1040x Form

What is the 1040X?

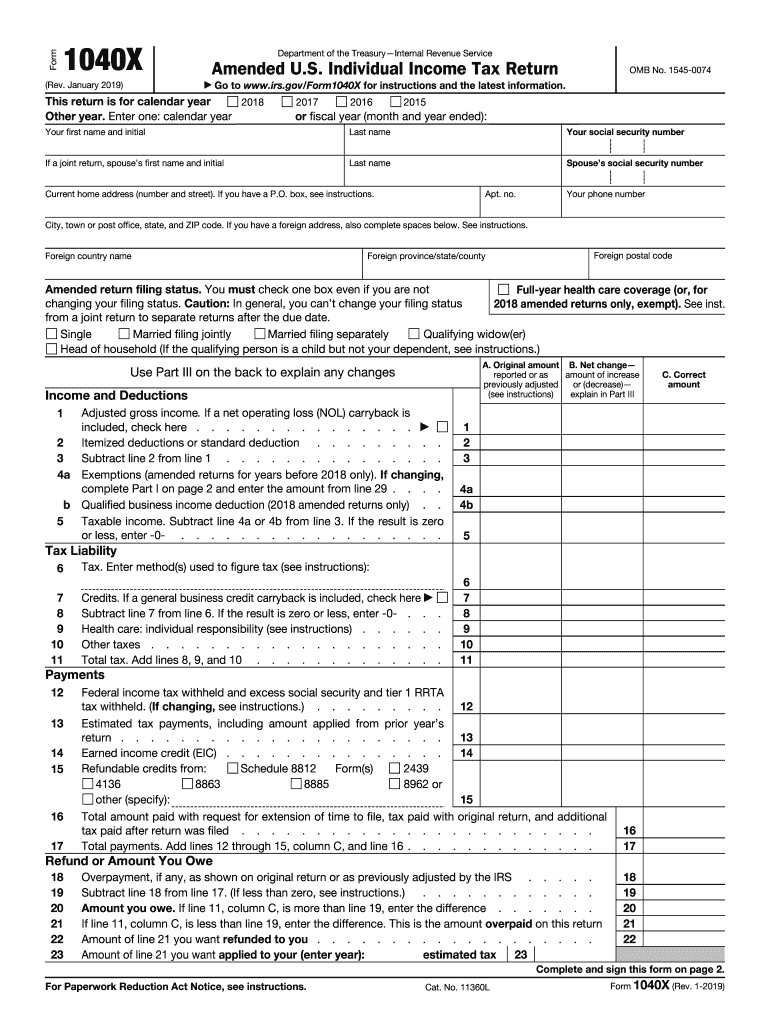

The 1040X is the official form used to amend a previously filed federal tax return. Taxpayers may need to file this form to correct errors or make changes to their original return, such as updating income, deductions, or filing status. The 2019 amended tax return allows individuals to ensure their tax records are accurate and compliant with IRS regulations. The form is specifically designed for tax years prior to the current year, making it essential for those looking to amend their 2019 tax filings.

Steps to Complete the 1040X

Completing the 1040X involves several important steps to ensure accuracy and compliance. First, gather all relevant documents, including your original 2019 tax return and any supporting documentation for the changes you are making. Next, fill out the 1040X form, clearly indicating the changes in the appropriate sections. Provide explanations for each amendment in the designated area. After completing the form, review it for accuracy and ensure all necessary signatures are included. Finally, submit the amended return to the IRS, either electronically or by mail, depending on your preference and eligibility.

How to Obtain the 1040X

The 1040X form is readily available for taxpayers who need to amend their returns. You can obtain the form directly from the IRS website, where it can be downloaded as a printable document. Additionally, many tax preparation software programs include the 1040X, allowing users to fill it out electronically. This accessibility makes it easier for individuals to amend their 2019 tax returns without unnecessary delays.

IRS Guidelines

The IRS provides specific guidelines for filing the 1040X, which are crucial for ensuring compliance. Taxpayers must file the amended return within three years of the original filing date or within two years of paying the tax owed, whichever is later. The IRS also recommends that taxpayers clearly indicate the tax year being amended at the top of the form. Following these guidelines helps to avoid potential penalties and ensures that the amendments are processed efficiently.

Form Submission Methods

Taxpayers have several options for submitting the 1040X. The form can be filed electronically using approved tax software, which often streamlines the process and provides immediate confirmation of submission. Alternatively, individuals may choose to print the completed form and mail it to the appropriate IRS address. It is important to check the IRS website for the correct mailing address, as it may vary based on the taxpayer's location and whether a refund is expected.

Required Documents

When filing the 1040X, taxpayers should have specific documents on hand to support their amendments. This includes a copy of the original 2019 tax return, any W-2s or 1099s that pertain to the income being amended, and documentation for any new deductions or credits being claimed. Having these documents ready will facilitate a smoother filing process and help ensure that all changes are accurately reported.

Penalties for Non-Compliance

Failing to comply with IRS regulations when filing an amended return can result in penalties. If the amendments lead to an increase in tax liability, taxpayers may owe additional taxes along with interest on the unpaid amount. Additionally, failing to file the 1040X within the required timeframe can result in the loss of potential refunds or credits. It is essential to adhere to IRS guidelines to avoid these consequences and ensure that tax records remain in good standing.

Quick guide on how to complete form 1040x rev january 2019 amended us individual income tax return

Easily Prepare 1040x on Any Device

Managing documents online has become increasingly popular among companies and individuals. It provides a flawless eco-conscious alternative to conventional printed and signed papers, allowing you to locate the right template and securely keep it online. airSlate SignNow offers all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle 1040x on any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The Easiest Way to Modify and eSign 1040x Effortlessly

- Locate 1040x and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Mark important sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign feature, which only takes a few seconds and holds the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to store your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to the computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and eSign 1040x and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1040x rev january 2019 amended us individual income tax return

How to create an electronic signature for the Form 1040x Rev January 2019 Amended Us Individual Income Tax Return in the online mode

How to make an electronic signature for the Form 1040x Rev January 2019 Amended Us Individual Income Tax Return in Google Chrome

How to create an electronic signature for signing the Form 1040x Rev January 2019 Amended Us Individual Income Tax Return in Gmail

How to generate an electronic signature for the Form 1040x Rev January 2019 Amended Us Individual Income Tax Return straight from your mobile device

How to generate an eSignature for the Form 1040x Rev January 2019 Amended Us Individual Income Tax Return on iOS devices

How to generate an eSignature for the Form 1040x Rev January 2019 Amended Us Individual Income Tax Return on Android OS

People also ask

-

What is the 2019 x pricing structure for airSlate SignNow?

The 2019 x pricing structure for airSlate SignNow offers various tiers designed to fit different business needs. You can choose from a free trial to see if it meets your requirements before committing to a monthly or yearly plan. This flexibility allows you to select a plan that aligns with your budget and usage.

-

What features does the 2019 x version of airSlate SignNow include?

The 2019 x version of airSlate SignNow comes packed with features like customizable templates, advanced security options, and multi-party signing. These tools make it easy to manage documents efficiently, helping to streamline your workflow. With the 2019 x version, you can ensure that your document signing process is secure and hassle-free.

-

How can airSlate SignNow help improve my business efficiency in 2019 x?

Using airSlate SignNow in the 2019 x version can signNowly improve business efficiency by simplifying the document signing process. It allows for quick eSigning, automatic reminders, and tracking, which helps reduce delays. This means your team can focus more on core activities, ultimately driving productivity.

-

Does airSlate SignNow offer integrations in the 2019 x version?

Yes, the 2019 x version of airSlate SignNow includes various integrations with popular applications like Google Drive, Dropbox, and Salesforce. These integrations enhance your workflow, allowing you to manage documents directly from your favorite tools. By utilizing these integrations, you can make the most out of your 2019 x experience.

-

Is airSlate SignNow compliant with legal eSignature standards in the 2019 x model?

Absolutely! The 2019 x model of airSlate SignNow complies with legal eSignature standards such as ESIGN and UETA. This means that all documents signed using the platform are legally binding, providing peace of mind when executing transactions. Compliance with these standards is crucial for maintaining trust and security in your business dealings.

-

Can I access airSlate SignNow from mobile devices in the 2019 x setup?

Yes, the 2019 x setup of airSlate SignNow is fully optimized for mobile devices. This allows users to send and eSign documents on-the-go, making it convenient for busy professionals. The mobile accessibility ensures that you can manage your document workflow anytime, anywhere.

-

What are the benefits of using mail merge with airSlate SignNow in the 2019 x version?

Utilizing mail merge with airSlate SignNow in the 2019 x version allows you to create personalized documents quickly. It saves time and reduces manual entry errors by automatically filling in client information. This feature is particularly beneficial for businesses that send bulk documents, enhancing efficiency and accuracy.

Get more for 1040x

Find out other 1040x

- Can I eSign Louisiana Car Dealer Quitclaim Deed

- eSign Michigan Car Dealer Operating Agreement Mobile

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple