Irs Form 943

What is the IRS Form 943?

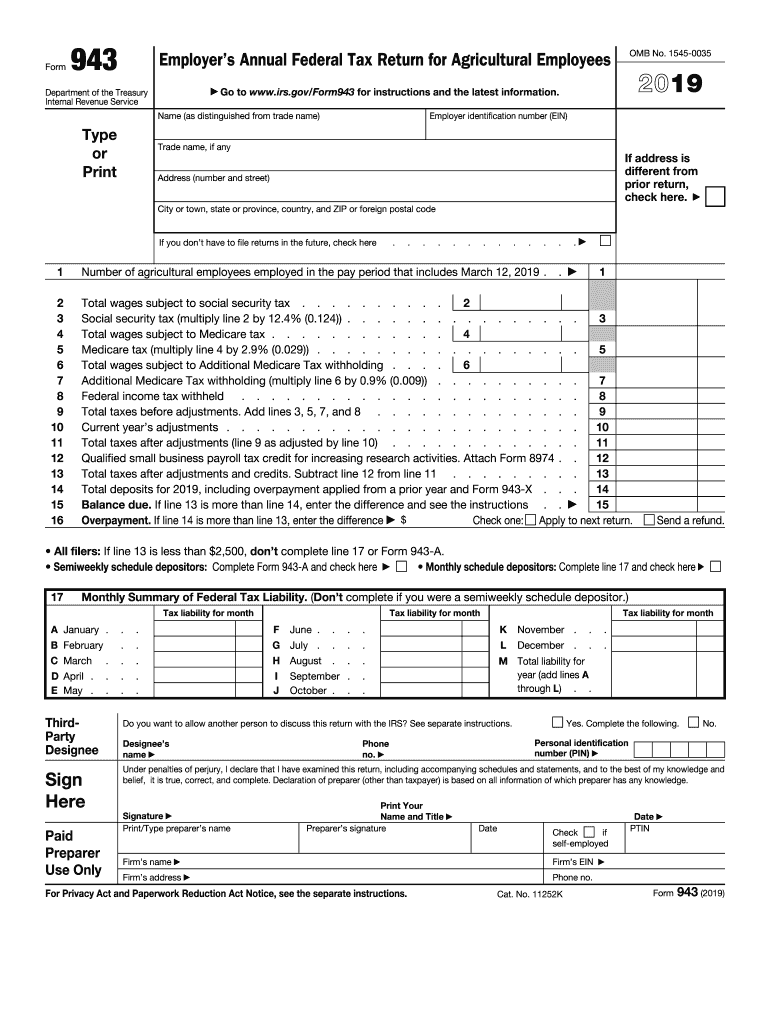

The IRS Form 943 is a tax form specifically designed for agricultural employers in the United States. It is used to report income tax withheld from employees who work in agricultural sectors. The form is essential for employers who pay wages to farmworkers and need to comply with federal tax regulations. The 943 form covers various aspects of employment taxes, including social security and Medicare taxes, ensuring that agricultural businesses fulfill their tax obligations accurately.

How to Use the IRS Form 943

Using the IRS Form 943 involves several key steps that ensure compliance with tax regulations. First, employers must gather necessary information about their employees, including names, social security numbers, and wages paid. Next, the form requires detailed reporting of the total wages paid and the amount of federal income tax withheld. Employers must also calculate the social security and Medicare taxes owed. After completing the form, it must be submitted to the IRS by the designated deadline to avoid penalties.

Steps to Complete the IRS Form 943

Completing the IRS Form 943 requires careful attention to detail. Follow these steps:

- Gather employee information, including names and social security numbers.

- Calculate total wages paid to each employee throughout the year.

- Determine the federal income tax withheld from each employee's wages.

- Calculate the total social security and Medicare taxes owed.

- Fill out the form accurately, ensuring all calculations are correct.

- Review the form for any errors before submission.

- Submit the completed form to the IRS by the specified deadline.

Filing Deadlines / Important Dates

It is crucial for employers to be aware of the filing deadlines associated with the IRS Form 943. The form must be submitted annually, typically by January thirty-first of the following year. Employers should also keep track of any changes in deadlines that may occur due to holidays or other factors. Timely submission helps avoid penalties and ensures compliance with federal tax regulations.

Legal Use of the IRS Form 943

The IRS Form 943 is legally binding when completed and submitted according to IRS guidelines. Employers must ensure that the information provided is accurate and truthful, as discrepancies can lead to audits or penalties. Utilizing a reliable platform for electronic submission can enhance the legal validity of the form, as it often includes features such as digital signatures and secure data transmission, ensuring compliance with eSignature regulations.

Required Documents

To complete the IRS Form 943, employers need several documents and pieces of information, including:

- Employee records, including names and social security numbers.

- Payroll records that detail wages paid to employees.

- Documentation of federal income tax withheld from employee wages.

- Records of social security and Medicare taxes calculated.

Having these documents readily available streamlines the completion process and helps ensure accuracy.

Quick guide on how to complete 6 printable 943 form templates fillable samples in pdf

Complete Irs Form 943 effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed documents, as you can obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the resources you require to create, edit, and eSign your documents swiftly without setbacks. Manage Irs Form 943 on any platform with airSlate SignNow Android or iOS applications and enhance any document-focused operation today.

The simplest method to edit and eSign Irs Form 943 effortlessly

- Locate Irs Form 943 and click Get Form to initiate.

- Employ the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal value as a traditional handwritten signature.

- Verify the details and then click on the Done button to save your changes.

- Choose how you wish to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Irs Form 943 and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 6 printable 943 form templates fillable samples in pdf

How to make an eSignature for your 6 Printable 943 Form Templates Fillable Samples In Pdf in the online mode

How to create an eSignature for the 6 Printable 943 Form Templates Fillable Samples In Pdf in Chrome

How to create an electronic signature for signing the 6 Printable 943 Form Templates Fillable Samples In Pdf in Gmail

How to create an eSignature for the 6 Printable 943 Form Templates Fillable Samples In Pdf straight from your smartphone

How to create an eSignature for the 6 Printable 943 Form Templates Fillable Samples In Pdf on iOS

How to generate an eSignature for the 6 Printable 943 Form Templates Fillable Samples In Pdf on Android devices

People also ask

-

What is 2019 943 and how does it relate to airSlate SignNow?

The term '2019 943' refers to the guidelines and tax forms that many businesses encounter each year. AirSlate SignNow facilitates the signing and sending of these important documents seamlessly, ensuring compliance with the 2019 943 regulations. This makes it easier for businesses to manage tax-related paperwork.

-

How can airSlate SignNow help with the 2019 943 form?

AirSlate SignNow simplifies the process of completing and eSigning the 2019 943 form by providing an intuitive platform. Users can easily upload, fill out, and send the form to relevant parties for signature, ensuring that important deadlines are met without hassle.

-

Is airSlate SignNow cost-effective for handling 2019 943 forms?

Absolutely! AirSlate SignNow offers various pricing plans designed to provide value to businesses of all sizes. By opting for this solution, companies can save on printing, mailing, and storage costs associated with the 2019 943 and other essential documents.

-

What features does airSlate SignNow offer for managing 2019 943 documents?

AirSlate SignNow includes features such as customizable templates, real-time tracking, and audit trails that are particularly useful for managing 2019 943 documents. These tools help ensure that every signing process is secure, efficient, and compliant with the necessary regulations.

-

Can I integrate airSlate SignNow with other tools for 2019 943 management?

Yes, airSlate SignNow offers seamless integrations with various business tools and applications. This allows users to manage their workflow effectively when handling the 2019 943 form, consolidating processes for easier document management and collaboration.

-

What security measures does airSlate SignNow have in place for 2019 943 forms?

Security is a top priority at airSlate SignNow, especially when handling sensitive documents like the 2019 943 form. The platform provides advanced encryption, user authentication, and a secure environment to protect your documents and personal information during the signing process.

-

How intuitive is the airSlate SignNow platform for signing 2019 943 documents?

The airSlate SignNow platform is designed with user-friendliness in mind, making it intuitive for individuals to navigate. Even those with limited technical expertise can easily complete and eSign the 2019 943 forms without any complications.

Get more for Irs Form 943

- Convert pdf to word online for form

- Thequotresidencequot form

- Sheriffs night out set for july 29community form

- Bureau of motor vehicles eye examination form

- State of new mexico uniform crash report instruction manual

- Vehicle service affidavit form

- Ignition interlock program vehicle service affidavit r 621 washington state patrol impaired driving section form

- Mv3598 form

Find out other Irs Form 943

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF