Form 720

What is the Form 720

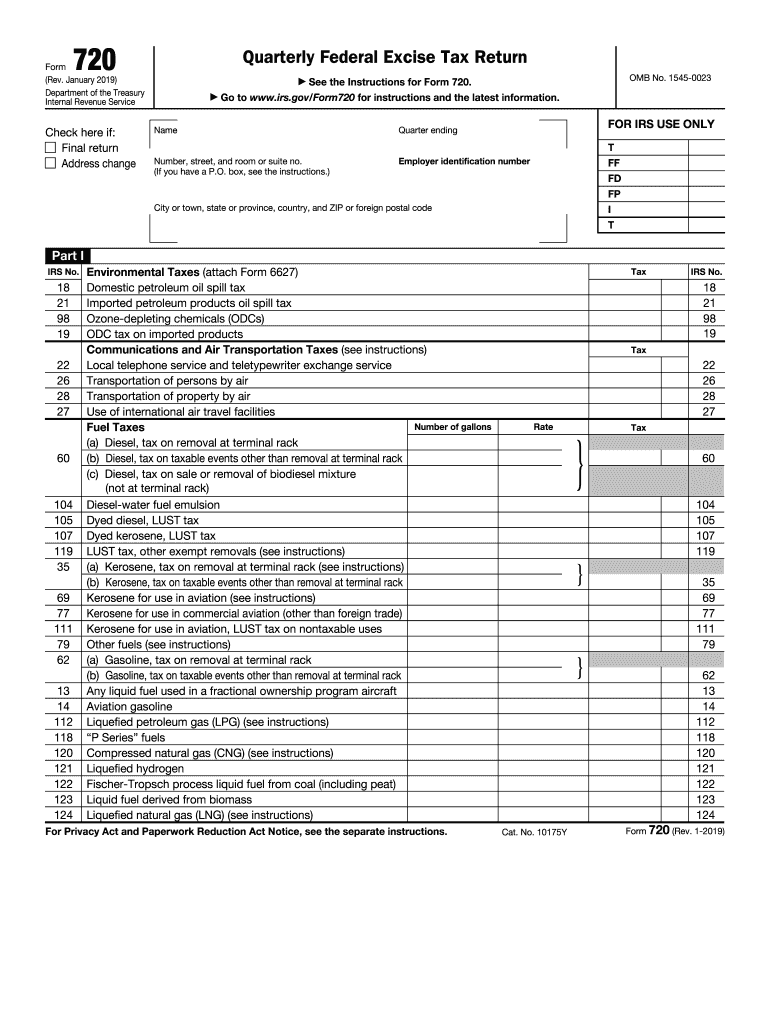

The 720 form for 2019 is an IRS document used to report and pay federal excise taxes. This form is primarily utilized by businesses that engage in activities subject to excise taxes, such as the sale of certain goods or services. It includes various sections that require detailed information about the taxable activities and the corresponding amounts owed. Understanding the purpose of this form is essential for compliance with federal tax regulations.

How to use the Form 720

Using the 720 form involves a systematic approach to ensure accurate reporting of excise taxes. First, identify the specific excise tax liabilities applicable to your business. Next, gather all necessary financial records and documentation that support your tax calculations. The form is divided into several parts, each addressing different types of excise taxes. Complete each section carefully, ensuring that all figures are accurate and that you include any applicable credits or adjustments. Finally, submit the form according to IRS guidelines, either electronically or via mail.

Steps to complete the Form 720

Completing the 720 form for 2019 requires attention to detail and adherence to IRS instructions. Follow these steps:

- Gather all relevant financial documents, including sales records and previous tax returns.

- Review the instructions for the 720 form to understand the requirements for each section.

- Fill out the form, ensuring that you accurately report all taxable activities and amounts owed.

- Double-check your calculations and ensure that all necessary signatures are included.

- Submit the completed form by the designated deadline to avoid penalties.

Legal use of the Form 720

The legal use of the 720 form is governed by federal tax laws. It is crucial that businesses use this form to report their excise tax liabilities accurately. Failure to do so can result in penalties, interest, and potential audits by the IRS. The form must be completed in compliance with the Internal Revenue Code and any related regulations. Using electronic signatures through a trusted platform can enhance the legal validity of the submitted documents.

Filing Deadlines / Important Dates

Filing deadlines for the 720 form are critical to avoid penalties. Generally, the form must be filed quarterly, with specific due dates for each quarter. For the 2019 tax year, the deadlines are as follows:

- First quarter: April 30

- Second quarter: July 31

- Third quarter: October 31

- Fourth quarter: January 31 of the following year

It is important to mark these dates on your calendar and ensure timely submission to maintain compliance with IRS regulations.

Form Submission Methods (Online / Mail / In-Person)

The 720 form can be submitted through various methods, providing flexibility for businesses. Options include:

- Online submission: Many businesses choose to file electronically through the IRS e-file system, which offers faster processing times.

- Mail: The form can be printed and mailed to the appropriate IRS address, depending on your location and the specific type of excise tax being reported.

- In-person: Some businesses may opt to deliver their forms directly to an IRS office, although this is less common.

Choosing the right submission method can help streamline the filing process and ensure compliance.

Quick guide on how to complete about form 720 xinternal revenue service irsgov

Complete Form 720 effortlessly on any gadget

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-conscious substitute for conventional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Form 720 on any gadget with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Form 720 seamlessly

- Find Form 720 and click Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal authority as a traditional wet ink signature.

- Review all the data and click on the Done button to save your modifications.

- Select how you would like to share your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your needs in document management in just a few clicks from any device you prefer. Modify and eSign Form 720 and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the about form 720 xinternal revenue service irsgov

How to generate an electronic signature for your About Form 720 Xinternal Revenue Service Irsgov online

How to create an electronic signature for your About Form 720 Xinternal Revenue Service Irsgov in Chrome

How to generate an electronic signature for signing the About Form 720 Xinternal Revenue Service Irsgov in Gmail

How to make an electronic signature for the About Form 720 Xinternal Revenue Service Irsgov from your smart phone

How to create an electronic signature for the About Form 720 Xinternal Revenue Service Irsgov on iOS

How to generate an eSignature for the About Form 720 Xinternal Revenue Service Irsgov on Android OS

People also ask

-

What is the form 720 2019 and why do I need it?

The form 720 2019 is a tax form used by businesses to report and pay federal excise taxes. Understanding its requirements is essential for compliance with IRS regulations, ensuring that your business doesn't face penalties. Utilizing tools like airSlate SignNow can simplify the eSigning process, making it easier to manage your documentation.

-

How can airSlate SignNow help me with the form 720 2019?

airSlate SignNow streamlines the eSigning of the form 720 2019, making it easy to send, review, and sign documents online. With its user-friendly interface, you can ensure that your filings are completed efficiently and securely. This helps save time and reduces the likelihood of errors in your submissions.

-

What features does airSlate SignNow offer for handling the form 720 2019?

airSlate SignNow offers features such as automated workflows, customizable templates, and audit trails specifically designed to assist with forms like the form 720 2019. These features enhance the accuracy and speed of your document handling, allowing you to focus on your business instead of paperwork. Additionally, real-time collaboration tools streamline communication between team members when completing tax forms.

-

Is there a cost associated with using airSlate SignNow for the form 720 2019?

Yes, there is a subscription cost for using airSlate SignNow, but it is a cost-effective solution compared to traditional methods. The pricing may vary based on the features you choose and the number of users in your organization. Investing in airSlate SignNow ensures that you have a reliable tool for efficiently managing documents like the form 720 2019 while saving time and resources.

-

Can I integrate airSlate SignNow with other software for the form 720 2019?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, enhancing your workflow when handling the form 720 2019. This means you can connect it with CRM systems, document management platforms, and more, allowing for a unified approach to document handling and eSigning.

-

What are the benefits of using airSlate SignNow for the form 720 2019?

Some benefits of using airSlate SignNow for the form 720 2019 include increased efficiency, reduced time spent on document processes, and enhanced security regarding sensitive tax information. Additionally, it allows for easy tracking of document statuses and ensures compliance, making it an invaluable tool for businesses managing their tax forms.

-

Is airSlate SignNow compliant with federal regulations for the form 720 2019?

Yes, airSlate SignNow is designed to comply with federal regulations for handling documents, including the form 720 2019. The platform implements various security measures to protect user data and maintain compliance with industry standards. You can confidently use airSlate SignNow knowing that it adheres to regulatory guidelines.

Get more for Form 720

- Rhode island employment town form

- Declaration form 609342238

- Ls 119 labor standards complaint form

- Employment application mukwonago fire department form

- Ucb 12 work search action log this form may be used to document your work search actions for a week

- 621 n form

- Department of workforce development workers compen form

- Department of workforce development wisconsin forms jobs

Find out other Form 720

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile