GST524 GSTHST New Residential Rental Property Rebate 2020-2026

What is the GST524 GSTHST New Residential Rental Property Rebate

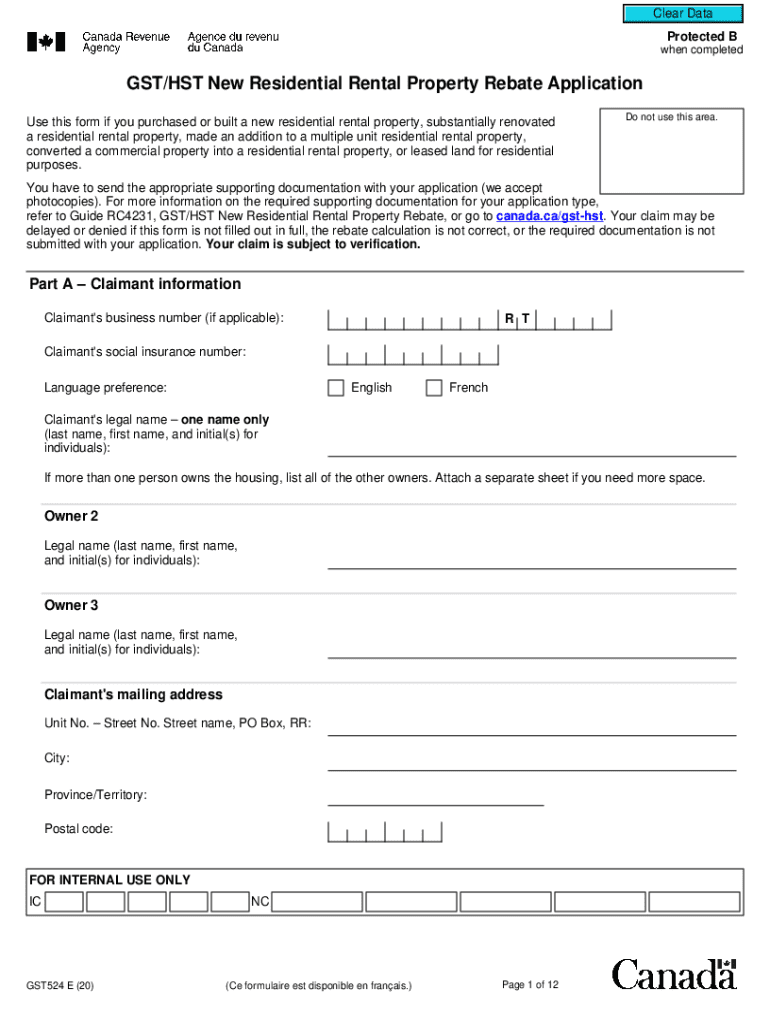

The GST524, also known as the GST/HST New Residential Rental Property Rebate, is a form used in the United States to apply for a rebate on the Goods and Services Tax (GST) or Harmonized Sales Tax (HST) paid on the purchase of new residential rental properties. This rebate is designed to assist landlords and property owners in recovering some of the tax costs associated with acquiring new rental properties. The rebate can be claimed by individuals or businesses that meet specific eligibility criteria, making it an essential financial tool for those involved in the rental market.

Eligibility Criteria

To qualify for the GST524 rebate, applicants must meet certain criteria. Generally, the property must be a newly constructed residential rental property that has been purchased or built for the purpose of renting. Additionally, the property must not have been previously occupied. Applicants need to ensure that they have paid the GST or HST on the purchase price. It is important to review the eligibility requirements thoroughly to confirm that all conditions are met before submitting the form.

Steps to complete the GST524 GSTHST New Residential Rental Property Rebate

Completing the GST524 form involves several key steps:

- Gather necessary documentation, including proof of purchase and tax payment.

- Fill out the GST524 form accurately, providing all required information about the property and the applicant.

- Attach supporting documents, such as receipts and contracts, to substantiate the claim.

- Review the completed form for accuracy before submission.

- Submit the form and supporting documents to the appropriate tax authority, either online or by mail.

Required Documents

When applying for the GST524 rebate, several documents are essential for a successful application. Applicants typically need:

- Proof of purchase, such as a sales agreement or invoice.

- Receipts showing the GST or HST paid on the property.

- Identification information for the applicant, including social security numbers or business identification numbers.

- Any additional documentation that supports the claim, such as rental agreements or property management contracts.

How to use the GST524 GSTHST New Residential Rental Property Rebate

The GST524 rebate can be a valuable resource for property owners. To effectively use this rebate, applicants should first determine their eligibility and gather all necessary documentation. Once the form is completed and submitted, applicants can expect a review period during which tax authorities will assess the claim. If approved, the rebate amount will be issued, providing financial relief that can be reinvested into property maintenance or improvements.

Form Submission Methods (Online / Mail / In-Person)

Applicants have several options for submitting the GST524 form. The form can be submitted online through designated tax authority portals, which often provide a faster processing time. Alternatively, applicants may choose to mail the completed form along with supporting documents to the appropriate address. In some cases, in-person submissions may be possible at local tax offices, allowing for immediate assistance and clarification of any questions regarding the application process.

Quick guide on how to complete gst524 gsthst new residential rental property rebate

Complete GST524 GSTHST New Residential Rental Property Rebate effortlessly on any device

Digital document management has gained considerable traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the essential tools to create, modify, and electronically sign your documents promptly without unnecessary hold-ups. Handle GST524 GSTHST New Residential Rental Property Rebate on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign GST524 GSTHST New Residential Rental Property Rebate with ease

- Obtain GST524 GSTHST New Residential Rental Property Rebate and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important parts of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click the Done button to secure your modifications.

- Select your preferred method for sending your form, whether by email, SMS, an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign GST524 GSTHST New Residential Rental Property Rebate to ensure effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct gst524 gsthst new residential rental property rebate

Create this form in 5 minutes!

How to create an eSignature for the gst524 gsthst new residential rental property rebate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a gst524 fillable form?

A gst524 fillable form is a digital document designed for easy completion and submission. It allows users to fill out necessary information electronically, streamlining the process of filing GST returns. With airSlate SignNow, you can create and manage gst524 fillable forms efficiently.

-

How can I create a gst524 fillable form using airSlate SignNow?

Creating a gst524 fillable form with airSlate SignNow is simple. You can start by uploading your existing GST form and then use our intuitive editor to add fillable fields. This allows you to customize the form to meet your specific needs.

-

Is there a cost associated with using gst524 fillable forms on airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans that include access to gst524 fillable forms. Our plans are designed to be cost-effective, ensuring that businesses of all sizes can benefit from our eSigning and document management solutions.

-

What are the benefits of using gst524 fillable forms?

Using gst524 fillable forms enhances efficiency by reducing paperwork and minimizing errors. With airSlate SignNow, you can easily track submissions and ensure compliance, making the filing process smoother and more reliable for your business.

-

Can I integrate gst524 fillable forms with other software?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, allowing you to connect your gst524 fillable forms with your existing tools. This integration helps streamline your workflow and enhances productivity.

-

Are gst524 fillable forms secure on airSlate SignNow?

Yes, security is a top priority at airSlate SignNow. Our platform ensures that all gst524 fillable forms are protected with advanced encryption and compliance measures, safeguarding your sensitive information throughout the signing process.

-

Can multiple users collaborate on a gst524 fillable form?

Yes, airSlate SignNow allows multiple users to collaborate on a gst524 fillable form. You can invite team members to review and fill out the form simultaneously, making it easier to gather necessary information and complete the document efficiently.

Get more for GST524 GSTHST New Residential Rental Property Rebate

- Bampo quarterly tax report city of lacey form

- Sepa checklist app city of lakewood form

- Single trip oversize load permit the city of lakewood washington form

- Seattle city light electric service application package city of seattle seattle form

- Seattle refrigeration permit form

- For damages form

- Environmental policy form

- Security guard incident report pdf form

Find out other GST524 GSTHST New Residential Rental Property Rebate

- Can I eSignature Iowa Standstill Agreement

- How To Electronic signature Tennessee Standard residential lease agreement

- How To Electronic signature Alabama Tenant lease agreement

- Electronic signature Maine Contract for work Secure

- Electronic signature Utah Contract Myself

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now