1099 R Form 2017

What is the 1099-R Form?

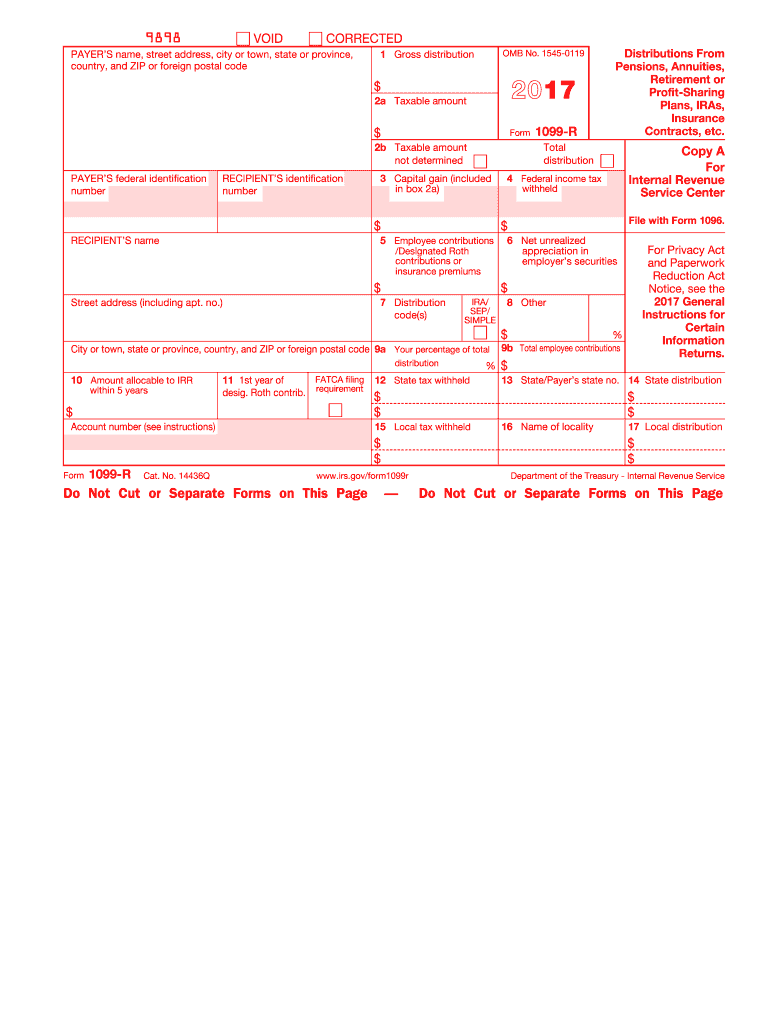

The 1099-R Form is an essential tax document used in the United States to report distributions from retirement plans, pensions, annuities, and other similar financial arrangements. It is issued by the plan administrator or payer when a distribution of more than $10 is made. This form serves as a record for both the recipient and the IRS, ensuring proper reporting of income during tax season. Recipients must include the amounts reported on the 1099-R Form in their personal income tax returns to accurately calculate their tax obligations.

Steps to Complete the 1099-R Form

Completing the 1099-R Form involves several key steps to ensure accuracy and compliance with IRS regulations:

- Gather necessary information, including the recipient's name, address, and taxpayer identification number (TIN).

- Enter the payer's information, including the name, address, and TIN of the organization issuing the form.

- Report the gross distribution amount in Box 1, which represents the total amount distributed to the recipient.

- Fill in Box 2a with the taxable amount, if applicable, and Box 2b to indicate if the distribution is taxable.

- Complete additional boxes as necessary, including those for federal income tax withheld and distribution codes.

- Review the form for accuracy before submitting it to the IRS and providing a copy to the recipient.

How to Obtain the 1099-R Form

The 1099-R Form can be obtained through various means. Recipients typically receive it directly from the financial institution or plan administrator that issued the distribution. If you need to access the form for your records, you can also download it from the IRS website or request a copy from the issuer. For electronic filing, many tax software programs include the 1099-R Form template, allowing users to fill it out and submit it digitally.

Key Elements of the 1099-R Form

Understanding the key elements of the 1099-R Form is crucial for accurate reporting. Important sections include:

- Box 1: Gross distribution amount.

- Box 2a: Taxable amount, if applicable.

- Box 2b: Indicates whether the distribution is taxable.

- Box 4: Federal income tax withheld.

- Distribution codes: Found in Box 7, these codes indicate the type of distribution made.

Filing Deadlines / Important Dates

Filing deadlines for the 1099-R Form are critical for compliance. Typically, the form must be sent to recipients by January 31 of the year following the tax year in which the distribution was made. Additionally, the IRS requires that the form be filed by the end of February if submitting by mail, or by March 31 if filing electronically. Missing these deadlines can result in penalties, so it is important to stay informed about these dates.

Penalties for Non-Compliance

Failure to comply with 1099-R Form filing requirements can lead to significant penalties. The IRS imposes fines for late filings, incorrect information, or failure to file altogether. Penalties vary based on how late the form is filed, with amounts ranging from $50 to $550 per form, depending on the circumstances. It is essential to ensure accurate and timely submission to avoid these financial repercussions.

Quick guide on how to complete 1099 r 2017 2018 form

Explore the simplest method to complete and endorse your 1099 R Form

Are you still spending time creating your official documents on paper instead of online? airSlate SignNow offers a superior way to complete and endorse your 1099 R Form and associated forms for public services. Our intelligent eSignature solution equips you with everything necessary to handle paperwork promptly and in compliance with official guidelines - powerful PDF editing, management, protection, signing, and sharing features at your fingertips within a user-friendly interface.

Only a few steps are needed to finalize and endorse your 1099 R Form:

- Upload the editable template to the editor using the Get Form button.

- Verify what information you need to provide in your 1099 R Form.

- Navigate through the fields with the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to complete the fields with your information.

- Modify the content with Text boxes or Images from the upper toolbar.

- Emphasize what is essential or Redact sections that are no longer relevant.

- Click on Sign to generate a legally recognized eSignature using whichever method you prefer.

- Add the Date adjacent to your signature and conclude your task with the Done button.

Store your completed 1099 R Form in the Documents folder within your account, download it, or send it to your preferred cloud storage. Our service also allows flexible form sharing. There's no need to print your forms when you need to submit them to the appropriate public office - do it via email, fax, or by requesting USPS "snail mail" delivery from your account. Try it out today!

Create this form in 5 minutes or less

Find and fill out the correct 1099 r 2017 2018 form

FAQs

-

How many people fill out Form 1099 each year?

There are a few different ways of estimating the numbers and thinking about this question. Data from the most recent years are not available—at least not from a reliable source with rigorous methodology—but here is what I can tell you:The most popular type of 1099 is Form 1099-MISC—the form used to report non-employee income including those for self-employed independent contractors (as well as various other types of “miscellaneous” income)Since 2015, there have been just under 16 million self-employed workers (including incorporated and unincorporated contractor businesses). And the data from the BLS seems to suggest this number has been largely consistent from one year to the next: Table A-9. Selected employment indicatorsNow, the total number of 1099-MISC forms has been inching up each year—along with W-2 form filings—and may have surpassed 100 million filing forms. RE: Evaluating the Growth of the 1099 Workforce But this data only goes to 2014 because, again, it’s hard to find reliable data from recent tax years.In terms of the total number of Form 1099s, you’d have to include Interest and Dividend 1099 forms, real estate and rental income, health and education savings accounts, retirement accounts, etc. I’m sure the total number of all 1099 forms surely ranges in the hundreds of millions.Finally, not everybody who is supposed to get a 1099 form gets one. So if you’re asking about the total number of freelancers, the estimates range from about 7.6 million people who primarily rely on self-employed 1099 income and 53 million people who have some type of supplemental income.If you’re someone who’s responsible for filing Form 1099s to the IRS and payee/recipients, I recommend Advanced Micro Solutions for most small-to-medium accounting service needs. It’s basic but very intuitive and cheap.$79 1099 Software Filer & W2 Software for Small Businesses

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

What is the link of the official website to fill out the IBPS RRB 2017-2018 form?

Hello,The notification of IBPS RRB 2017–18 is soon going to be announce by the Officials.With this news, the candidates are now looking for the official links to apply for the IBPS RRB Exam and the complete Step by step procedure of how to apply online.The link of Official website to apply is given below:Welcome to IBPS ::Below are the steps to apply online for the exam.Firstly, visit the official link mentioned above.After click on the link ‘CWE RRB’ at the left side of the page.As soon as the official sources will release the IBPS RRB Notification 2017, the candidates will be able to see another link ‘Common Written Examination – Regional Rural Banks Phase VI’ on the page.After clicking on this link, you can start your IBPS RRB Online Application process.Enter all the required details and upload scanned photographs and signature to proceed with the registration process.After entering all these details, candidates will get a registration number and password through which they can login anytime and make changes in IBPS RRB Online Application.For the final submission, fee payment is required.Application Fee for Officer Scale (I, II & III) and Office Assistant – INR 100 for ST/SC/PWD Candidates and INR 600 for all others.The payment can be made by using Debit Cards (RuPay/ Visa/ MasterCard/ Maestro), Credit Cards, Internet Banking, IMPS, Cash Cards/ Mobile Wallets by providing information as asked on the screen.8. Check all the details before you finally submit the form.9. Take a print out of the form for future use.Hope the above information is useful for you!Thankyou!

-

How do I fill out the NTSE form 2017- 2018 Jharkhand online?

You cannot gove NTSE online or at your own level you have to belong to a school which is conducting ntse. Then download the form online from the page of ntse, fill it and submit it to your school along with fee. If your school is not conducting ntse, sorry to say but you cannot give ntse. It can only be given through, no institutions are allowed to conduct thos exam.

-

Do I have to fill out a 1099 tax form for my savings account interest?

No, the bank files a 1099 — not you. You’ll get a copy of the 1099-INT that they filed.

-

Can I use broker statements to fill out form 8949 instead of a 1099-B?

Yes you can. Should you? Perhaps, but remember that the 1099 is what the IRS is going to receive. There could be differences.You may receive a 1099 which is missing basis information. You will indicate that, and use your records to fill in the missing information.My suggestion is to use the 1099, cross-referencing to your statements.

-

Can we fill out the NEET application form (2018) in general after filling in SC (2017)?

Yes, you may do so. The details of the previous year shall not be carried forward in the current year. However, it can only be confirmed once the application form will be released.

-

Is it possible for me to fill out the CMA foundation form now for Dec 2017 and appear in June 2018?

Get full detail information about cma foundation registration from the following link. cma foundation registration process

Create this form in 5 minutes!

How to create an eSignature for the 1099 r 2017 2018 form

How to make an electronic signature for the 1099 R 2017 2018 Form in the online mode

How to create an electronic signature for the 1099 R 2017 2018 Form in Google Chrome

How to make an electronic signature for putting it on the 1099 R 2017 2018 Form in Gmail

How to generate an electronic signature for the 1099 R 2017 2018 Form from your smart phone

How to create an electronic signature for the 1099 R 2017 2018 Form on iOS

How to generate an eSignature for the 1099 R 2017 2018 Form on Android

People also ask

-

What is a 1099 R Form and why do I need it?

The 1099 R Form is a tax document used to report distributions from pensions, annuities, retirement plans, and other similar accounts. If you receive funds from these sources, you will need this form to accurately file your taxes. Using airSlate SignNow, you can easily manage and eSign your 1099 R Form to ensure timely submission.

-

How can airSlate SignNow help me with my 1099 R Form?

airSlate SignNow provides a seamless solution for sending and eSigning your 1099 R Form. With our user-friendly platform, you can quickly prepare, send, and track your forms, ensuring that all necessary parties can sign electronically. This streamlines your workflow and reduces the hassle of paper documents.

-

Is there a cost associated with using airSlate SignNow for 1099 R Forms?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs. You can choose a plan that fits your budget while gaining access to features specifically designed for managing documents like the 1099 R Form. Our cost-effective solutions ensure that you get value for your investment.

-

What features does airSlate SignNow offer for handling 1099 R Forms?

With airSlate SignNow, you can enjoy features like customizable templates for your 1099 R Form, secure eSigning, and real-time tracking of document status. These tools help simplify the process of preparing and sending your forms, making it easier to stay organized and compliant.

-

Can I integrate airSlate SignNow with other software for my 1099 R Forms?

Absolutely! airSlate SignNow offers integrations with popular software such as accounting and tax preparation tools, enhancing your ability to manage your 1099 R Form efficiently. This connectivity allows for a smoother workflow and helps keep all your financial documents in one place.

-

Is airSlate SignNow secure for eSigning my 1099 R Form?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your 1099 R Form is signed in a safe environment. We utilize advanced encryption and authentication measures, providing peace of mind that your sensitive information is protected throughout the signing process.

-

How do I get started with airSlate SignNow for my 1099 R Form?

Getting started with airSlate SignNow is easy! Simply sign up for an account, and you can begin creating or uploading your 1099 R Form. Our intuitive interface will guide you through the process of sending and eSigning your documents in no time.

Get more for 1099 R Form

Find out other 1099 R Form

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile