2441 Form

What is the 2441?

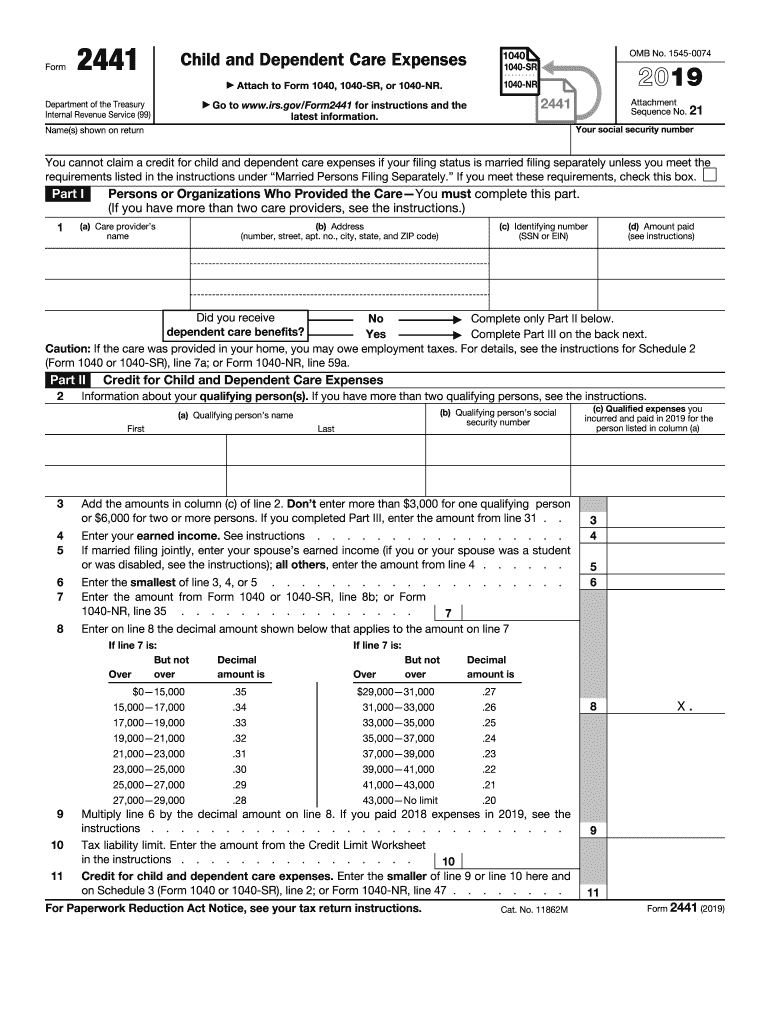

The 2 form, officially known as the IRS Form 2441, is used to claim the Child and Dependent Care Expenses Credit. This form is essential for taxpayers who have incurred costs for the care of a qualifying individual while they work or look for work. The qualifying individual can be a child under the age of thirteen or a dependent who is physically or mentally incapable of self-care. This form allows taxpayers to report their expenses and calculate the credit they may be eligible for, which can significantly reduce their tax liability.

How to use the 2441

To effectively use the 2 form, taxpayers need to gather all necessary information regarding their dependent care expenses. This includes the names, addresses, and taxpayer identification numbers of the care providers. Once this information is collected, taxpayers can fill out the form, detailing their expenses and the qualifying individuals. The form will guide users through various sections that require specific details about the care provided and the associated costs, ultimately leading to the calculation of the credit.

Steps to complete the 2441

Completing the 2 form involves several key steps:

- Gather all relevant documentation, including receipts and provider information.

- Fill out the identification section, including your name, Social Security number, and filing status.

- Provide details about the qualifying individuals, including their names and ages.

- List the care providers' information, including their names, addresses, and taxpayer identification numbers.

- Report the total amount spent on care for each qualifying individual.

- Calculate the credit based on your total expenses and the applicable percentage.

- Review the form for accuracy before submission.

Legal use of the 2441

The 2 form must be used in compliance with IRS regulations. To ensure legal use, taxpayers should only claim expenses that meet the IRS criteria for qualifying care. Additionally, accurate reporting of all information is crucial, as any discrepancies could lead to penalties or disallowance of the credit. It is important to retain all supporting documents for at least three years in case of an audit.

Eligibility Criteria

To qualify for the Child and Dependent Care Expenses Credit using the 2 form, taxpayers must meet certain eligibility criteria:

- The taxpayer must have earned income from employment or self-employment.

- The care must be provided for a qualifying individual under the age of thirteen or a dependent who cannot care for themselves.

- The care expenses must be necessary for the taxpayer to work or look for work.

- The care provider must be someone other than the taxpayer's spouse or a relative under the age of nineteen.

Filing Deadlines / Important Dates

For the 2019 tax year, the deadline to file the 2 form coincides with the general tax filing deadline, which is typically April fifteenth of the following year. If taxpayers need additional time, they may file for an extension, but any owed taxes must still be paid by the original deadline to avoid penalties and interest. It is advisable to stay informed about any changes to tax laws that may affect filing dates.

Quick guide on how to complete 2019 form 2441 child and dependent care expenses

Effortlessly handle 2441 on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an excellent environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and safely keep it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without delays. Manage 2441 on any device with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The simplest way to edit and electronically sign 2441 with ease

- Locate 2441 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or conceal sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes only seconds and carries the same legal authority as a conventional wet ink signature.

- Verify the details and click the Done button to save your modifications.

- Choose your preferred method to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about missing or misplaced documents, tedious form hunting, or mistakes that necessitate printing new copies. airSlate SignNow satisfies all your document management needs with just a few clicks from any device you prefer. Edit and electronically sign 2441 and ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 form 2441 child and dependent care expenses

How to make an electronic signature for your 2019 Form 2441 Child And Dependent Care Expenses online

How to make an eSignature for the 2019 Form 2441 Child And Dependent Care Expenses in Chrome

How to create an electronic signature for signing the 2019 Form 2441 Child And Dependent Care Expenses in Gmail

How to make an electronic signature for the 2019 Form 2441 Child And Dependent Care Expenses from your smart phone

How to generate an eSignature for the 2019 Form 2441 Child And Dependent Care Expenses on iOS devices

How to generate an electronic signature for the 2019 Form 2441 Child And Dependent Care Expenses on Android

People also ask

-

What is the 2019 2441 type and how does it relate to airSlate SignNow?

The 2019 2441 type refers to a specific document classification that users may frequently need to send and eSign. With airSlate SignNow, you can easily manage and process 2019 2441 type documents, ensuring compliance and efficiency in your business operations.

-

How does airSlate SignNow handle the 2019 2441 type documents?

AirSlate SignNow offers a user-friendly interface for managing 2019 2441 type documents. Users can upload, edit, and eSign their documents quickly, making the workflow seamless and minimizing the time spent on administrative tasks related to these specific forms.

-

What are the pricing options for using airSlate SignNow for 2019 2441 type documents?

AirSlate SignNow offers competitive pricing plans that cater to various business needs, including those who frequently handle 2019 2441 type documents. Whether you are a small business or a large enterprise, you will find a subscription plan that fits your budget while providing access to essential features.

-

Are there any special features in airSlate SignNow for managing 2019 2441 type eSignatures?

Yes, airSlate SignNow includes specific features designed to simplify the eSigning process for 2019 2441 type documents. These features include customizable templates, automated workflows, and advanced security measures to ensure that your data remains protected while processing these important documents.

-

Can I integrate airSlate SignNow with other applications for handling 2019 2441 type documents?

Absolutely! airSlate SignNow supports integration with various applications, facilitating a smooth workflow for 2019 2441 type documents. Users can connect with tools such as CRM systems, cloud storage services, and more, enhancing productivity and document management capabilities.

-

What are the benefits of using airSlate SignNow for 2019 2441 type documents?

Using airSlate SignNow for your 2019 2441 type documents streamlines the eSigning process, saving time and reducing human error. The platform also ensures secure storage and easy access to your documents, allowing for efficient collaboration among team members and stakeholders.

-

Is airSlate SignNow compliant with regulations governing 2019 2441 type signatures?

Yes, airSlate SignNow is fully compliant with regulatory standards for electronic signatures, including those relevant to the 2019 2441 type documents. This compliance ensures that your eSigned documents hold legal weight and can be used confidently in various legal and business environments.

Get more for 2441

- 1040pr 2017 form

- Arizona form 321 credit for contributions to qualifying charitable organizations

- 1120 f 2018 form

- Form 8879 2018

- Tennessee individual income tax return inc250 2017 individual income tax form

- All state income tax dollars support education form

- Text of irs publication 503 child and dependent care form

- Ohio form it 1040fill out and use this pdf

Find out other 2441

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy