Ks Individual Tax Form Schedule S

What is the Kansas Individual Tax Form Schedule S

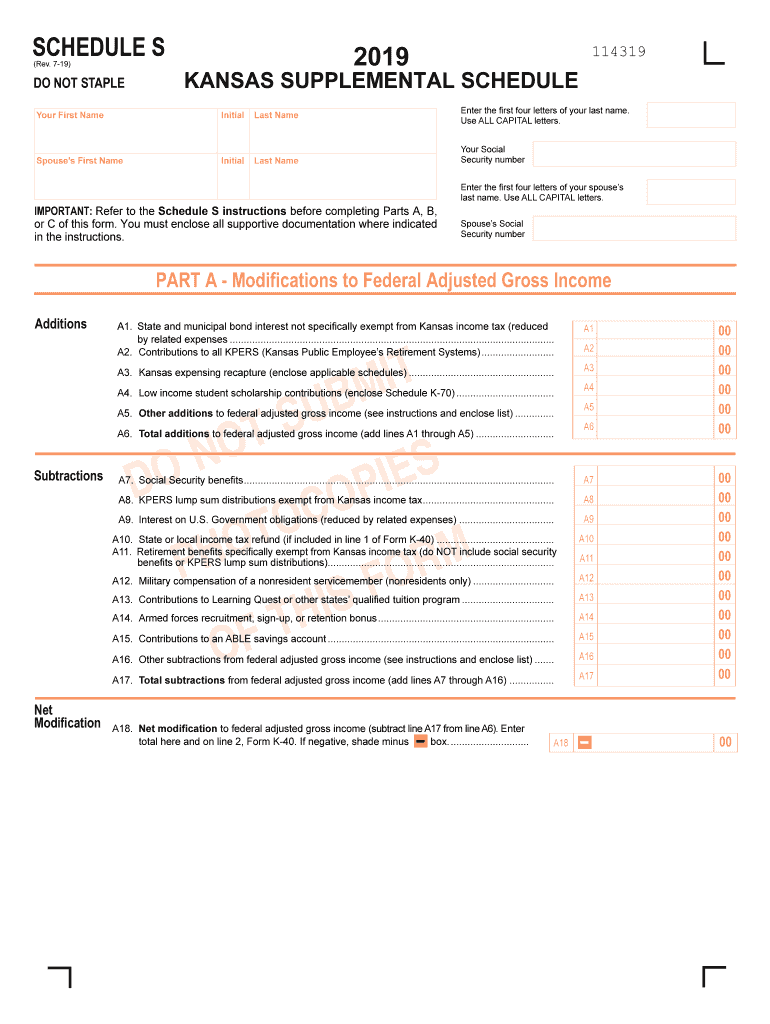

The Kansas Individual Tax Form Schedule S is a supplemental form used by residents of Kansas to report income from various sources, including partnerships, S corporations, and estates. This form is essential for accurately calculating your state income tax liability. It allows taxpayers to detail their income from these entities, ensuring compliance with Kansas tax laws. By using Schedule S, individuals can report their share of income, deductions, and credits, which may affect their overall tax obligation.

How to use the Kansas Individual Tax Form Schedule S

To effectively use the Kansas Individual Tax Form Schedule S, begin by gathering all necessary financial documents related to your income sources. This includes K-1 forms from partnerships or S corporations. Fill out the form by entering your income details, deductions, and any applicable credits as instructed. Ensure that all figures are accurate and reflect your financial situation. After completing the form, it should be attached to your Kansas Individual Income Tax Return (Form K-40) before submission.

Steps to complete the Kansas Individual Tax Form Schedule S

Completing the Kansas Individual Tax Form Schedule S involves several key steps:

- Gather all relevant documentation, including K-1 forms and other income statements.

- Begin filling out the form by entering your personal information at the top.

- Report your income from partnerships, S corporations, and estates in the designated sections.

- List any deductions or credits you are eligible for, ensuring that you have supporting documentation.

- Review your entries for accuracy, making sure all calculations are correct.

- Sign and date the form, then attach it to your K-40 return.

Legal use of the Kansas Individual Tax Form Schedule S

The Kansas Individual Tax Form Schedule S is legally valid when completed according to state regulations. It must be filled out accurately and submitted with the appropriate Kansas tax return. Electronic signatures are acceptable, provided they comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and other relevant laws. This ensures that your submission is recognized as legally binding and meets the requirements set forth by the Kansas Department of Revenue.

Filing Deadlines / Important Dates

Filing deadlines for the Kansas Individual Tax Form Schedule S align with the general tax return deadlines. Typically, individual income tax returns are due on April 15 each year. If you need additional time, you may file for an extension, which extends the deadline by six months. However, any taxes owed must still be paid by the original due date to avoid penalties and interest. Always check for any updates or changes to deadlines on the Kansas Department of Revenue website.

Form Submission Methods (Online / Mail / In-Person)

The Kansas Individual Tax Form Schedule S can be submitted through various methods to accommodate taxpayer preferences. You may choose to file electronically using approved tax software, which often simplifies the process and ensures accuracy. Alternatively, you can mail your completed form along with your K-40 return to the designated address provided by the Kansas Department of Revenue. In-person submissions are also accepted at local tax offices, where assistance may be available if needed.

Quick guide on how to complete sch s supplemental schedule rev 7 19 income tax

Effortlessly prepare Ks Individual Tax Form Schedule S on any device

Online document management has become increasingly popular among organizations and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the resources necessary to create, modify, and eSign your documents swiftly without any holdups. Manage Ks Individual Tax Form Schedule S on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Ks Individual Tax Form Schedule S with ease

- Obtain Ks Individual Tax Form Schedule S and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes only a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Select your preferred method to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new copies of documents. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your choice. Adjust and eSign Ks Individual Tax Form Schedule S and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sch s supplemental schedule rev 7 19 income tax

How to make an eSignature for your Sch S Supplemental Schedule Rev 7 19 Income Tax in the online mode

How to create an electronic signature for the Sch S Supplemental Schedule Rev 7 19 Income Tax in Chrome

How to create an eSignature for signing the Sch S Supplemental Schedule Rev 7 19 Income Tax in Gmail

How to generate an eSignature for the Sch S Supplemental Schedule Rev 7 19 Income Tax from your mobile device

How to create an eSignature for the Sch S Supplemental Schedule Rev 7 19 Income Tax on iOS devices

How to make an eSignature for the Sch S Supplemental Schedule Rev 7 19 Income Tax on Android

People also ask

-

What are Kansas Schedule S instructions?

Kansas Schedule S instructions refer to the guidelines provided by the Kansas Department of Revenue for reporting the income and expenses of partnerships, S corporations, and similar entities. By understanding these instructions, businesses can ensure they meet their tax obligations accurately and efficiently.

-

How can airSlate SignNow assist with Kansas Schedule S instructions?

airSlate SignNow offers a streamlined solution for businesses to send and eSign important documents like Kansas Schedule S instructions. This ensures that your tax documents are handled securely and efficiently, making the process simpler for you and your partners.

-

Are there any costs associated with using airSlate SignNow for Kansas Schedule S instructions?

AirSlate SignNow provides a cost-effective solution for managing your Kansas Schedule S instructions. Pricing plans vary, but they typically include features that streamline document management and eSigning, making it a valuable investment for your tax preparation needs.

-

What features does airSlate SignNow offer for handling Kansas Schedule S instructions?

airSlate SignNow includes features such as customizable templates, electronic signatures, and secure document storage, specifically tailored to simplify your Kansas Schedule S instructions. These functionalities enhance collaboration among team members and ensure compliance throughout your documentation process.

-

Can airSlate SignNow integrate with other software to facilitate Kansas Schedule S instructions?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax preparation software, making it easier to manage your Kansas Schedule S instructions. This integration helps streamline workflows and ensures that your financial data is synced across platforms for accuracy.

-

What are the benefits of using airSlate SignNow for Kansas Schedule S instructions?

Using airSlate SignNow for Kansas Schedule S instructions offers numerous benefits, including time savings, improved accuracy, and enhanced security. It enables businesses to efficiently manage their tax documentation while ensuring compliance with the state's requirements.

-

Is airSlate SignNow suitable for small businesses handling Kansas Schedule S instructions?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small enterprises managing Kansas Schedule S instructions. Its user-friendly interface and affordable pricing make it an ideal choice for small businesses looking to simplify their document management.

Get more for Ks Individual Tax Form Schedule S

- Employment application city of ashland fire department form

- Charter township of emmett department of public safety form

- South haven area emergency services authority form

- Www graylingjellystone compdfsprint jellystonejellystone park grayling pre employment application form

- Application for employment lyon township fire department form

- Iowa direct care worker registry form

- City of clinton job announcement mta part time fixed route form

- Region 1 job order pdf iowa workforce development iowaworkforce form

Find out other Ks Individual Tax Form Schedule S

- How To eSign Maine Church Directory Form

- How To eSign New Hampshire Church Donation Giving Form

- eSign North Dakota Award Nomination Form Free

- eSignature Mississippi Demand for Extension of Payment Date Secure

- Can I eSign Oklahoma Online Donation Form

- How Can I Electronic signature North Dakota Claim

- How Do I eSignature Virginia Notice to Stop Credit Charge

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple