1120s Form 2017

What is the 1120S Form

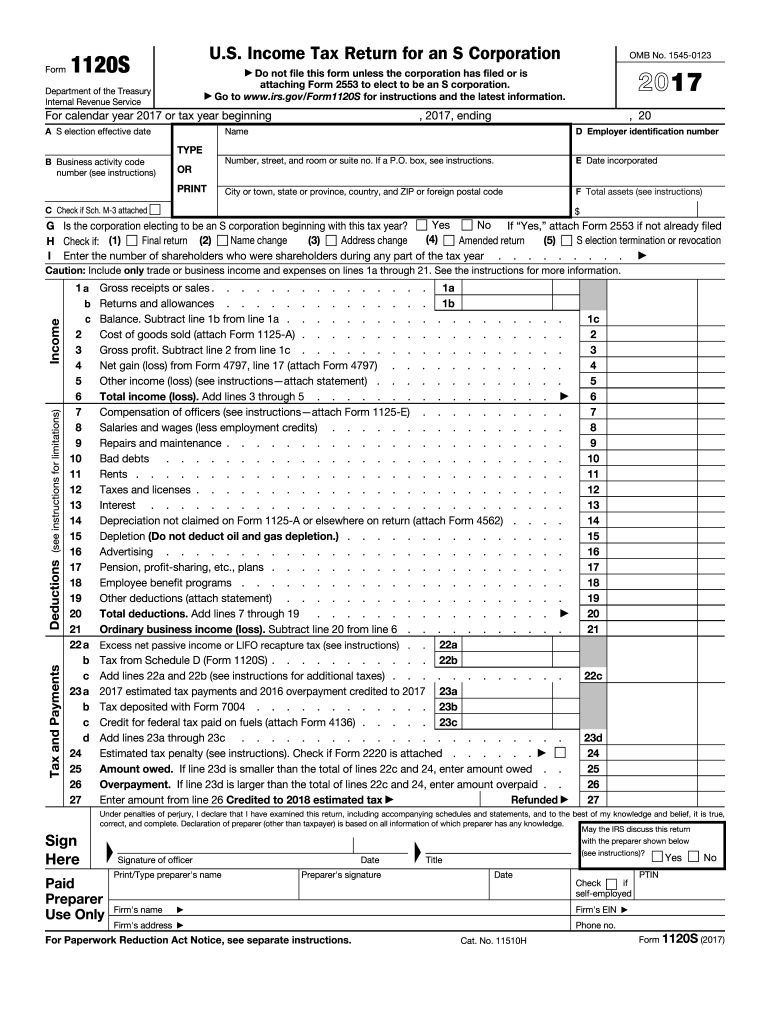

The 1120S Form is a tax document used by S corporations to report income, deductions, and credits. This form is essential for S corporations as it allows them to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes. The information provided on the 1120S Form is crucial for determining each shareholder's tax liability based on their ownership percentage in the corporation.

Steps to Complete the 1120S Form

Completing the 1120S Form involves several key steps to ensure accuracy and compliance with IRS regulations:

- Gather necessary financial documents, including income statements, balance sheets, and previous tax returns.

- Fill out the general information section, including the corporation's name, address, and Employer Identification Number (EIN).

- Report income by detailing all sources of revenue and any deductions applicable to the corporation.

- Complete the tax and payments section, indicating any federal taxes owed.

- Provide signatures from authorized individuals, ensuring all contact information is included for follow-up.

How to Obtain the 1120S Form

The 1120S Form can be easily obtained from the IRS website or through tax preparation software. It is available in a downloadable PDF format, making it accessible for printing and completing by hand. Additionally, many tax professionals can provide the form as part of their services, ensuring that it is filled out correctly and submitted on time.

Key Elements of the 1120S Form

Several key elements must be included when completing the 1120S Form:

- General Information: This includes the corporation's name, address, and EIN.

- Income Reporting: All sources of income must be itemized, including sales, dividends, and interest.

- Deductions: A detailed account of all deductions, such as operating expenses and losses, must be provided.

- Shareholder Information: Each shareholder's ownership percentage and corresponding income must be reported.

Filing Deadlines / Important Dates

Filing the 1120S Form is subject to specific deadlines that must be adhered to in order to avoid penalties:

- The form is typically due on the fifteenth day of the third month following the end of the corporation's tax year.

- If the corporation operates on a calendar year, the deadline is March 15.

- Extensions can be requested, allowing an additional six months to file, but any taxes owed must still be paid by the original deadline.

IRS Guidelines

The IRS provides specific guidelines for completing and filing the 1120S Form. It is essential to follow these guidelines to ensure compliance and avoid potential issues:

- Ensure all information is accurate and complete to prevent delays in processing.

- Review the instructions provided by the IRS for any updates or changes to the form.

- Consult with a tax professional if there are uncertainties regarding the completion or submission of the form.

Quick guide on how to complete 1120s 2017 2018 form

Discover the simplest method to complete and endorse your 1120s Form

Are you still expending time preparing your official documents on paper instead of doing it online? airSlate SignNow presents a superior approach to complete and endorse your 1120s Form and associated forms for public services. Our intelligent electronic signature solution provides you with all the resources necessary to manage paperwork efficiently and in compliance with official standards - comprehensive PDF editing, organizing, securing, signing, and sharing tools all available within an intuitive interface.

Only a few steps are needed to finalize the completion and endorsement of your 1120s Form:

- Load the fillable template into the editor using the Get Form button.

- Review what details you need to input in your 1120s Form.

- Navigate through the fields using the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the fields with your details.

- Update the content with Text boxes or Images from the top toolbar.

- Emphasize what is important or Obscure sections that are no longer relevant.

- Click on Sign to create a legally effective electronic signature using any method you prefer.

- Insert the Date beside your signature and conclude your task with the Done button.

Store your completed 1120s Form in the Documents section of your profile, download it, or send it to your preferred cloud storage. Our solution also enables versatile form sharing. There’s no requirement to print your forms when you need to submit them to the appropriate public office - do it via email, fax, or by selecting a USPS “snail mail” delivery from your account. Try it today!

Create this form in 5 minutes or less

Find and fill out the correct 1120s 2017 2018 form

FAQs

-

How do I fill out the NTSE form 2017- 2018 Jharkhand online?

You cannot gove NTSE online or at your own level you have to belong to a school which is conducting ntse. Then download the form online from the page of ntse, fill it and submit it to your school along with fee. If your school is not conducting ntse, sorry to say but you cannot give ntse. It can only be given through, no institutions are allowed to conduct thos exam.

-

What is the link of the official website to fill out the IBPS RRB 2017-2018 form?

Hello,The notification of IBPS RRB 2017–18 is soon going to be announce by the Officials.With this news, the candidates are now looking for the official links to apply for the IBPS RRB Exam and the complete Step by step procedure of how to apply online.The link of Official website to apply is given below:Welcome to IBPS ::Below are the steps to apply online for the exam.Firstly, visit the official link mentioned above.After click on the link ‘CWE RRB’ at the left side of the page.As soon as the official sources will release the IBPS RRB Notification 2017, the candidates will be able to see another link ‘Common Written Examination – Regional Rural Banks Phase VI’ on the page.After clicking on this link, you can start your IBPS RRB Online Application process.Enter all the required details and upload scanned photographs and signature to proceed with the registration process.After entering all these details, candidates will get a registration number and password through which they can login anytime and make changes in IBPS RRB Online Application.For the final submission, fee payment is required.Application Fee for Officer Scale (I, II & III) and Office Assistant – INR 100 for ST/SC/PWD Candidates and INR 600 for all others.The payment can be made by using Debit Cards (RuPay/ Visa/ MasterCard/ Maestro), Credit Cards, Internet Banking, IMPS, Cash Cards/ Mobile Wallets by providing information as asked on the screen.8. Check all the details before you finally submit the form.9. Take a print out of the form for future use.Hope the above information is useful for you!Thankyou!

-

Can we fill out the NEET application form (2018) in general after filling in SC (2017)?

Yes, you may do so. The details of the previous year shall not be carried forward in the current year. However, it can only be confirmed once the application form will be released.

-

Is it possible for me to fill out the CMA foundation form now for Dec 2017 and appear in June 2018?

Get full detail information about cma foundation registration from the following link. cma foundation registration process

-

If I was unable to fill SSC Cgl 2017, can I fill SSC Cgl 2018 form?

Don’t wait till the last date, apply your form well in advance. If still you are unable to fill your form, you may fill in 2018.

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

Create this form in 5 minutes!

How to create an eSignature for the 1120s 2017 2018 form

How to generate an electronic signature for your 1120s 2017 2018 Form in the online mode

How to create an electronic signature for the 1120s 2017 2018 Form in Chrome

How to generate an eSignature for signing the 1120s 2017 2018 Form in Gmail

How to generate an electronic signature for the 1120s 2017 2018 Form from your mobile device

How to make an eSignature for the 1120s 2017 2018 Form on iOS

How to make an eSignature for the 1120s 2017 2018 Form on Android

People also ask

-

What is the 1120s Form used for?

The 1120s Form is used by S corporations to report income, deductions, and credits to the IRS. This form is essential for S corporations to accurately file their tax returns and determine their tax obligations. Understanding how to properly complete the 1120s Form can help businesses maximize their tax benefits.

-

How can airSlate SignNow help with the 1120s Form?

airSlate SignNow simplifies the process of signing and sending the 1120s Form electronically. With its user-friendly interface, you can quickly gather signatures from all necessary parties, ensuring compliance and reducing processing times. This streamlines your tax filing process, making it more efficient and less stressful.

-

What are the pricing options for using airSlate SignNow for the 1120s Form?

airSlate SignNow offers flexible pricing plans that cater to various business needs, making it an affordable solution for managing the 1120s Form. You can choose from monthly or annual subscriptions, which provide access to features designed specifically for document signing and management. Explore the pricing page for detailed options and features included with each plan.

-

Is airSlate SignNow secure for signing the 1120s Form?

Yes, airSlate SignNow prioritizes the security of your documents, including the 1120s Form. The platform employs advanced encryption protocols and complies with industry standards to ensure that your sensitive information remains protected. You can confidently eSign and send your 1120s Form without worrying about data bsignNowes.

-

Can I integrate airSlate SignNow with other software for my 1120s Form?

Absolutely! airSlate SignNow offers seamless integrations with a variety of popular business applications, allowing you to enhance your workflow when managing the 1120s Form. Whether you use CRM systems, accounting software, or cloud storage solutions, you can easily connect them to streamline your document processes.

-

What features does airSlate SignNow offer for the 1120s Form?

airSlate SignNow provides a range of features that can be particularly beneficial for handling the 1120s Form. These include customizable templates, automated workflows, and real-time tracking of document status. With these tools, you can ensure that the signing process is efficient and organized.

-

How does airSlate SignNow improve the efficiency of filing the 1120s Form?

Using airSlate SignNow enhances the efficiency of filing the 1120s Form by eliminating the need for physical paperwork and in-person signatures. The platform allows for quick electronic signing and document sharing, which signNowly reduces turnaround time. This means you can file your 1120s Form faster and focus on other critical aspects of your business.

Get more for 1120s Form

- 740 x 2016 2018 form

- 5500sf form 2018

- 2017 irs h form

- Irs 3520 2018 form

- 2017 ohio sd 100 school district income tax return form

- Instructions for form 6251

- Instructions for form 990 pf instructions for form 990 pf return of private foundation or section 4947a1 trust treated as 794685434

- Do not staple or attach this voucher to your payment or your return form

Find out other 1120s Form

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online