1040 V 2018

What is the 1040 V

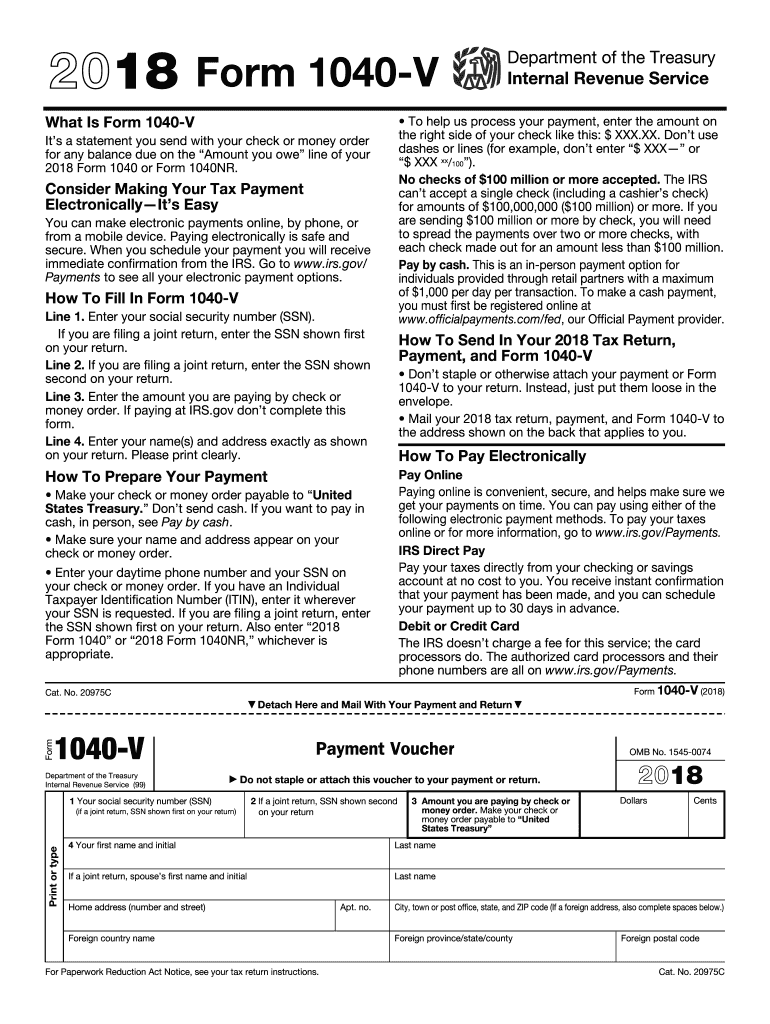

The 2017 Form 1040 V is a payment voucher used by taxpayers in the United States to submit payments for their federal income tax liabilities. This form is specifically designed to accompany the 2017 federal tax return, ensuring that payments are properly applied to the taxpayer's account. The 1040 V serves as a record of payment and helps the IRS process payments efficiently. It is essential for individuals who owe taxes and wish to make a payment by mail.

How to use the 1040 V

To use the 2017 Form 1040 V, taxpayers need to fill out the form with their personal information, including their name, address, and Social Security number. The voucher requires the taxpayer to indicate the amount being paid and the tax year for which the payment is being made. After completing the form, it should be mailed along with the payment to the address specified by the IRS. This ensures that the payment is correctly attributed to the taxpayer's account.

Steps to complete the 1040 V

Completing the 2017 Form 1040 V involves several straightforward steps:

- Obtain the form from the IRS website or a tax preparation service.

- Enter your name, address, and Social Security number in the designated fields.

- Indicate the amount of payment you are submitting.

- Specify the tax year for which the payment is intended.

- Sign and date the form if required.

- Mail the completed voucher along with your payment to the appropriate IRS address.

Legal use of the 1040 V

The 2017 Form 1040 V is legally recognized by the IRS as a valid method for submitting tax payments. Taxpayers are encouraged to use this form to ensure that their payments are processed accurately and in a timely manner. Using the voucher helps maintain proper records for both the taxpayer and the IRS, reducing the risk of errors or misapplied payments. It is important to follow the guidelines set forth by the IRS to ensure compliance with tax laws.

Filing Deadlines / Important Dates

For the 2017 tax year, the deadline for filing federal income tax returns, along with any payments due, was April 17, 2018. Taxpayers who missed this deadline may face penalties or interest on unpaid balances. It is crucial to keep track of important dates related to tax filings and payments to avoid any complications with the IRS. Extensions may be available, but they do not extend the time to pay taxes owed.

Form Submission Methods (Online / Mail / In-Person)

The 2017 Form 1040 V can be submitted by mail along with the payment. Taxpayers should ensure that they send the payment to the correct IRS address based on their location and the type of payment being made. While electronic payment options are available, using the 1040 V is specifically for those who prefer to submit payments by mail. It is advisable to use certified mail or another reliable method to ensure that the payment is received by the IRS on time.

Quick guide on how to complete irs 1040 es payment voucher 2018 form

Discover the simplest method to complete and endorse your 1040 V

Are you still spending time preparing your formal paperwork on paper instead of managing it online? airSlate SignNow offers an improved approach to finish and authorize your 1040 V and related forms for public services. Our advanced electronic signature system equips you with all the tools necessary to handle documents swiftly and in accordance with official standards - robust PDF editing, management, protection, signing, and sharing functionalities are all readily accessible through an intuitive interface.

Only a few steps are needed to complete and sign your 1040 V:

- Upload the editable template to the editor using the Get Form button.

- Review the information you need to input in your 1040 V.

- Move between the fields using the Next button to ensure nothing is missed.

- Utilize Text, Check, and Cross tools to fill out the blanks with your details.

- Modify the content with Text boxes or Images from the upper toolbar.

- Emphasize what is important or Obscure sections that are no longer relevant.

- Click on Sign to create a legally valid electronic signature using your preferred method.

- Add the Date next to your signature and finalize your work by pressing the Done button.

Store your prepared 1040 V in the Documents folder of your profile, download it, or transfer it to your preferred cloud storage. Our service also offers adaptable form sharing. There’s no requirement to print your forms when you need to submit them to the appropriate public office - accomplish it through email, fax, or by requesting a USPS “snail mail” delivery from your account. Give it a try now!

Create this form in 5 minutes or less

Find and fill out the correct irs 1040 es payment voucher 2018 form

FAQs

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How can I change the online exam to offline exam in IIT Mains exam after completing the filled form and payment in 2018?

I am afraid that this mistake can not be corrected..but the correction window will be open from 2nd january onwards..so u can see if anything can be done..just hope for the best..

-

How do I register for the ANTHE 2018? I was registering online. I successfully made the payment, but was unable to fill the form due to connectivity issues. How should I enroll now?

Now look into your email Id. They will send you an email regarding your enrollment. Follow the instructions given there.

-

How should I fill out the preference form for the IBPS PO 2018 to get a posting in an urban city?

When you get selected as bank officer of psb you will have to serve across the country. Banks exist not just in urban areas but also in semi urban and rural areas also. Imagine every employee in a bank got posting in urban areas as their wish as a result bank have to shut down all rural and semi urban branches as there is no people to serve. People in other areas deprived of banking service. This makes no sense. Being an officer you will be posted across the country and transferred every three years. You have little say of your wish. Every three year urban posting followed by three years rural and vice versa. If you want your career to grow choose Canara bank followed by union bank . These banks have better growth potentials and better promotion scope

Create this form in 5 minutes!

How to create an eSignature for the irs 1040 es payment voucher 2018 form

How to generate an electronic signature for the Irs 1040 Es Payment Voucher 2018 Form online

How to create an electronic signature for your Irs 1040 Es Payment Voucher 2018 Form in Google Chrome

How to make an electronic signature for signing the Irs 1040 Es Payment Voucher 2018 Form in Gmail

How to generate an eSignature for the Irs 1040 Es Payment Voucher 2018 Form from your smart phone

How to make an eSignature for the Irs 1040 Es Payment Voucher 2018 Form on iOS devices

How to create an eSignature for the Irs 1040 Es Payment Voucher 2018 Form on Android OS

People also ask

-

What is the '2017 form 1040 v' and who needs it?

The '2017 form 1040 v' is a payment voucher used for submitting payments with your individual income tax return. It's essential for anyone filing a '2017 form 1040' who owed taxes for that year. By including the '2017 form 1040 v' with your payment, you ensure timely processing of your tax payment.

-

How can airSlate SignNow help me with the '2017 form 1040 v'?

AirSlate SignNow provides a seamless way to eSign and send documents, including the '2017 form 1040 v.' With our platform, you can quickly upload, sign, and share your tax documents securely, streamlining your filing process and reducing the chance of errors.

-

Is there a cost associated with using airSlate SignNow for '2017 form 1040 v' submissions?

Yes, airSlate SignNow offers various pricing plans that cater to different needs. You can choose a plan that best fits your requirements for handling the '2017 form 1040 v' and other documents. Our cost-effective solutions ensure you get the best value while managing your tax documentation.

-

Can I integrate airSlate SignNow with other tax software to handle the '2017 form 1040 v'?

Absolutely! airSlate SignNow integrates with popular tax software to streamline the filing process of your '2017 form 1040 v' and other necessary documents. These integrations allow for easy document management, enhancing productivity and efficiency during tax season.

-

What are the benefits of using airSlate SignNow for my tax forms like the '2017 form 1040 v'?

Using airSlate SignNow for your tax forms like the '2017 form 1040 v' offers several advantages, including easy eSigning, secure document sharing, and access to templates. Our platform simplifies the entire process, ensuring you're compliant and can easily track your submissions.

-

How secure is airSlate SignNow when submitting sensitive documents like the '2017 form 1040 v'?

Security is a top priority at airSlate SignNow. We employ advanced encryption technology and strict access controls to protect sensitive documents such as the '2017 form 1040 v.' You can trust that your information is secure as you eSign and send your tax forms.

-

Can I access my signed '2017 form 1040 v' documents at any time?

Yes! With airSlate SignNow, you can access your signed '2017 form 1040 v' documents anytime, from anywhere. Our cloud-based platform ensures that all your signed documents are stored securely, making it easy for you to retrieve them whenever necessary.

Get more for 1040 V

Find out other 1040 V

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement