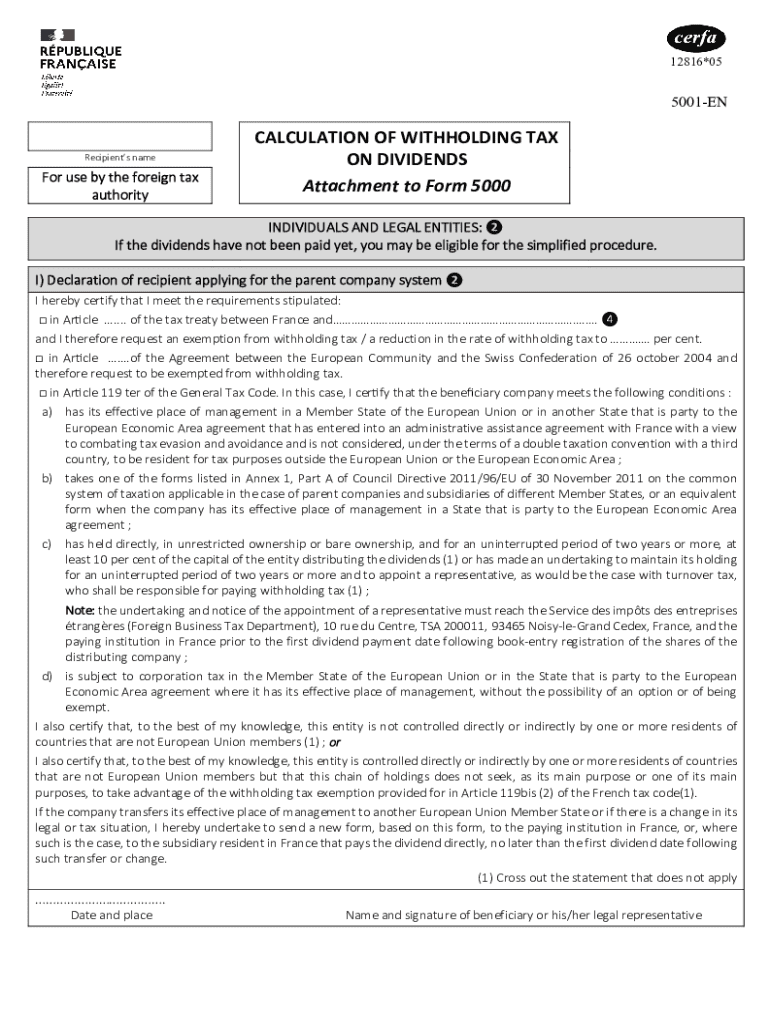

CALCULATION of WITHHOLDING TAX on DIVIDENDS 2024

What is the calculation of withholding tax on dividends

The calculation of withholding tax on dividends refers to the process by which a portion of dividend payments is withheld by the payer and remitted to the Internal Revenue Service (IRS) as a prepayment of the recipient's income tax liability. This tax applies to both U.S. citizens and foreign investors receiving dividends from U.S. corporations. The standard withholding tax rate on dividends for U.S. residents is generally fifteen percent, although this rate may vary based on specific tax treaties between the U.S. and other countries.

Key elements of the calculation of withholding tax on dividends

Several key elements are involved in the calculation of withholding tax on dividends:

- Dividend Amount: The total amount of dividends declared by the corporation.

- Withholding Rate: The applicable withholding tax rate, which can vary based on the recipient's residency status and any applicable tax treaties.

- Tax Identification Number: The recipient's Tax Identification Number (TIN) or Social Security Number (SSN) is necessary for proper reporting.

- Filing Requirements: The payer must file Form 1099-DIV to report the dividends paid and the withholding tax deducted.

Steps to complete the calculation of withholding tax on dividends

To accurately complete the calculation of withholding tax on dividends, follow these steps:

- Determine the total dividend amount to be paid to the shareholder.

- Identify the appropriate withholding tax rate based on the shareholder's residency status.

- Calculate the withholding tax by multiplying the total dividend amount by the withholding tax rate.

- Withhold the calculated amount from the dividend payment and remit it to the IRS.

- Ensure proper documentation is maintained for reporting purposes, including Form 1099-DIV.

IRS guidelines

The IRS provides specific guidelines regarding the calculation of withholding tax on dividends. It is essential for businesses to adhere to these guidelines to avoid penalties. Key points include:

- Understanding the withholding tax rates applicable to different types of dividends.

- Filing deadlines for submitting withheld amounts and related forms.

- Maintaining accurate records of all dividend payments and withholding amounts.

Filing deadlines / important dates

Filing deadlines for the calculation of withholding tax on dividends are crucial for compliance. The following dates are important:

- January 31: Deadline for providing Form 1099-DIV to recipients.

- February 28: Deadline for submitting paper Forms 1099-DIV to the IRS.

- March 31: Deadline for submitting electronic Forms 1099-DIV to the IRS.

Penalties for non-compliance

Failure to comply with the withholding tax requirements can result in significant penalties. These may include:

- Failure to file penalties for not submitting Form 1099-DIV on time.

- Failure to pay penalties for not remitting the withheld tax to the IRS.

- Increased scrutiny from the IRS, potentially leading to audits.

Quick guide on how to complete calculation of withholding tax on dividends

Complete CALCULATION OF WITHHOLDING TAX ON DIVIDENDS effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools you require to create, modify, and eSign your documents swiftly without hurdles. Manage CALCULATION OF WITHHOLDING TAX ON DIVIDENDS on any device using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign CALCULATION OF WITHHOLDING TAX ON DIVIDENDS with ease

- Locate CALCULATION OF WITHHOLDING TAX ON DIVIDENDS and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant parts of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the information and click on the Done button to save your changes.

- Select your preferred method to send your form, either by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your needs in document management with just a few clicks from any device of your choice. Revise and eSign CALCULATION OF WITHHOLDING TAX ON DIVIDENDS to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct calculation of withholding tax on dividends

Create this form in 5 minutes!

How to create an eSignature for the calculation of withholding tax on dividends

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the calculation of withholding tax on dividends?

The calculation of withholding tax on dividends refers to the process of determining the tax amount that must be withheld from dividend payments to shareholders. This calculation is essential for compliance with tax regulations and ensures that the correct amount is remitted to tax authorities. Understanding this calculation helps businesses manage their tax liabilities effectively.

-

How can airSlate SignNow assist with the calculation of withholding tax on dividends?

airSlate SignNow provides tools that streamline the documentation process related to the calculation of withholding tax on dividends. By enabling businesses to send and eSign necessary tax forms electronically, it simplifies compliance and record-keeping. This efficiency can save time and reduce errors in tax calculations.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features such as customizable templates, secure eSigning, and automated workflows that enhance tax document management. These features are particularly useful for the calculation of withholding tax on dividends, as they ensure that all necessary documents are accurately completed and stored. This leads to improved efficiency and compliance.

-

Is there a cost associated with using airSlate SignNow for tax calculations?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost is competitive and reflects the value of features that assist in the calculation of withholding tax on dividends. Investing in this solution can lead to signNow time savings and improved accuracy in tax-related processes.

-

Can airSlate SignNow integrate with accounting software for tax calculations?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, enhancing the calculation of withholding tax on dividends. This integration allows for automatic data transfer, reducing manual entry errors and ensuring that tax calculations are based on the most current financial data.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. These advantages are particularly relevant for the calculation of withholding tax on dividends, as they help ensure that all documents are processed quickly and securely. This leads to better compliance and peace of mind for businesses.

-

How does airSlate SignNow ensure the security of tax documents?

airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect tax documents. This is crucial for the calculation of withholding tax on dividends, as sensitive financial information must be safeguarded. Businesses can trust that their documents are secure while using airSlate SignNow.

Get more for CALCULATION OF WITHHOLDING TAX ON DIVIDENDS

- Booking confirmation form hummer limo hire

- Currency transaction report omb no 1506 0064 form

- Criminal record check ar920100z arkansas department of human humanservices arkansas form

- Cori form general town of lexington lexingtonma

- Commision sale agreement template form

- Commercial tenancy agreement template form

- Commission advance agreement template form

- Commissary agreement template form

Find out other CALCULATION OF WITHHOLDING TAX ON DIVIDENDS

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors