Form 8863

What is the Form 8863

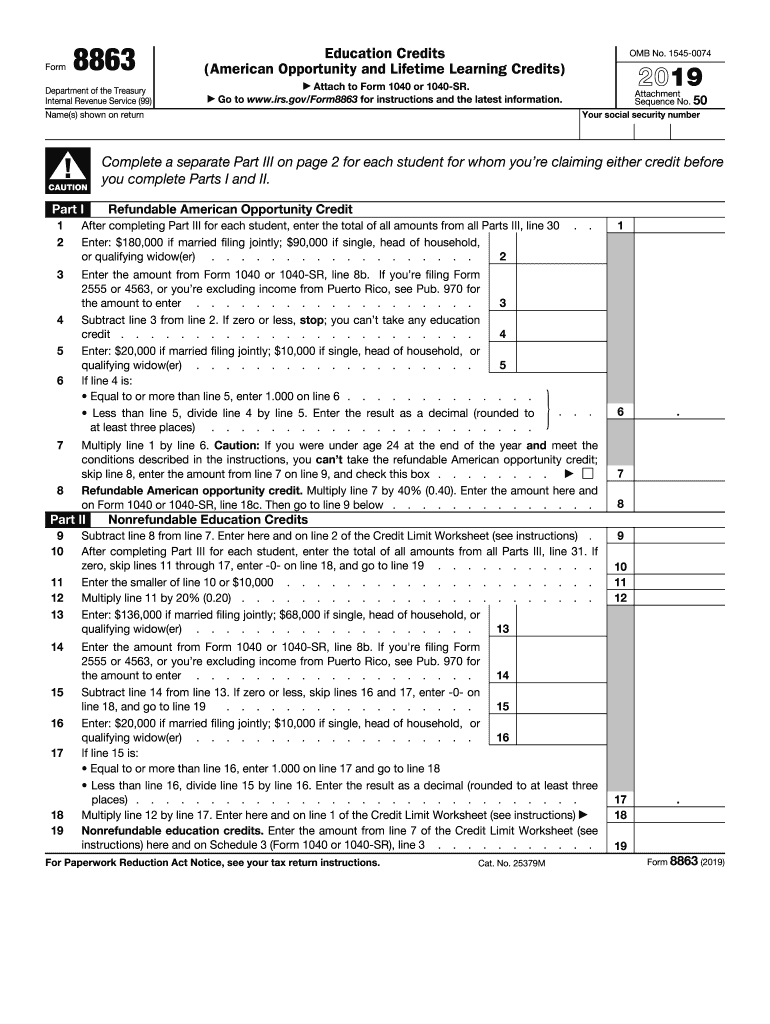

The IRS Form 8863 is used to claim education credits for qualified tuition and related expenses. These credits can help reduce the amount of tax owed, making education more affordable for students and their families. The form specifically addresses the American Opportunity Credit and the Lifetime Learning Credit, which are designed to assist taxpayers in offsetting the costs associated with higher education.

How to use the Form 8863

To use the Form 8863, you must first determine your eligibility for the education credits it offers. Gather all necessary documentation, including Form 1098-T, which provides information on tuition payments made. Complete the form by providing your personal information, detailing your educational expenses, and calculating the credits you qualify for. Once completed, the form should be submitted with your tax return.

Steps to complete the Form 8863

Completing the Form 8863 involves several key steps:

- Gather necessary documents, including Form 1098-T and any receipts for qualified expenses.

- Fill out your personal information at the top of the form.

- Calculate the amount of qualified expenses for the credits you are claiming.

- Complete the sections for the American Opportunity Credit and/or Lifetime Learning Credit as applicable.

- Transfer the total credits to your tax return.

Legal use of the Form 8863

The legal use of the Form 8863 is governed by IRS regulations. To ensure compliance, taxpayers must accurately report their education expenses and only claim credits for eligible costs. It is important to keep records of all relevant documentation, as the IRS may request proof of expenses during an audit. Using a reliable eSignature platform like signNow can facilitate the signing and submission of tax documents while ensuring compliance with legal standards.

Eligibility Criteria

To be eligible for the credits claimed on Form 8863, taxpayers must meet specific criteria. For the American Opportunity Credit, the student must be enrolled at least half-time in a degree or certificate program and not have completed four years of higher education. The Lifetime Learning Credit is available for students enrolled in eligible courses, regardless of their enrollment status. Income limits also apply, which may affect the amount of credit you can claim.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8863 align with the general tax filing deadlines. Typically, individual tax returns must be filed by April fifteenth of the following year. If you need additional time, you may file for an extension, but any taxes owed must still be paid by the original deadline to avoid penalties. It's essential to keep track of these dates to ensure timely submission of your tax documents.

Quick guide on how to complete f8863 form 8863 department of the treasury internal revenue

Effortlessly Prepare Form 8863 on Any Device

Managing documents online has gained traction among companies and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed papers, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, revise, and electronically sign your documents promptly without interruptions. Access Form 8863 from any device with the airSlate SignNow Android or iOS applications and enhance any document-focused procedure today.

The Easiest Method to Edit and Electronically Sign Form 8863 Seamlessly

- Locate Form 8863 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed for this purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form 8863 to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the f8863 form 8863 department of the treasury internal revenue

How to create an eSignature for your F8863 Form 8863 Department Of The Treasury Internal Revenue online

How to make an eSignature for your F8863 Form 8863 Department Of The Treasury Internal Revenue in Chrome

How to create an electronic signature for putting it on the F8863 Form 8863 Department Of The Treasury Internal Revenue in Gmail

How to generate an electronic signature for the F8863 Form 8863 Department Of The Treasury Internal Revenue straight from your smartphone

How to create an eSignature for the F8863 Form 8863 Department Of The Treasury Internal Revenue on iOS devices

How to make an eSignature for the F8863 Form 8863 Department Of The Treasury Internal Revenue on Android devices

People also ask

-

What features does airSlate SignNow offer for tax filing 2019?

airSlate SignNow provides a range of features that streamline your tax filing 2019 process. Users can easily create, send, and eSign documents, ensuring compliance and accuracy. The platform allows for document templates, making it efficient for repeated tax forms required for filing.

-

How can airSlate SignNow help with document organization during tax filing 2019?

With airSlate SignNow, users can organize all necessary documents for tax filing 2019 in one place. Our robust filing system allows you to categorize and label documents, ensuring you have easy access to everything needed for accurate submission. This reduces the likelihood of errors in your tax reporting process.

-

Is airSlate SignNow a cost-effective solution for tax filing 2019?

Yes, airSlate SignNow is designed to be a cost-effective solution for tax filing 2019. It minimizes printing costs and facilitates faster document turnaround times, which can save businesses money. With flexible pricing plans, you can choose one that fits your budget while accessing all essential features.

-

What integrations does airSlate SignNow offer that benefit tax filing 2019?

airSlate SignNow seamlessly integrates with popular accounting and tax software, which is incredibly beneficial for tax filing 2019. These integrations allow you to pull and push data directly between platforms, eliminating manual data entry and reducing errors. It's a convenient way to stay organized and efficient during tax season.

-

Can airSlate SignNow assist with international tax filing 2019?

Yes, airSlate SignNow can assist with international tax filing 2019 through its easy-to-use eSignature capabilities and compliance features. By streamlining document handling and ensuring secure signatures from anywhere in the world, users can adhere to various international tax regulations. This flexibility is essential for businesses operating globally.

-

How secure is my data with airSlate SignNow for tax filing 2019?

The security of your data is a top priority at airSlate SignNow, especially during tax filing 2019. The platform employs advanced encryption and authentication techniques to protect your sensitive information. This ensures that your documents remain confidential and secure throughout the tax filing process.

-

What customer support options are available for airSlate SignNow users during tax filing 2019?

airSlate SignNow offers extensive customer support options to assist you during tax filing 2019. Users have access to live chat, email support, and a comprehensive knowledge base filled with FAQs and tutorials. Our dedicated support team is ready to help you with any issues or questions you might encounter.

Get more for Form 8863

- Www honeycreekfire com uploads 126honey creek department of fire and rescue services incorporated form

- Payroll client employee set up form pdf steven brewer

- Employer s contribution quarterly adjustment report form

- Law enforcementtelecommunications form

- School bus inc form

- City of clatskanie application for employment form

- Polk county fire district no 1career opportunitiespolk county fire district no 1 form

- Www salary comklamath falls ormedical billing specialist salary in klamath falls or form

Find out other Form 8863

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word