Changecorrection in PAN Data Tax Zone Form

Understanding the Changecorrection In PAN Data Tax Zone

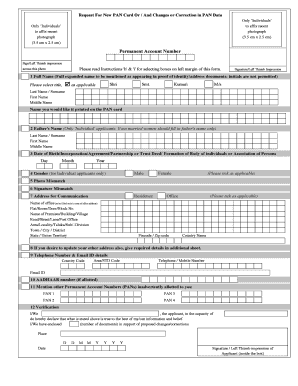

The Changecorrection In PAN Data Tax Zone refers to the process of correcting inaccuracies in the Permanent Account Number (PAN) data associated with tax filings. This correction is essential for ensuring that taxpayers are accurately identified and that their tax obligations are correctly calculated. The PAN serves as a unique identifier for individuals and entities in the U.S. tax system, making it crucial for compliance with tax laws.

Steps to Complete the Changecorrection In PAN Data Tax Zone

To effectively complete the Changecorrection In PAN Data Tax Zone, follow these steps:

- Gather necessary documentation, including your current PAN details and any supporting evidence for the correction.

- Access the appropriate tax form or online portal designated for PAN corrections.

- Fill out the form accurately, ensuring all information is current and reflects the necessary changes.

- Submit the form either online, by mail, or in person, depending on the submission method available.

- Retain a copy of the submitted form and any confirmation received for your records.

Required Documents for Changecorrection In PAN Data Tax Zone

When initiating a Changecorrection In PAN Data Tax Zone, it is important to prepare the following documents:

- Your current PAN card or any official identification that includes your PAN.

- Proof of the changes you are requesting, such as marriage certificates or court orders for name changes.

- Any previous tax returns that may support your correction request.

- A completed correction form as specified by the tax authority.

Legal Use of the Changecorrection In PAN Data Tax Zone

The legal use of the Changecorrection In PAN Data Tax Zone is crucial for maintaining compliance with U.S. tax regulations. Accurate PAN data ensures that individuals and businesses are properly taxed and that their tax records are maintained correctly. Failure to correct inaccurate PAN data can lead to penalties, audits, or other legal complications.

IRS Guidelines for Changecorrection In PAN Data Tax Zone

The Internal Revenue Service (IRS) provides specific guidelines for making corrections to PAN data. Taxpayers must adhere to these guidelines to ensure their corrections are processed efficiently. This includes submitting the correct forms, providing adequate documentation, and following the prescribed timelines for corrections. Familiarizing yourself with these guidelines can help prevent delays and complications in the correction process.

Examples of Using the Changecorrection In PAN Data Tax Zone

Examples of scenarios where the Changecorrection In PAN Data Tax Zone may be necessary include:

- A name change due to marriage or divorce that needs to be reflected in tax records.

- Address changes that may affect the taxpayer's residency status and tax obligations.

- Corrections to date of birth or other identifying information that was previously submitted incorrectly.

Quick guide on how to complete changecorrection in pan data tax zone

Complete [SKS] effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents quickly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

The simplest method to modify and eSign [SKS] with ease

- Find [SKS] and click Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow furnishes specifically for this purpose.

- Create your eSignature using the Sign tool, which takes moments and holds the same legal validity as a traditional handwritten signature.

- Verify the information and click the Done button to save your modifications.

- Select your preferred method of sharing your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searches, or errors that require printing new copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you choose. Edit and eSign [SKS] and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Changecorrection In PAN Data Tax Zone

Create this form in 5 minutes!

How to create an eSignature for the changecorrection in pan data tax zone

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Changecorrection In PAN Data Tax Zone?

Changecorrection In PAN Data Tax Zone refers to the process of updating and correcting Permanent Account Number (PAN) data within the specified tax zone. This ensures that your tax records are accurate and compliant with regulations, which is crucial for businesses and individuals alike.

-

How can airSlate SignNow assist with Changecorrection In PAN Data Tax Zone?

airSlate SignNow provides a streamlined platform for managing documents related to Changecorrection In PAN Data Tax Zone. With our eSigning capabilities, you can easily send, sign, and store necessary documents securely, ensuring a hassle-free experience.

-

What are the pricing options for using airSlate SignNow for Changecorrection In PAN Data Tax Zone?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including those focused on Changecorrection In PAN Data Tax Zone. You can choose from monthly or annual subscriptions, with options that scale based on the number of users and features required.

-

Are there any specific features in airSlate SignNow for Changecorrection In PAN Data Tax Zone?

Yes, airSlate SignNow includes features specifically designed to facilitate Changecorrection In PAN Data Tax Zone, such as customizable templates, automated workflows, and secure document storage. These features help streamline the correction process and enhance efficiency.

-

What benefits does airSlate SignNow provide for managing Changecorrection In PAN Data Tax Zone?

Using airSlate SignNow for Changecorrection In PAN Data Tax Zone offers numerous benefits, including improved accuracy in document handling, reduced turnaround times, and enhanced compliance with tax regulations. Our platform simplifies the entire process, making it easier for businesses to manage their tax data.

-

Can airSlate SignNow integrate with other tools for Changecorrection In PAN Data Tax Zone?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications, allowing you to enhance your workflow for Changecorrection In PAN Data Tax Zone. This integration capability ensures that you can connect with your existing systems for a more efficient document management process.

-

Is airSlate SignNow secure for handling Changecorrection In PAN Data Tax Zone documents?

Yes, airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your documents related to Changecorrection In PAN Data Tax Zone. You can trust that your sensitive information is safe while using our platform.

Get more for Changecorrection In PAN Data Tax Zone

Find out other Changecorrection In PAN Data Tax Zone

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online