1120 Form with M 3

What is the 1120 Form With M 3

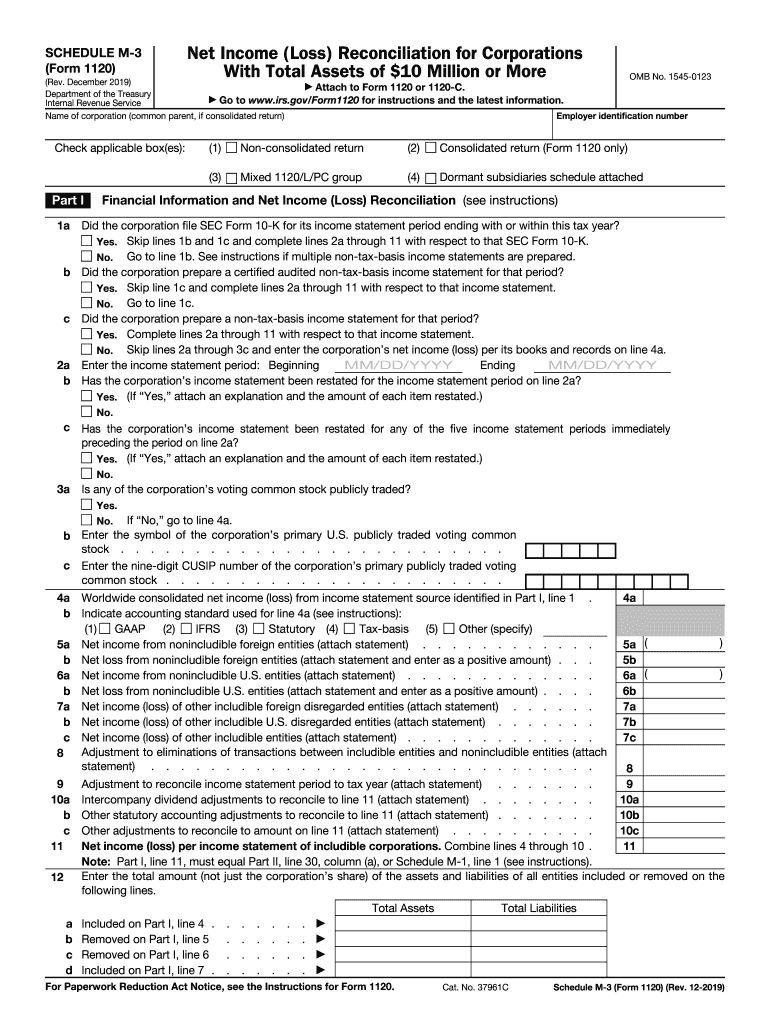

The 1120 Form With M 3, also known as IRS Form 1120 Schedule M-3, is a crucial tax document used by corporations to report their financial information to the Internal Revenue Service (IRS). This form is specifically designed for corporations with total assets of ten million dollars or more. It provides a detailed reconciliation of financial income and taxable income, allowing the IRS to better understand the differences between book income and taxable income. The Schedule M-3 is an essential component of the overall Form 1120, which is the U.S. Corporation Income Tax Return.

How to use the 1120 Form With M 3

To effectively use the 1120 Form With M 3, corporations must first gather their financial statements, including balance sheets and income statements. The form requires detailed information about the corporation's income, deductions, and credits. Corporations should carefully complete each section of the form, ensuring that all figures are accurate and consistent with their financial records. Additionally, it is important to follow the IRS instructions for the form to ensure compliance and avoid potential penalties.

Steps to complete the 1120 Form With M 3

Completing the 1120 Form With M 3 involves several key steps:

- Gather all necessary financial documents, including income statements and balance sheets.

- Fill out the basic information section of the 1120 Form, including the corporation's name, address, and Employer Identification Number (EIN).

- Complete the Schedule M-3 section, detailing the reconciliation of financial income to taxable income.

- Review all entries for accuracy, ensuring that all figures are consistent with the corporation's financial records.

- Sign and date the form before submission.

Legal use of the 1120 Form With M 3

The legal use of the 1120 Form With M 3 is governed by IRS regulations. Corporations are required to file this form if they meet specific criteria, such as having total assets of ten million dollars or more. Filing the form accurately and on time is essential to avoid penalties and ensure compliance with federal tax laws. Additionally, corporations must retain copies of their completed forms for their records, as they may be required for future audits or inquiries by the IRS.

Filing Deadlines / Important Dates

The filing deadlines for the 1120 Form With M 3 typically align with the general deadlines for corporate tax returns. Corporations must file their returns by the fifteenth day of the fourth month following the end of their tax year. For most corporations operating on a calendar year, this means the deadline is April fifteenth. However, if the due date falls on a weekend or holiday, the deadline may be extended to the next business day. Corporations should also be aware of any potential extensions that can be filed to allow for additional time to complete their tax returns.

Form Submission Methods (Online / Mail / In-Person)

Corporations have several options for submitting the 1120 Form With M 3 to the IRS. The form can be filed electronically using IRS-approved e-filing software, which is often the fastest and most efficient method. Alternatively, corporations can choose to mail a paper copy of the form to the appropriate IRS address based on their location. In-person submission is generally not available for this form, as the IRS does not accept walk-in filings for corporate tax returns. It is important for corporations to ensure that they send their forms to the correct address and to keep records of their submissions for future reference.

Quick guide on how to complete completing schedule m 3 internal revenue service

Effortlessly Prepare 1120 Form With M 3 on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Handle 1120 Form With M 3 on any platform using the airSlate SignNow Android or iOS applications and enhance your document-focused operations today.

The Easiest Way to Modify and eSign 1120 Form With M 3 with Ease

- Acquire 1120 Form With M 3 and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign tool, which takes just seconds and has the same legal validity as a conventional ink signature.

- Review all of the information and then click the Done button to save your updates.

- Choose your preferred method to deliver your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tiring searches for forms, or errors that necessitate printing additional document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Modify and eSign 1120 Form With M 3 to ensure excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the completing schedule m 3 internal revenue service

How to make an electronic signature for the Completing Schedule M 3 Internal Revenue Service online

How to generate an eSignature for your Completing Schedule M 3 Internal Revenue Service in Google Chrome

How to generate an electronic signature for signing the Completing Schedule M 3 Internal Revenue Service in Gmail

How to generate an electronic signature for the Completing Schedule M 3 Internal Revenue Service right from your smartphone

How to create an electronic signature for the Completing Schedule M 3 Internal Revenue Service on iOS devices

How to create an electronic signature for the Completing Schedule M 3 Internal Revenue Service on Android devices

People also ask

-

What is the 1120 schedule m pdf used for?

The 1120 Schedule M PDF is used by corporations to reconcile book income to taxable income. This form helps ensure that any differences between financial records and tax returns are clearly communicated and justified. Properly filling out the 1120 Schedule M PDF is essential for accurate tax reporting.

-

How can airSlate SignNow help with filling out the 1120 schedule m pdf?

airSlate SignNow provides an intuitive platform for electronically signing and managing your 1120 Schedule M PDF documents. Our solution streamlines the process, allowing you to fill out, sign, and send your forms securely. This saves time and eliminates errors in your tax preparation.

-

What are the pricing options for using airSlate SignNow for the 1120 schedule m pdf?

airSlate SignNow offers flexible pricing plans that cater to different business needs, ensuring you can efficiently manage your 1120 Schedule M PDF documents. Subscriptions typically start with a monthly plan ideal for small businesses and scale to enterprise solutions. You can choose a plan that best fits your frequency and volume of document signing.

-

Are there features in airSlate SignNow specifically designed for tax documents like the 1120 schedule m pdf?

Yes, airSlate SignNow includes features tailored for tax documents, including templates, document routing, and automated reminders. These tools help you manage your 1120 Schedule M PDF more efficiently, ensuring all necessary signatures are obtained on time. This improves accuracy and facilitates compliance.

-

Is airSlate SignNow compliant with security standards for handling documents like the 1120 schedule m pdf?

Absolutely! airSlate SignNow implements robust security measures to protect your sensitive documents, including the 1120 Schedule M PDF. With features like encryption, multi-factor authentication, and audit trails, you can trust that your tax information is safe and compliant with industry standards.

-

Can I integrate airSlate SignNow with other software to manage the 1120 schedule m pdf?

Yes, airSlate SignNow offers seamless integration with various accounting and productivity software that can enhance your workflow for managing the 1120 Schedule M PDF. This allows for a more streamlined approach to document handling, enabling easy transfers of data and smoother collaboration.

-

What are the benefits of using airSlate SignNow for the 1120 schedule m pdf over traditional methods?

Using airSlate SignNow for your 1120 Schedule M PDF provides several advantages over traditional methods, including increased efficiency, reduced paper usage, and faster turnaround times. The electronic process minimizes delays and errors associated with mail or physical signatures, allowing you to focus on your business.

Get more for 1120 Form With M 3

- Imm 5373e form

- Fhcs housing counseling program disclosure form generic image fairhousingakron

- 2092 contingency for sale and closing of buyers property v10 04 sampleqxp contact attorneys deskbook form

- Colorado power of attorney template form

- D 4 dc withholding allowance worksheet d 4 dc withholding form

- Claim for disability support pension sa466 form

- Clean contract template form

- Clean employee contract template form

Find out other 1120 Form With M 3

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure