Irs Form 13844

What is the IRS Form 13844?

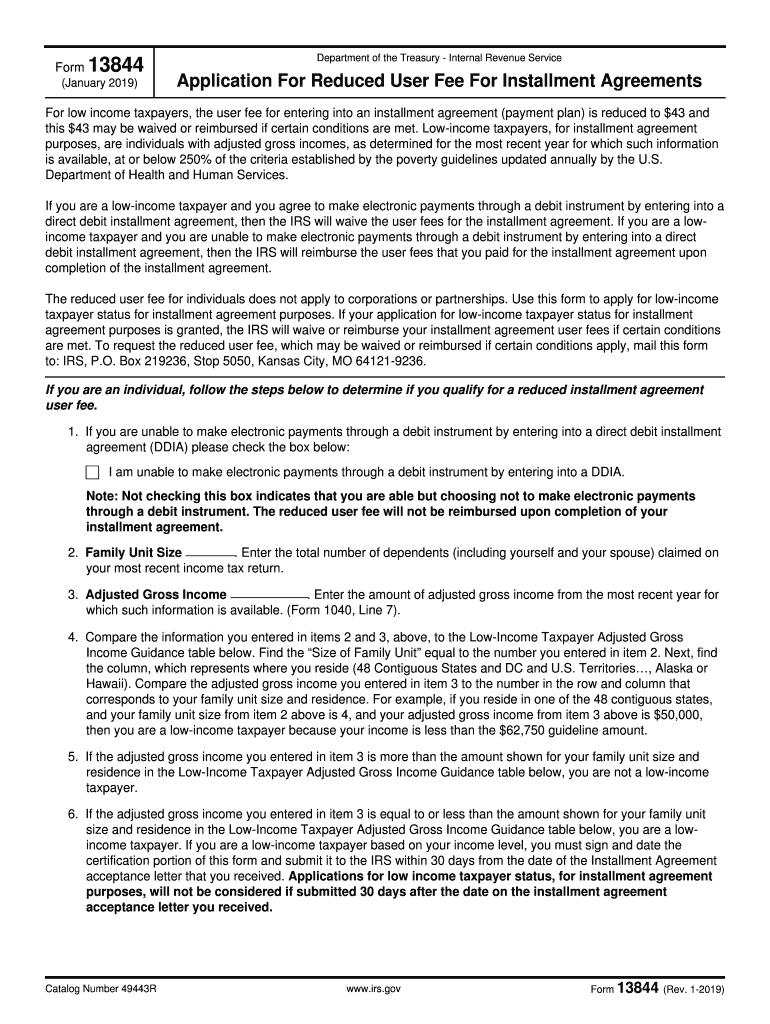

The IRS Form 13844, also known as the reduced user fee form, is a document used by taxpayers in the United States to request a reduction in user fees associated with certain IRS applications. This form is particularly relevant for individuals who are seeking to enter into an installment agreement with the IRS for tax liabilities. By submitting Form 13844, taxpayers can potentially lower the fees they are required to pay when applying for a payment plan.

How to Use the IRS Form 13844

Using the IRS Form 13844 involves a straightforward process. Taxpayers must first determine their eligibility for a reduced user fee based on their financial situation and the specific guidelines provided by the IRS. Once eligibility is established, the form should be filled out with accurate information regarding the taxpayer’s financial condition. After completing the form, it can be submitted alongside the application for the installment agreement to ensure that the reduced fee is applied.

Steps to Complete the IRS Form 13844

Completing the IRS Form 13844 requires careful attention to detail. Here are the steps to follow:

- Gather necessary financial documents, including income statements and expense reports.

- Review the eligibility criteria outlined by the IRS for reduced user fees.

- Fill out the form with accurate personal and financial information.

- Double-check the completed form for any errors or omissions.

- Submit the form along with your installment agreement application.

Key Elements of the IRS Form 13844

Several key elements must be included in the IRS Form 13844 to ensure its acceptance. These elements include:

- Taxpayer identification information, such as name and Social Security number.

- Details regarding the taxpayer's financial situation, including income and expenses.

- Specific reasons for requesting a reduced user fee.

- Signature of the taxpayer to certify the accuracy of the information provided.

Eligibility Criteria for the IRS Form 13844

To qualify for the reduced user fee through the IRS Form 13844, taxpayers must meet certain eligibility criteria. Generally, these criteria include:

- Demonstrating financial hardship or low income.

- Being in compliance with all tax filing requirements.

- Not having a history of non-compliance with IRS agreements.

Form Submission Methods

The IRS Form 13844 can be submitted through various methods to accommodate taxpayer preferences. These methods include:

- Online submission via the IRS website, if applicable.

- Mailing the completed form to the appropriate IRS address.

- In-person submission at designated IRS offices.

Quick guide on how to complete form 13844 application for reduced user fee for installment

Effortlessly Prepare Irs Form 13844 on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal sustainable alternative to conventional printed and signed paperwork, allowing you to access the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents rapidly without delays. Manage Irs Form 13844 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The easiest way to modify and eSign Irs Form 13844 effortlessly

- Obtain Irs Form 13844 and click Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, by email, text message (SMS), or invite link, or download it to your computer.

Eliminate the worries of lost or misplaced files, tedious document searches, or errors that require new copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and eSign Irs Form 13844 and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 13844 application for reduced user fee for installment

How to make an electronic signature for your Form 13844 Application For Reduced User Fee For Installment in the online mode

How to create an electronic signature for your Form 13844 Application For Reduced User Fee For Installment in Chrome

How to make an electronic signature for signing the Form 13844 Application For Reduced User Fee For Installment in Gmail

How to generate an eSignature for the Form 13844 Application For Reduced User Fee For Installment from your mobile device

How to make an electronic signature for the Form 13844 Application For Reduced User Fee For Installment on iOS

How to create an electronic signature for the Form 13844 Application For Reduced User Fee For Installment on Android devices

People also ask

-

What is IRS Form 13844 and how does it relate to airSlate SignNow?

IRS Form 13844 is used to apply for a refund of excess payments made to the Internal Revenue Service. With airSlate SignNow, you can easily eSign and send IRS Form 13844 electronically, ensuring a quick and efficient submission process.

-

How can airSlate SignNow help me with completing IRS Form 13844?

airSlate SignNow provides a user-friendly platform that allows you to fill out and eSign IRS Form 13844 online. This simplifies the process, making it easy to manage your documents and submit them to the IRS without any hassle.

-

Is airSlate SignNow cost-effective for businesses needing to file IRS Form 13844?

Yes, airSlate SignNow offers a cost-effective solution for businesses needing to file IRS Form 13844. With flexible pricing plans, you can choose an option that fits your budget while benefiting from advanced features that streamline your document management.

-

What features does airSlate SignNow offer for IRS Form 13844?

airSlate SignNow offers features such as document templates, automated workflows, and secure eSigning that are perfect for handling IRS Form 13844. These tools help ensure that your form is completed accurately and submitted on time.

-

Can I integrate airSlate SignNow with other applications when working on IRS Form 13844?

Absolutely! airSlate SignNow seamlessly integrates with various applications such as Google Drive, Dropbox, and CRM systems. This allows you to manage IRS Form 13844 alongside your existing tools, enhancing your workflow efficiency.

-

What are the benefits of using airSlate SignNow for IRS Form 13844?

Using airSlate SignNow for IRS Form 13844 provides numerous benefits, including time savings, increased accuracy, and improved security during the document signing process. These advantages ensure that your forms are handled professionally and efficiently.

-

How secure is the transmission of IRS Form 13844 through airSlate SignNow?

The transmission of IRS Form 13844 through airSlate SignNow is highly secure. We utilize advanced encryption protocols and comply with industry standards to protect your sensitive information during the eSigning process.

Get more for Irs Form 13844

Find out other Irs Form 13844

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online