Page 1 of 3 Purchase Preapproval Application Form 18 Sep

What is the Page 1 Of 3 Purchase Preapproval Application Form 18 Sep

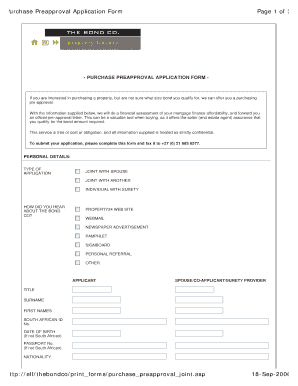

The Page 1 Of 3 Purchase Preapproval Application Form 18 Sep is a crucial document used in the home buying process. This form serves as an initial step for prospective buyers to obtain preapproval for a mortgage. By completing this form, applicants provide essential financial information to lenders, allowing them to assess creditworthiness and determine how much financing the applicant may qualify for. This preapproval can significantly enhance a buyer's position when making an offer on a property, as it indicates to sellers that the buyer is serious and financially capable.

Steps to complete the Page 1 Of 3 Purchase Preapproval Application Form 18 Sep

Completing the Page 1 Of 3 Purchase Preapproval Application Form 18 Sep involves several key steps:

- Gather financial documents: Collect necessary information such as income statements, tax returns, and details of any existing debts.

- Fill out personal information: Provide your full name, address, Social Security number, and contact details.

- Disclose financial status: Include information about your income, employment history, and assets.

- Review and verify: Ensure all information is accurate and complete before submission.

- Submit the form: Follow the specified submission method, whether online, by mail, or in person.

Key elements of the Page 1 Of 3 Purchase Preapproval Application Form 18 Sep

This form contains several key elements that are vital for the preapproval process:

- Applicant information: Personal details including name, address, and contact information.

- Income details: Information regarding current employment, salary, and other income sources.

- Debt obligations: A comprehensive list of existing debts, including credit cards, loans, and mortgages.

- Asset disclosure: Information about savings accounts, investments, and other assets that contribute to financial stability.

Eligibility Criteria

To qualify for preapproval using the Page 1 Of 3 Purchase Preapproval Application Form 18 Sep, applicants must meet specific eligibility criteria, which typically include:

- Minimum credit score: Lenders often require a certain credit score to consider an application.

- Stable income: Proof of steady employment and income is essential.

- Debt-to-income ratio: Lenders assess the ratio of monthly debt payments to gross monthly income.

- Residency status: Applicants must be legal residents of the United States.

Form Submission Methods

The Page 1 Of 3 Purchase Preapproval Application Form 18 Sep can be submitted through various methods, ensuring convenience for applicants:

- Online submission: Many lenders offer digital platforms for completing and submitting the form electronically.

- Mail: Applicants can print the completed form and send it via postal service to the lender.

- In-person submission: Some applicants may prefer to deliver the form directly to a lender's office.

Application Process & Approval Time

The application process for the Page 1 Of 3 Purchase Preapproval Application Form 18 Sep generally follows these stages:

- Submission: After completing the form, it is submitted through the chosen method.

- Review: The lender reviews the application, assessing the financial information provided.

- Approval: If approved, the lender issues a preapproval letter, detailing the amount the applicant can borrow.

- Timeframe: The approval process can vary, but many lenders provide a decision within a few days to a week.

Quick guide on how to complete page 1 of 3 purchase preapproval application form 18 sep

Complete [SKS] effortlessly on any device

Online document organization has gained traction among companies and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed papers, as you can obtain the correct form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without interruptions. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign [SKS] with ease

- Find [SKS] and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that task.

- Create your electronic signature using the Sign tool, which takes seconds and carries the same legal significance as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the woes of lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow caters to all your document management requirements in just a few clicks from any device you choose. Modify and electronically sign [SKS] and guarantee exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Page 1 Of 3 Purchase Preapproval Application Form 18 Sep

Create this form in 5 minutes!

How to create an eSignature for the page 1 of 3 purchase preapproval application form 18 sep

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Page 1 Of 3 Purchase Preapproval Application Form 18 Sep?

The Page 1 Of 3 Purchase Preapproval Application Form 18 Sep is a crucial document for individuals seeking preapproval for a purchase. This form helps streamline the application process, ensuring that all necessary information is collected efficiently. By using airSlate SignNow, you can easily fill out and eSign this form, making the process quick and hassle-free.

-

How does airSlate SignNow simplify the Page 1 Of 3 Purchase Preapproval Application Form 18 Sep?

airSlate SignNow simplifies the Page 1 Of 3 Purchase Preapproval Application Form 18 Sep by providing an intuitive interface for filling out and signing documents. Users can easily navigate through the form, ensuring that all required fields are completed accurately. This not only saves time but also reduces the likelihood of errors in the application.

-

What are the pricing options for using airSlate SignNow for the Page 1 Of 3 Purchase Preapproval Application Form 18 Sep?

airSlate SignNow offers flexible pricing plans that cater to different business needs when handling the Page 1 Of 3 Purchase Preapproval Application Form 18 Sep. Whether you are a small business or a large enterprise, you can find a plan that fits your budget. Additionally, the cost-effectiveness of airSlate SignNow makes it an attractive option for managing your document workflows.

-

What features does airSlate SignNow offer for the Page 1 Of 3 Purchase Preapproval Application Form 18 Sep?

airSlate SignNow provides a range of features for the Page 1 Of 3 Purchase Preapproval Application Form 18 Sep, including customizable templates, secure eSigning, and real-time tracking. These features enhance the user experience and ensure that your documents are handled securely and efficiently. You can also integrate with other tools to streamline your workflow further.

-

What are the benefits of using airSlate SignNow for the Page 1 Of 3 Purchase Preapproval Application Form 18 Sep?

Using airSlate SignNow for the Page 1 Of 3 Purchase Preapproval Application Form 18 Sep offers numerous benefits, including increased efficiency and reduced turnaround times. The platform allows for quick eSigning and document sharing, which accelerates the approval process. Additionally, the user-friendly interface ensures that even those unfamiliar with digital forms can navigate easily.

-

Can I integrate airSlate SignNow with other applications for the Page 1 Of 3 Purchase Preapproval Application Form 18 Sep?

Yes, airSlate SignNow supports integration with various applications, making it easy to manage the Page 1 Of 3 Purchase Preapproval Application Form 18 Sep alongside your existing tools. This integration capability allows for seamless data transfer and enhances your overall workflow. You can connect with CRM systems, cloud storage, and more to optimize your document management.

-

Is airSlate SignNow secure for handling the Page 1 Of 3 Purchase Preapproval Application Form 18 Sep?

Absolutely! airSlate SignNow prioritizes security, ensuring that the Page 1 Of 3 Purchase Preapproval Application Form 18 Sep is handled with the utmost care. The platform employs advanced encryption and security protocols to protect your sensitive information. You can trust that your documents are safe and compliant with industry standards.

Get more for Page 1 Of 3 Purchase Preapproval Application Form 18 Sep

Find out other Page 1 Of 3 Purchase Preapproval Application Form 18 Sep

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT