Profit Extension Form

What is the Profit Extension

The net profit extension request is a formal application that allows businesses to extend the deadline for filing their net profit tax returns. This request is particularly relevant for businesses that may need additional time to prepare their financial documents accurately. By submitting this extension, businesses can avoid penalties associated with late filings while ensuring compliance with state tax regulations.

Steps to complete the Profit Extension

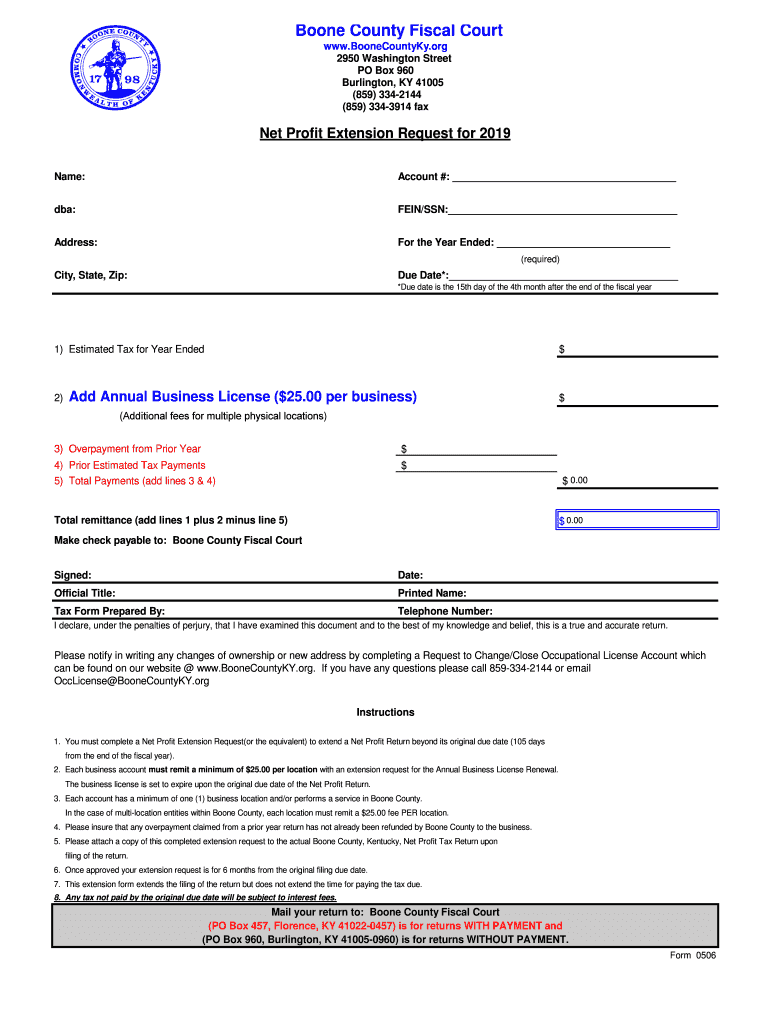

Completing the net profit extension request involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and expense reports. Next, fill out the required form, typically designated as Form 0506 for Boone County, Kentucky. Ensure that all sections are completed thoroughly, including business identification information and the reason for the extension. After reviewing the form for accuracy, submit it by the specified deadline, either online or by mail, to the appropriate tax authority.

Required Documents

When filing a net profit extension request, specific documents are essential to support your application. These typically include:

- Recent financial statements, such as profit and loss statements.

- Tax identification numbers for your business.

- Any previous tax returns that may be relevant.

- Documentation supporting the reason for the extension request.

Having these documents ready can streamline the process and ensure that your request is processed without delays.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the net profit extension request. Generally, the extension request must be submitted before the original due date of the net profit tax return. For many businesses, this date falls on the fifteenth day of the fourth month following the end of their fiscal year. Missing this deadline can result in penalties, so it is advisable to mark your calendar and prepare your documents in advance.

Legal use of the Profit Extension

The legal use of the net profit extension request is governed by state tax laws, which outline the conditions under which an extension may be granted. To be considered valid, the request must be submitted in a timely manner and should include all required information. Additionally, businesses must adhere to any stipulations set forth by the state regarding the extension period. Utilizing a reliable eSignature solution can further ensure that the submission process is secure and compliant with legal standards.

Who Issues the Form

The net profit extension request form is typically issued by the local tax authority, such as the Boone County Fiscal Court in Kentucky. This form is designed to facilitate the extension process for businesses operating within the jurisdiction. It is important to verify that you are using the correct and most current version of the form to avoid any issues during submission.

Quick guide on how to complete net profit extension request for 2019

Complete Profit Extension effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to acquire the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without any holdups. Manage Profit Extension on any platform using airSlate SignNow Android or iOS applications and streamline any document-related process today.

The most efficient way to modify and eSign Profit Extension without hassle

- Obtain Profit Extension and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize critical sections of the documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Verify the details and then click the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Alter and eSign Profit Extension and ensure excellent communication at every stage of your form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the net profit extension request for 2019

How to generate an eSignature for your Net Profit Extension Request For 2019 in the online mode

How to create an eSignature for your Net Profit Extension Request For 2019 in Google Chrome

How to create an eSignature for putting it on the Net Profit Extension Request For 2019 in Gmail

How to generate an eSignature for the Net Profit Extension Request For 2019 straight from your mobile device

How to create an eSignature for the Net Profit Extension Request For 2019 on iOS devices

How to make an eSignature for the Net Profit Extension Request For 2019 on Android OS

People also ask

-

What is a net profit extension request?

A net profit extension request is a formal application submitted to extend the deadline for submitting profit information to tax authorities. This type of request can help businesses manage their financial reporting timelines effectively. Using airSlate SignNow makes it easy to prepare and eSign your net profit extension request quickly and securely.

-

How can airSlate SignNow assist with a net profit extension request?

airSlate SignNow streamlines the process of creating and sending a net profit extension request by providing intuitive document templates and eSigning capabilities. By utilizing this platform, businesses can ensure that their requests are completed accurately and delivered on time. This efficiency minimizes the risk of delays in obtaining necessary extensions.

-

Is there a cost associated with using airSlate SignNow for net profit extension requests?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, including those who need to submit net profit extension requests. Each plan is designed to provide cost-effective solutions with features that may include unlimited signatures, document storage, and more functionality. You can choose a plan that suits your budget while ensuring compliance.

-

What features does airSlate SignNow offer for handling net profit extension requests?

Key features of airSlate SignNow for handling a net profit extension request include customizable document templates, secure eSigning, and automated workflows. These tools help streamline the submission process, making it easier for businesses to handle submissions efficiently and comply with tax regulations. Enhanced security measures also protect sensitive financial data.

-

Can I integrate airSlate SignNow with other applications for my net profit extension request?

Yes, airSlate SignNow offers integrations with various applications that can simplify the process of managing your net profit extension request. You can connect it with tools like CRM systems, cloud storage, and more to facilitate seamless document handling and collaboration. This versatility allows businesses to enhance their workflows and improve efficiency.

-

What benefits does airSlate SignNow provide for businesses making a net profit extension request?

Using airSlate SignNow for a net profit extension request offers numerous benefits, including time savings, enhanced accuracy, and reliable document tracking. Businesses can expedite their submission processes while ensuring all documents are securely signed and stored. This leads to improved compliance and peace of mind.

-

How secure is airSlate SignNow when submitting a net profit extension request?

airSlate SignNow prioritizes security, ensuring that all net profit extension requests are transmitted safely using encryption and secure storage. The platform also provides authentication features that safeguard against unauthorized access. Companies can confidently submit sensitive documents, knowing they are protected.

Get more for Profit Extension

- Form st 133cats sales tax exemption certificate capital asset

- 202109020s tax type motor vehicle document type statute form

- Form st 133cats sales tax exemption certificate capital

- Sales or use tax exemption certificatemotor vehicles form

- Sales under special conditions tn form fill out and sign

- Printable nebraska dmv data form fill online printable

- Idaho state tax exemption policies form

- Form st 108 sales tax affidavit untitled transport trailer office trailer and boat

Find out other Profit Extension

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form