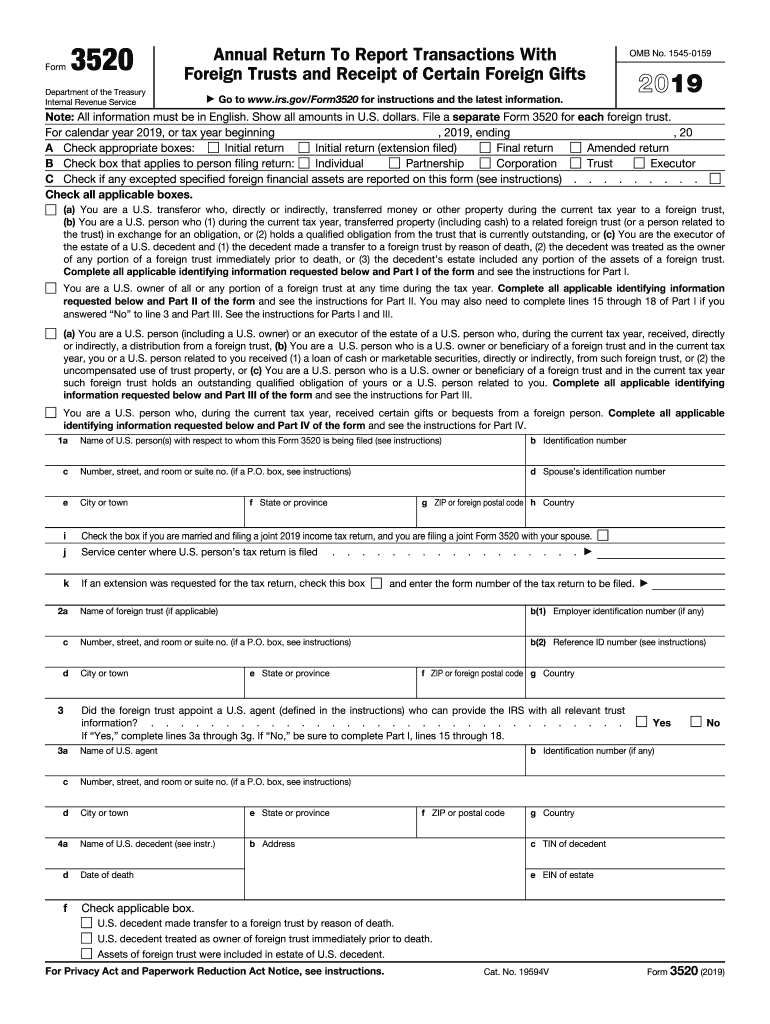

Irs Form 3520

What is the IRS Form 3520?

The IRS Form 3520 is a tax form used by U.S. taxpayers to report certain transactions with foreign trusts, as well as the receipt of certain foreign gifts. This form is essential for individuals who have foreign financial interests or receive gifts from foreign individuals or entities. Filing this form ensures compliance with U.S. tax laws and helps avoid potential penalties related to underreporting foreign income or assets.

Steps to Complete the IRS Form 3520

Completing the IRS Form 3520 requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including details about foreign trusts and gifts received.

- Fill out the form accurately, ensuring that all required sections are completed.

- Report any foreign gifts received, including the name and address of the donor.

- Include information about any foreign trusts, such as the trust's name, address, and taxpayer identification number.

- Review the completed form for accuracy before submission.

Legal Use of the IRS Form 3520

The IRS Form 3520 serves a critical legal function in U.S. tax compliance. It is legally required for individuals who engage with foreign trusts or receive substantial gifts from foreign sources. Failure to file this form can result in significant penalties, making it essential for individuals to understand their obligations under U.S. tax law. The form also helps the IRS track foreign financial activities, ensuring transparency and compliance.

Filing Deadlines / Important Dates

Timely filing of the IRS Form 3520 is crucial to avoid penalties. The form is typically due on the same date as your federal income tax return, which is usually April 15. However, if you file for an extension on your tax return, the deadline for Form 3520 will also be extended. It is important to keep track of these dates to ensure compliance and avoid potential fines.

Required Documents

When preparing to file the IRS Form 3520, gather the following documents:

- Records of any foreign gifts received, including the donor's information.

- Documentation related to foreign trusts, such as trust agreements and identification numbers.

- Previous tax returns that may provide context for your current filing.

Who Must File Form 3520?

U.S. citizens and residents who receive gifts from foreign individuals or entities exceeding a certain threshold must file the IRS Form 3520. Additionally, individuals who are grantors or beneficiaries of foreign trusts are also required to file this form. Understanding who must file is essential to ensure compliance with IRS regulations and avoid penalties.

Quick guide on how to complete about form 3520 annual return to report transactions with

Manage Irs Form 3520 effortlessly on any device

Digital document handling has gained traction among businesses and individuals. It serves as an excellent eco-conscious alternative to traditional printed and signed documents, enabling you to access the right template and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents promptly without interruptions. Manage Irs Form 3520 on any device using the airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

How to modify and eSign Irs Form 3520 easily

- Obtain Irs Form 3520 and then click Get Form to commence.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the woes of lost or overlooked files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Edit and eSign Irs Form 3520 and guarantee outstanding communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the about form 3520 annual return to report transactions with

How to create an eSignature for your About Form 3520 Annual Return To Report Transactions With in the online mode

How to create an eSignature for your About Form 3520 Annual Return To Report Transactions With in Google Chrome

How to generate an electronic signature for signing the About Form 3520 Annual Return To Report Transactions With in Gmail

How to make an electronic signature for the About Form 3520 Annual Return To Report Transactions With right from your smartphone

How to create an electronic signature for the About Form 3520 Annual Return To Report Transactions With on iOS devices

How to create an eSignature for the About Form 3520 Annual Return To Report Transactions With on Android devices

People also ask

-

What is IRS Form 3520 and why do I need it?

IRS Form 3520 is an important tax document that U.S. taxpayers must file to report certain transactions with foreign trusts, as well as the receipt of foreign gifts. If you have foreign accounts or investments, it's crucial to understand how to properly complete IRS Form 3520 to avoid penalties.

-

How can airSlate SignNow help me with IRS Form 3520?

airSlate SignNow provides an easy-to-use platform for managing your IRS Form 3520 documentation. With our electronic signature capabilities, you can securely sign and send your documents, ensuring compliance and efficiency in the filing process.

-

Is there a cost to use airSlate SignNow for IRS Form 3520?

Yes, airSlate SignNow offers various pricing plans tailored to suit different business needs. You can choose a plan that allows you to efficiently manage and eSign IRS Form 3520 and other important documents without breaking the bank.

-

What features does airSlate SignNow offer for IRS Form 3520 preparation?

With airSlate SignNow, you can enjoy features like customizable templates, secure eSigning, and real-time document tracking that streamline the IRS Form 3520 preparation process. These tools help ensure that you can fill out and submit your forms accurately and on time.

-

Can I integrate airSlate SignNow with other software for IRS Form 3520?

Absolutely! airSlate SignNow offers integrations with various applications like Google Drive, Dropbox, and CRM systems, which can help you seamlessly manage your IRS Form 3520 within your existing workflows. This integration simplifies the process of gathering and submitting necessary documents.

-

What are the benefits of using airSlate SignNow for IRS Form 3520 filings?

Using airSlate SignNow for your IRS Form 3520 filings provides several benefits, including increased efficiency, reduced errors, and enhanced security. Our platform ensures that your documents are handled securely, making the filing process worry-free.

-

How secure is airSlate SignNow when handling IRS Form 3520?

airSlate SignNow prioritizes security, using advanced encryption and compliance measures to protect your sensitive information, including IRS Form 3520. You can trust our platform to keep your data safe while you manage your important tax documents.

Get more for Irs Form 3520

Find out other Irs Form 3520

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format