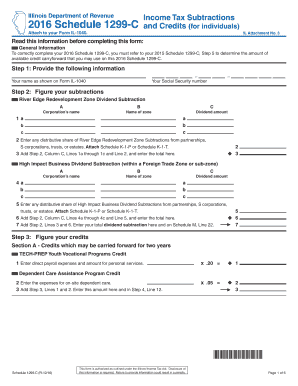

Schedule 1299 C, Income Tax Subtractions and Credits for Individuals Form

What is the Schedule 1299 C, Income Tax Subtractions and Credits for Individuals

The Schedule 1299 C is a form used by individuals in Illinois to report various income tax subtractions and credits. This form allows taxpayers to claim specific deductions that can reduce their taxable income, ultimately lowering their overall tax liability. The Schedule 1299 C is particularly relevant for individuals who qualify for certain credits, such as the Earned Income Credit or the Property Tax Credit. Understanding this form is essential for ensuring compliance with state tax laws and maximizing potential refunds.

Steps to Complete the Schedule 1299 C, Income Tax Subtractions and Credits for Individuals

Completing the Schedule 1299 C involves several key steps to ensure accurate reporting of income tax subtractions and credits. First, gather all necessary documentation, including income statements and information on any qualifying expenses. Next, fill out the form by entering your personal information and detailing the specific subtractions and credits you are claiming. It is crucial to follow the instructions provided with the form closely, as errors can lead to delays or penalties. After completing the form, review it for accuracy before submitting it with your Illinois income tax return.

Key Elements of the Schedule 1299 C, Income Tax Subtractions and Credits for Individuals

The Schedule 1299 C includes several key elements that taxpayers must understand. These elements typically include personal identification information, a list of eligible subtractions, and various credits available to individuals. Taxpayers must accurately report their income and any applicable deductions to ensure they receive the correct tax benefits. Additionally, the form may require supporting documentation for certain claims, making it essential to keep detailed records throughout the tax year.

Eligibility Criteria for the Schedule 1299 C, Income Tax Subtractions and Credits for Individuals

Eligibility for claiming subtractions and credits on the Schedule 1299 C is based on specific criteria set forth by the Illinois Department of Revenue. Generally, taxpayers must be residents of Illinois and meet income thresholds to qualify for various credits. Certain credits may also have additional requirements, such as age or dependency status. It is important for individuals to review these criteria carefully to determine their eligibility before filing.

Legal Use of the Schedule 1299 C, Income Tax Subtractions and Credits for Individuals

The Schedule 1299 C is legally recognized as a valid document for reporting income tax subtractions and credits in Illinois. To ensure compliance with state tax laws, it is essential that taxpayers complete the form accurately and submit it within the designated filing deadlines. The use of this form is governed by regulations that outline the requirements for claiming credits, and failure to adhere to these regulations can result in penalties or disallowance of claims.

Filing Deadlines / Important Dates for the Schedule 1299 C, Income Tax Subtractions and Credits for Individuals

Filing deadlines for the Schedule 1299 C align with the general income tax filing deadlines in Illinois. Typically, individual taxpayers must submit their completed tax returns, including the Schedule 1299 C, by April fifteenth of each year. However, it is advisable to check for any changes to deadlines or extensions that may apply. Staying informed about these important dates is crucial for avoiding late fees and ensuring timely processing of tax returns.

Quick guide on how to complete 2016 schedule 1299 c income tax subtractions and credits for individuals

Prepare Schedule 1299 C, Income Tax Subtractions And Credits for Individuals seamlessly on any gadget

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Schedule 1299 C, Income Tax Subtractions And Credits for Individuals on any gadget using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The most efficient way to modify and eSign Schedule 1299 C, Income Tax Subtractions And Credits for Individuals effortlessly

- Locate Schedule 1299 C, Income Tax Subtractions And Credits for Individuals and click Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your method of sending your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require generating new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your preference. Modify and eSign Schedule 1299 C, Income Tax Subtractions And Credits for Individuals and maintain excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

For a resident alien individual having farm income in the home country, India, how to report the agricultural income in US income tax return? Does the form 1040 schedule F needs to be filled?

The answer is yes, it should be. Remember that you will receive a credit for any Indian taxes you pay.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

I worked in two different states this year (and two different companies), will I have to fill out state income tax forms for both?

A2A BUT We need more information to give you an accurate answer. There are 50 different states and 43 of them have some form of individual income tax laws, so that is 1,849 different possibilities of how to answer this question. That is before we even factor in that you did not tell us how long you lived in either state, which could be a day or 364 days.I can give you the probably answer which is yes you will most likely need to file with two states this year. Take a look at your two W2’s and at the bottom you will see what state(s) your earnings were reported to. If the W2’s have different states then absolutely you should file a return with both states, because what is on the W2 will be presumed to be accurate, even if your presence in the state did not actually rise to the level of needing to file. The biggest question will become if you are filing as a resident, non-resident or part-year resident. Your filing status can make a difference in how much tax you owe and unfortunately it is not as simple as just thinking you lived in a place for only part of the year so you were automatically a part-year resident.This is one of those situations where I would advise you that your taxes this year are complex enough that you really need to go to a professional to have your taxes done. That person should be able to review the specifics of your situation and advise you how to file.

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

-

If I don't earn enough money on social security to file income taxes, will I still need an income tax return to fill out a FAFSA, and other financial aid forms for my daughter?

No. Just provide the information requested on the form. If you later need proof you didn't file, you can get that from the IRS BY requesting transcripts.

-

How much will a doctor with a physical disability and annual net income of around Rs. 2.8 lakhs pay in income tax? Which ITR form is to be filled out?

For disability a deduction of ₹75,000/- is available u/s 80U.Rebate u/s87AFor AY 17–18, rebate was ₹5,000/- or income tax which ever is lower for person with income less than ₹5,00,000/-For AY 18–19, rebate is ₹2,500/- or income tax whichever is lower for person with income less than 3,50,000/-So, for an income of 2.8 lakhs, taxable income after deduction u/s 80U will remain ₹2,05,000/- which is below the slab rate and hence will not be taxable for any of the above said AY.For ITR,If doctor is practicing himself i.e. He has a professional income than ITR 4 should be filedIf doctor is getting any salary than ITR 1 should be filed.:)

Create this form in 5 minutes!

How to create an eSignature for the 2016 schedule 1299 c income tax subtractions and credits for individuals

How to create an electronic signature for the 2016 Schedule 1299 C Income Tax Subtractions And Credits For Individuals in the online mode

How to make an electronic signature for your 2016 Schedule 1299 C Income Tax Subtractions And Credits For Individuals in Google Chrome

How to make an eSignature for putting it on the 2016 Schedule 1299 C Income Tax Subtractions And Credits For Individuals in Gmail

How to create an electronic signature for the 2016 Schedule 1299 C Income Tax Subtractions And Credits For Individuals from your mobile device

How to make an eSignature for the 2016 Schedule 1299 C Income Tax Subtractions And Credits For Individuals on iOS

How to create an eSignature for the 2016 Schedule 1299 C Income Tax Subtractions And Credits For Individuals on Android OS

People also ask

-

What is Schedule 1299 C, Income Tax Subtractions And Credits for Individuals?

Schedule 1299 C, Income Tax Subtractions And Credits for Individuals is a form used by individuals to claim various tax subtractions and credits on their income tax returns. It allows taxpayers to identify eligible deductions and credits that can reduce their overall tax liability. Understanding how to fill out this form properly can lead to signNow tax savings.

-

How can airSlate SignNow help with filing Schedule 1299 C?

airSlate SignNow streamlines the process of sending and eSigning important documents, including those related to Schedule 1299 C, Income Tax Subtractions And Credits for Individuals. By using our platform, you can quickly gather necessary signatures and manage your documents efficiently, ensuring that your tax forms are submitted on time.

-

Is there a cost associated with using airSlate SignNow for tax-related documents?

Yes, airSlate SignNow offers a range of pricing plans tailored to different needs, including individual users and businesses. Our service is designed to be cost-effective while providing robust features for managing documents related to tax forms like Schedule 1299 C, Income Tax Subtractions And Credits for Individuals. Explore our pricing options to find the best fit for you.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow includes features such as customizable templates, secure eSignature capabilities, and document tracking, which are essential for managing tax documents like Schedule 1299 C, Income Tax Subtractions And Credits for Individuals. These features ensure that you can efficiently prepare and submit your tax forms with ease.

-

Can I integrate airSlate SignNow with accounting software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software solutions, allowing you to manage your tax preparation tasks, including those involving Schedule 1299 C, Income Tax Subtractions And Credits for Individuals, more effectively. This integration helps streamline your workflow and ensures all your documents are in one place.

-

How secure is airSlate SignNow for signing tax documents?

Security is a top priority for airSlate SignNow. Our platform uses industry-leading encryption and security protocols to protect your sensitive information, including documents related to Schedule 1299 C, Income Tax Subtractions And Credits for Individuals. You can confidently eSign and send your tax documents knowing they are secure.

-

What are the benefits of using airSlate SignNow for tax document management?

Using airSlate SignNow offers several benefits for managing tax documents, such as increased efficiency, reduced paper waste, and simplified workflows. Specifically for Schedule 1299 C, Income Tax Subtractions And Credits for Individuals, our platform helps ensure that you can easily gather signatures, track document status, and maintain compliance with tax regulations.

Get more for Schedule 1299 C, Income Tax Subtractions And Credits for Individuals

Find out other Schedule 1299 C, Income Tax Subtractions And Credits for Individuals

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT