Gst524 2013

What is the GST524?

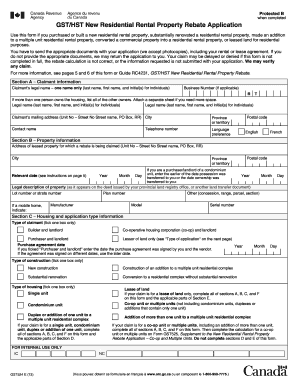

The GST524, also known as the GST HST New Residential Rental Property Rebate Application Form, is a crucial document used by property owners in Canada to claim rebates on the Goods and Services Tax (GST) or Harmonized Sales Tax (HST) paid on new residential rental properties. This form is primarily intended for individuals or entities that have purchased a new residential property and are renting it out. By completing the GST524, applicants can potentially recover some of the taxes paid during the purchase, making it an important financial tool for landlords.

How to Use the GST524

Using the GST524 involves a systematic approach to ensure all necessary information is accurately provided. Start by gathering relevant details about the property, including the purchase price and date of acquisition. The form requires specific information about the rental property, such as its address and the type of property. After filling out the required sections, including personal identification details, ensure that all calculations are double-checked. Once completed, the form can be submitted to the appropriate tax authority for processing.

Steps to Complete the GST524

Completing the GST524 involves several key steps:

- Gather necessary documents, including the purchase agreement and proof of tax paid.

- Fill in your personal information, including your name, address, and contact details.

- Provide details about the rental property, including its address and purchase date.

- Calculate the rebate amount based on the GST or HST paid.

- Review the form for accuracy and completeness.

- Submit the completed form to the relevant tax authority.

Legal Use of the GST524

The GST524 is legally binding when completed correctly and submitted in accordance with the applicable tax laws. It is essential to ensure that all information provided is accurate, as any discrepancies may lead to delays in processing or denial of the rebate. The form must be signed and dated to validate the application. Compliance with the legal requirements surrounding the GST524 helps protect applicants from potential penalties or issues with tax authorities.

Required Documents

To successfully complete the GST524, several documents are required:

- Proof of purchase, such as a purchase agreement or invoice.

- Receipts showing the GST or HST paid on the property.

- Identification documents to verify the applicant's identity.

- Any additional documentation that supports the claim for the rebate.

Form Submission Methods

The GST524 can be submitted through various methods, ensuring convenience for applicants. Options include:

- Online submission via the tax authority's official website.

- Mailing the completed form to the designated address.

- In-person submission at local tax offices, where available.

Eligibility Criteria

Eligibility to claim a rebate using the GST524 depends on several factors. Applicants must have purchased a new residential rental property and must be the owner of record. The property must be intended for rental purposes, and the applicant must have paid GST or HST on the purchase. Additionally, there may be specific thresholds regarding the purchase price and property type that must be met to qualify for the rebate.

Quick guide on how to complete gst524

Easily prepare Gst524 on any device

Digital document management has gained popularity among companies and individuals alike. It offers an excellent environmentally friendly alternative to conventional printed and signed paperwork, allowing you to find the right form and securely store it online. airSlate SignNow supplies you with all the resources necessary to create, edit, and electronically sign your documents quickly without delays. Manage Gst524 on any platform with airSlate SignNow’s Android or iOS applications and enhance any document-centric process today.

The simplest method to edit and electronically sign Gst524 effortlessly

- Find Gst524 and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your electronic signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced files, tiring form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device of your choice. Edit and electronically sign Gst524 and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct gst524

Create this form in 5 minutes!

How to create an eSignature for the gst524

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a gst524 fillable form?

A gst524 fillable form is an electronic document designed for completing GST-related transactions. This form allows users to input relevant information directly into the fields, making filing simpler and more efficient. Utilizing a gst524 fillable format can save businesses time and reduce the risk of errors.

-

How can I create a gst524 fillable form using airSlate SignNow?

Creating a gst524 fillable form with airSlate SignNow is straightforward. Simply upload your GST document, use our drag-and-drop editor to add fillable fields, and customize it to suit your needs. Once completed, you can send the form for eSignature or share it with your team easily.

-

Are there any costs associated with using the gst524 fillable form feature?

While airSlate SignNow offers various pricing plans, the gst524 fillable form feature is included across all tiers. Each plan is designed to be cost-effective, providing value for businesses of all sizes. You can explore our pricing options to find the best fit for your organization.

-

What benefits does using a gst524 fillable form offer?

Using a gst524 fillable form helps streamline your workflow by reducing paperwork and simplifying data entry. It ensures that all necessary fields are completed, minimizing errors during submission. Additionally, the electronic submission of gst524 forms helps improve tracking and compliance.

-

Can I integrate the gst524 fillable form with other software?

Yes, airSlate SignNow supports integrations with various third-party applications, enhancing the functionality of your gst524 fillable form. You can connect with CRM systems, cloud storage, and accounting software to ensure a seamless flow of information. This integration helps improve productivity and data organization.

-

Is it safe to use the gst524 fillable form feature?

Absolutely! airSlate SignNow prioritizes the security of your documents, including gst524 fillable forms. We employ industry-standard encryption and compliance protocols to protect sensitive information, ensuring that your data remains confidential and secure throughout the signing process.

-

How can I get my team to start using the gst524 fillable form?

Getting your team on board with the gst524 fillable form feature is simple. You can invite team members via email directly within the airSlate SignNow platform, allowing them to access and utilize the feature. Training resources and customer support are also available to assist with onboarding.

Get more for Gst524

Find out other Gst524

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure