Irs Form 706

What is the IRS Form 706

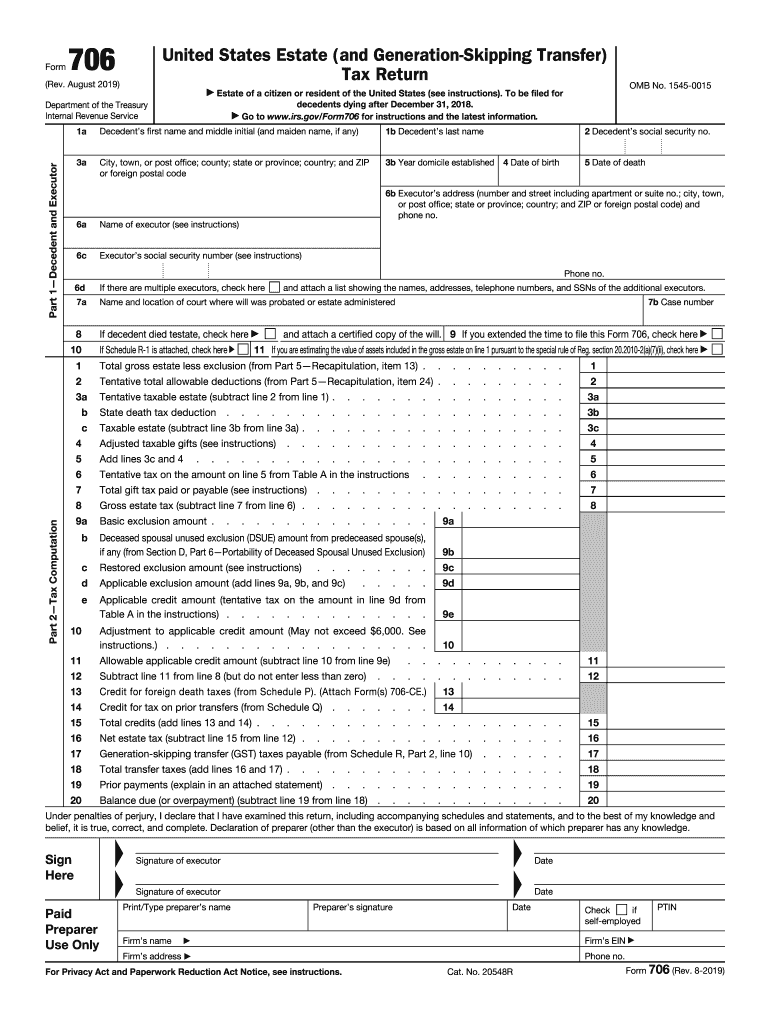

The IRS Form 706, also known as the United States Estate (and Generation-Skipping Transfer) Tax Return, is a federal tax form used to report the estate tax liability of a deceased individual. This form is typically required when the gross estate exceeds a certain threshold, which is adjusted periodically by the IRS. The form captures various details about the deceased's assets, liabilities, and deductions, ensuring that the estate tax is calculated accurately. Understanding the purpose and requirements of Form 706 is essential for executors and beneficiaries involved in estate settlement.

Steps to Complete the IRS Form 706

Completing the IRS Form 706 involves several key steps to ensure accuracy and compliance with federal regulations. Here is a straightforward process to follow:

- Gather necessary information: Collect all relevant financial documents, including asset valuations, debts, and prior gift tax returns.

- Determine the filing threshold: Verify if the gross estate exceeds the current exemption limit, which dictates whether the form is required.

- Complete the form: Fill out the various sections of Form 706, detailing the estate's assets, deductions, and calculating the tax owed.

- Review for accuracy: Double-check all entries for correctness and completeness to avoid potential penalties.

- File the form: Submit the completed Form 706 to the IRS by the due date, which is typically nine months after the date of death.

Legal Use of the IRS Form 706

The IRS Form 706 serves a critical legal function in the administration of estates. It is the official document that determines the estate tax liability, which must be settled before assets can be distributed to beneficiaries. Proper completion and timely submission of this form are essential to comply with federal tax laws. Failure to file or inaccuracies in the form can result in significant penalties, making it vital for executors to understand their responsibilities regarding this form.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 706 are crucial for compliance. The standard due date for submitting the form is nine months after the date of the decedent's death. However, extensions may be available under certain circumstances. Executors should be aware of the following important dates:

- Due date: Nine months from the date of death.

- Extension request: Form 4768 can be filed to request an automatic six-month extension, but this does not extend the time to pay any taxes owed.

Required Documents

To complete the IRS Form 706 accurately, a variety of supporting documents is required. These documents help substantiate the information reported on the form. Key documents include:

- Death certificate: Official proof of the decedent's passing.

- Asset valuations: Appraisals for real estate, stocks, and other significant assets.

- Liability statements: Documentation of debts owed by the estate.

- Prior gift tax returns: Forms 709 that may impact the estate tax calculation.

How to Obtain the IRS Form 706

The IRS Form 706 can be obtained through several convenient methods. Individuals can access the form directly from the IRS website, where it is available for download in PDF format. Additionally, physical copies can be requested by contacting the IRS directly or visiting a local IRS office. It is essential to ensure that the most current version of the form is used to comply with any recent changes in tax law.

Quick guide on how to complete form 706 rev august 2019 united states estate and generation skipping transfer tax return

Complete Irs Form 706 effortlessly on any device

Digital document management has become increasingly favored among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Irs Form 706 on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Irs Form 706 with ease

- Obtain Irs Form 706 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature with the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to send your form: via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or mistakes that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Edit and electronically sign Irs Form 706 to ensure clear communication throughout every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 706 rev august 2019 united states estate and generation skipping transfer tax return

How to generate an eSignature for the Form 706 Rev August 2019 United States Estate And Generation Skipping Transfer Tax Return online

How to make an electronic signature for the Form 706 Rev August 2019 United States Estate And Generation Skipping Transfer Tax Return in Google Chrome

How to create an eSignature for putting it on the Form 706 Rev August 2019 United States Estate And Generation Skipping Transfer Tax Return in Gmail

How to create an eSignature for the Form 706 Rev August 2019 United States Estate And Generation Skipping Transfer Tax Return from your mobile device

How to create an eSignature for the Form 706 Rev August 2019 United States Estate And Generation Skipping Transfer Tax Return on iOS

How to make an eSignature for the Form 706 Rev August 2019 United States Estate And Generation Skipping Transfer Tax Return on Android devices

People also ask

-

What is the 706 more label form 20706 more wills, and how does it work?

The 706 more label form 20706 more wills is a specialized document designed for estate planning and the administration of wills. With airSlate SignNow, you can easily create, send, and eSign this form, ensuring that all necessary information is accurately captured and legally binding.

-

How can airSlate SignNow help with the 706 more label form 20706 more wills?

airSlate SignNow offers a streamlined process for handling the 706 more label form 20706 more wills. Our platform simplifies document management, allowing users to send and eSign forms securely while tracking their status, making the estate planning process more efficient.

-

Is there a cost associated with using airSlate SignNow for the 706 more label form 20706 more wills?

Yes, airSlate SignNow provides various pricing plans that cater to different needs. Each plan includes access to eSigning features for documents like the 706 more label form 20706 more wills, ensuring you get cost-effective solutions without compromising functionality.

-

What features does airSlate SignNow offer for the 706 more label form 20706 more wills?

Our platform includes versatile features such as customizable templates, real-time collaboration, and secured cloud storage. With airSlate SignNow, you can effortlessly manage the 706 more label form 20706 more wills while ensuring data security and compliance.

-

Can I integrate airSlate SignNow with other tools when handling the 706 more label form 20706 more wills?

Absolutely! airSlate SignNow integrates seamlessly with various applications, including Google Drive, Dropbox, and CRM systems. This enables you to streamline your workflow when working on the 706 more label form 20706 more wills, enhancing productivity across platforms.

-

How does airSlate SignNow ensure the security of the 706 more label form 20706 more wills?

Security is a top priority at airSlate SignNow. We implement industry-leading encryption protocols and compliance measures to protect your documents, including the 706 more label form 20706 more wills, ensuring that your sensitive information remains confidential and secure.

-

What benefits does using airSlate SignNow provide for completing the 706 more label form 20706 more wills?

Using airSlate SignNow allows for quick turnaround times and enhanced accuracy when completing the 706 more label form 20706 more wills. Our user-friendly platform reduces errors and expedites the eSigning process, making it easier for individuals and businesses alike.

Get more for Irs Form 706

- Tax table form

- If the organization answered yes on form 990 part iv line 3 or form 990 ez part v line 46 political campaign activities then irs

- 2017 5498 sa form 2018

- 2017 m form 2018

- Form 80 110 17 8 1 000 rev

- W3pr 2017 form

- School safety handbook form

- Who lives at 101 e main st elkton md 21921spokeo form

Find out other Irs Form 706

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document