October 1 to December 31, due by January 31

Required Documents

To successfully complete the Kentucky Quarterly return, employers should prepare the following documents:

- Employee payroll records, detailing wages paid and taxes withheld.

- Previous quarterly returns, if applicable, for reference and consistency.

- Any correspondence from the Kentucky Department of Revenue regarding tax obligations.

Form Submission Methods

Employers have various options for submitting the Kentucky Quarterly return. These methods include:

- Online submission through the Kentucky Department of Revenue’s e-filing system.

- Mailing a physical copy of the completed form to the appropriate tax office.

- In-person delivery at designated state offices, if preferred.

Quick guide on how to complete 2019 quarterly withholding form boone county ky

Complete Ky Quarterly effortlessly on any device

Web-based document management has become popular among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, enabling you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents promptly without delays. Manage Ky Quarterly on any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest method to adjust and eSign Ky Quarterly with ease

- Locate Ky Quarterly and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, invitation link, or download it to your PC.

Eliminate concerns about lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign Ky Quarterly and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 quarterly withholding form boone county ky

How to create an electronic signature for your 2019 Quarterly Withholding Form Boone County Ky online

How to create an electronic signature for the 2019 Quarterly Withholding Form Boone County Ky in Chrome

How to make an eSignature for putting it on the 2019 Quarterly Withholding Form Boone County Ky in Gmail

How to generate an eSignature for the 2019 Quarterly Withholding Form Boone County Ky right from your smartphone

How to generate an electronic signature for the 2019 Quarterly Withholding Form Boone County Ky on iOS

How to create an eSignature for the 2019 Quarterly Withholding Form Boone County Ky on Android devices

People also ask

-

What is the process for filing a 2019 ky return using airSlate SignNow?

To file your 2019 ky return using airSlate SignNow, you can easily upload your tax documents and apply electronic signatures as needed. Our platform streamlines the entire process, ensuring you can sign and send documents securely and efficiently. You can also track the status of your submissions in real-time.

-

Is airSlate SignNow free to use for preparing a 2019 ky return?

While airSlate SignNow offers various pricing plans, you can start with a free trial to explore its features for preparing your 2019 ky return. The platform offers affordable options that cater to businesses of all sizes, making it a cost-effective solution for document signing and management.

-

How does airSlate SignNow enhance the security of my 2019 ky return documents?

airSlate SignNow employs industry-standard encryption and security protocols to protect your 2019 ky return documents. Our secure servers and compliance with regulatory standards ensure that your information remains confidential and protected from unauthorized access.

-

Can I integrate airSlate SignNow with my accounting software for the 2019 ky return?

Yes, airSlate SignNow supports numerous integrations with popular accounting software, making it easier to manage your 2019 ky return. This functionality streamlines your workflow by allowing you to import data directly from your accounting system, reducing manual entry and errors.

-

What features does airSlate SignNow offer for managing my 2019 ky return?

AirSlate SignNow offers a variety of features to assist with your 2019 ky return, including electronic signatures, customizable templates, and document tracking. These features help ensure that your documents are completed accurately and promptly, improving overall efficiency in your filing process.

-

How can airSlate SignNow help me reduce the time spent on my 2019 ky return?

By utilizing airSlate SignNow, you can signNowly reduce the time spent on your 2019 ky return through its intuitive workflow automation and quick document signing features. Our platform allows for easy collaboration and communication among team members, speeding up the process of review and approval.

-

What support options does airSlate SignNow provide for questions regarding the 2019 ky return?

airSlate SignNow offers comprehensive customer support, including a knowledge base, live chat, and email support for any questions related to your 2019 ky return. Our dedicated support team is available to help you navigate any challenges you may encounter while using the platform.

Get more for Ky Quarterly

- Transcript request form with fill ins pdf

- Laverne noyes scholarship application for purdue university form

- A completed tax return fp 7c is required to record any deed deed of trust modification or form

- D 30 office of tax and revenue dc gov form

- Mony10481changeofbeneficiaryandorrightsholderowner rtf form

- Sellerpurchaser affidavit of exemption sold for removal form

- Government of the district of columbia office of form

- Franchise ampamp excise tax tennessee department of revenue form

Find out other Ky Quarterly

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now