8879 Form Irs

What is the 8879 Form Irs

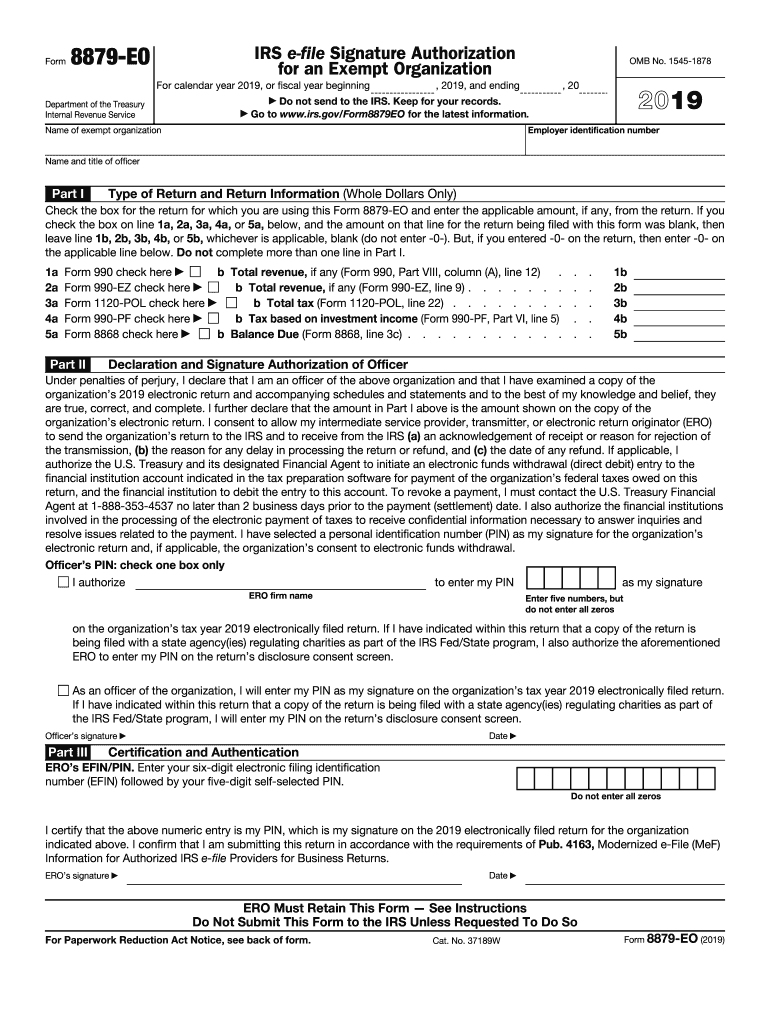

The 8879 form, officially known as the IRS e-file Signature Authorization, is a crucial document for taxpayers who file their returns electronically. This form allows taxpayers to authorize an electronic return originator (ERO) to submit their tax return on their behalf. It serves as a signature substitute, ensuring that the IRS has the necessary approval to process the electronic filing. The 8879 form is particularly important for individuals and businesses that utilize tax preparation software or services, as it streamlines the filing process while maintaining compliance with IRS regulations.

How to use the 8879 Form Irs

To effectively use the 8879 form, taxpayers need to follow a straightforward process. First, ensure that all necessary information is accurately filled out, including personal details and the tax return data. Once completed, the taxpayer must sign the form, which can be done electronically using a trusted eSignature solution. After signing, the form is submitted to the ERO, who will then use it to e-file the tax return with the IRS. It is essential to keep a copy of the signed 8879 form for personal records, as it serves as proof of authorization for the electronic submission.

Steps to complete the 8879 Form Irs

Completing the 8879 form involves several key steps:

- Gather all necessary tax documents, including income statements and deductions.

- Fill out the personal information section, ensuring accuracy in names and Social Security numbers.

- Input the tax return information, including the amount of tax owed or refund expected.

- Review the completed form for any errors or omissions.

- Sign the form electronically or manually, depending on the method used for filing.

- Submit the signed form to your ERO, who will then e-file your tax return with the IRS.

Legal use of the 8879 Form Irs

The legal use of the 8879 form is governed by IRS regulations that stipulate its role as a signature substitute for electronic filings. For the form to be legally binding, it must be completed accurately and signed by the taxpayer. The use of a reliable eSignature tool ensures compliance with the Electronic Signatures in Global and National Commerce (ESIGN) Act, which validates electronic signatures in legal contexts. Additionally, maintaining records of the signed form is vital for addressing any future inquiries or audits by the IRS.

Key elements of the 8879 Form Irs

Several key elements make up the 8879 form, which include:

- Taxpayer Information: This section includes the taxpayer's name, Social Security number, and address.

- Tax Return Data: Details about the tax return being filed, such as the total income and tax liability.

- Signature Section: A space for the taxpayer's signature and date, confirming authorization for e-filing.

- ERO Information: The electronic return originator's details, including their name and identification number.

Filing Deadlines / Important Dates

Understanding the filing deadlines associated with the 8879 form is crucial for timely tax submissions. Typically, the deadline for filing individual tax returns is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. For taxpayers who file for an extension, the deadline to submit the 8879 form is usually October 15. It is important to adhere to these deadlines to avoid penalties and ensure compliance with IRS regulations.

Quick guide on how to complete 2019 form 8879 eo irs e file signature authorization for an exempt organization

Complete 8879 Form Irs seamlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage 8879 Form Irs on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign 8879 Form Irs effortlessly

- Locate 8879 Form Irs and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign 8879 Form Irs to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 form 8879 eo irs e file signature authorization for an exempt organization

How to make an eSignature for the 2019 Form 8879 Eo Irs E File Signature Authorization For An Exempt Organization in the online mode

How to generate an eSignature for your 2019 Form 8879 Eo Irs E File Signature Authorization For An Exempt Organization in Google Chrome

How to make an electronic signature for signing the 2019 Form 8879 Eo Irs E File Signature Authorization For An Exempt Organization in Gmail

How to make an eSignature for the 2019 Form 8879 Eo Irs E File Signature Authorization For An Exempt Organization from your smartphone

How to create an electronic signature for the 2019 Form 8879 Eo Irs E File Signature Authorization For An Exempt Organization on iOS

How to generate an electronic signature for the 2019 Form 8879 Eo Irs E File Signature Authorization For An Exempt Organization on Android devices

People also ask

-

What is the 8879 eo form and how does it work with airSlate SignNow?

The 8879 eo form is a tax document that allows taxpayers to electronically sign and transmit their tax returns. With airSlate SignNow, you can easily create, send, and eSign the 8879 eo form, ensuring secure and efficient handling of your important tax documents.

-

What features does airSlate SignNow offer for the 8879 eo form?

airSlate SignNow provides a variety of features for the 8879 eo form, including customizable templates, secure eSignature options, and automated document workflows. These features streamline the process, making it simple for users to manage their tax forms and obtain necessary signatures without hassle.

-

Is there a cost associated with using airSlate SignNow for the 8879 eo form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, allowing you to choose the best option for managing the 8879 eo form. Each plan provides access to essential features that ensure efficient document management and eSigning capabilities.

-

How secure is the eSigning process for the 8879 eo form with airSlate SignNow?

The eSigning process for the 8879 eo form with airSlate SignNow is highly secure, utilizing industry-leading encryption and compliance measures. This ensures that all sensitive information contained within your tax documents is protected during transmission and storage.

-

Can I integrate airSlate SignNow with other software for managing the 8879 eo form?

Absolutely! airSlate SignNow seamlessly integrates with various applications and software platforms, allowing for a smooth workflow when handling the 8879 eo form. This integration capability enhances productivity by connecting your existing tools and processes.

-

What are the benefits of using airSlate SignNow for the 8879 eo form compared to traditional methods?

Using airSlate SignNow for the 8879 eo form offers numerous benefits over traditional methods, such as faster processing times, reduced paper usage, and enhanced accessibility. By switching to electronic signing, you can expedite your tax filing process while maintaining accuracy and security.

-

How can I track the status of my 8879 eo form once sent through airSlate SignNow?

airSlate SignNow provides real-time tracking features, allowing you to monitor the status of your 8879 eo form after it has been sent for eSigning. You will receive notifications when the document is viewed and signed, offering transparency throughout the process.

Get more for 8879 Form Irs

Find out other 8879 Form Irs

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement